As the 2016 General Election nears closer, one of the considerations for investors and owners alike is how the outcome of the election will immediately impact the market, as well as how businesses and investments will be impacted as we progress into the new presidential term.

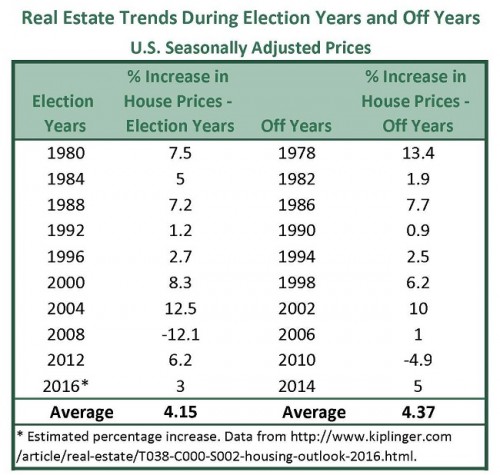

Historically, we have seen that markets tend to fall during an election year, with the S&P 500 falling on average by 1.2% and housing prices experiencing lower increases in value than in non-election years. Since 1980, housing prices in the 12th month of non-election years have increased 0.22% more than those in election years, and 2016 is expected to see a 3% increase in the housing price, down from 5% in 2014.

These numbers are amplified in elections where there is a greater amount of uncertainty surrounding the results, implying that the economic impact of the 2016 election will likely be more substantial. As Clinton and Trump have significantly different platforms, many may be more hesitant to invest than in non-election years or in less uncertain election years, demonstrating how emotions can significantly impact the volatility of the markets.

According to a survey done by Redfin, 27% of homebuyers believe this election will negatively impact the housing market. Looking at the transaction volume over the past several election cycles, it is more common for larger corporate investments and deals to be postponed until later into the new presidential term, with companies reducing investment expenditures by 4.8% on average during election years compared to non-election years.

While this year’s election will likely cause reduced positive growth for the economy, the majority of the impact on commercial real estate will not likely be seen immediately, except for in the office sector due to some companies postponing signing new leases. Longer term, one of the effects that we can expect from this election is a greater focus on the tax regulations surrounding real estate that have been brought up due to Trump’s dealings in real estate.

It is also worth noting that when the economy is performing well, Americans will normally continue to vote for the same party or candidate if applicable, and when it is not performing as well, the opposite is more likely the voting result. This result is demonstrated by viewing the election results compared to the market performance during August to October of election years, with Americans voting for the incumbent party 82% of the time when the markets have climbed, and voting for the replacement party 86% of the time when the markets have declined.