Authors: Morgan Zollinger, Ravikanth Pamidimukkala (Downloadable PDF)

As William Sullivan walked to his car to begin the commute home after a long day at work, he considered the different options before him. As the CEO of the Texmark Real Estate Company (TexREC), Sullivan was concerned about the future of the company he had been leading for four years now. During this time, TexREC had enjoyed considerable success, nearly doubling the value of assets under management to $7.5 billion; however, the rapid growth also meant new challenges for the company. Sullivan was focused on finding new lines of business and untapped markets with the potential for high risk-adjusted returns, including potential expansion overseas if the right opportunity presented itself. Sullivan innately understood that finding the right talent to lead such initiatives was a crucial first step.

TexREC in the past couple of years had aggressively ramped up its hiring efforts to find qualified professionals that suited the company’s culture. On-campus recruiting had grown significantly in order to locate entry-level financial analysts, and a rotational program for new hires had also recently been started to get them up to speed more quickly. Despite these programs, the human resources team at TexREC still often struggled to fill each opening with capable individuals. Part of the difficulty owed to the fact that TexREC was located in San Antonio, where the pool of real estate professionals was relatively small as compared to other major cities. Even for the needs of back-of-the-house operations, TexREC had been forced to open a satellite office in Dallas to tap into the market of experienced real estate accountants.

Similarly, Sullivan recognized that TexREC would soon have to address the space issues it currently faced at its headquarters in suburban San Antonio. Located across the highway from its financial services company (FinCo), TexREC’s home office was nearing its capacity because of the large number of recent hires. Continued growth meant that new space would soon be necessary, and Sullivan had already identified three different options. As Sullivan sped down the interstate towards his home at the edge of Texas Hill Country, he understood that the upcoming decision on TexREC’s new headquarters would have a dramatic impact on the company’s future, especially its capacity to attract sorely needed expertise.

TexREC operates as a wholly-owned subsidiary of its parent financial services company (FinCo). Despite being located in a separate building across the highway from FinCo’s main corporate campus, TexREC shares FinCo’s core mission, which is to provide affordable financial services to U.S. military veterans and their families. As such, TexREC’s ultimate goal is to generate profits that could be passed through to FinCo and then be used to supplement the broader business. Many of TexREC’s employees are also veterans or have family members that have served in the military.

Since becoming CEO, Sullivan has also pushed for TexREC to concentrate more heavily on sustainable enterprises, and he believed the potential relocation could imprint this mindset in the company culture if he could place TexREC in a cutting-edge office building. This initiative aligned with Sullivan’s personal values and his vision for making TexREC a more socially responsible investor. He also believed that it would benefit the bottom line, despite larger upfront capital commitments. By lowering operating costs and attracting environmentally minded tenants, Sullivan was confident that his vision could be achieved.

Company Background:

Originally tasked with managing FinCo’s long-term real estate investments, TexREC in recent years had expanded its business line to include managing and advising third-party investors. Although all of TexREC’s profits are passed along to its parent organization, today only about a third of the capital it invests actually comes from FinCo. In this sense, TexREC could perhaps be most accurately understood as a mid-sized private equity group. The rapid growth and consistent above-market returns have earned TexREC a great deal of respect within the institutional real estate community.

TexREC counts nearly 150 employees, all of whom are based in the San Antonio headquarters except for a handful of acquisition representatives spread across the country in gateway markets. Although the accounting team represents the largest division within TexREC, managing taxes and investments for increasingly complicated deal structures, the core of the business centers on the roughly 40 professionals that actively manage real estate investment decisions. Many of the real estate professionals have worked at TexREC most, if not, all of their careers, constituting an old guard that has enjoyed considerable success but is quickly approaching retirement. Many members of the real estate team also graduated from universities in Texas, although it has become more diverse with some of the recent hires.

Sullivan’s Background:

Sullivan joined TexREC six years ago, originally in the capacity of COO, after being recruited for several months by then CEO Michelle Parker. Sullivan and Parker had previously built a close working relationship when Sullivan served as President and CEO of a smaller fund based in Houston. Sullivan feels his background and expertise give him a three- to five-year mandate as CEO, at which point a successor would be necessary to oversee the next phase of the company’s growth. As a career-long real estate professional, Sullivan is emotionally invested in the decision about TexREC’s future headquarters and sees it as a clear piece of his professional legacy at the firm.

In total, Sullivan brought 25 years of experience in the real estate industry to the table, including several years working as an investment sales broker and in development. This varied real estate experience has served Sullivan well since becoming CEO four years ago, allowing him greater insights into the various interrelated aspects of each investment opportunity as well as familiarity with the San Antonio market. This background also has led Sullivan to develop an appreciation for the importance of the built environment, especially in the work place, and has given him confidence in his ability to make the right decision about the company’s future location.

The Options:

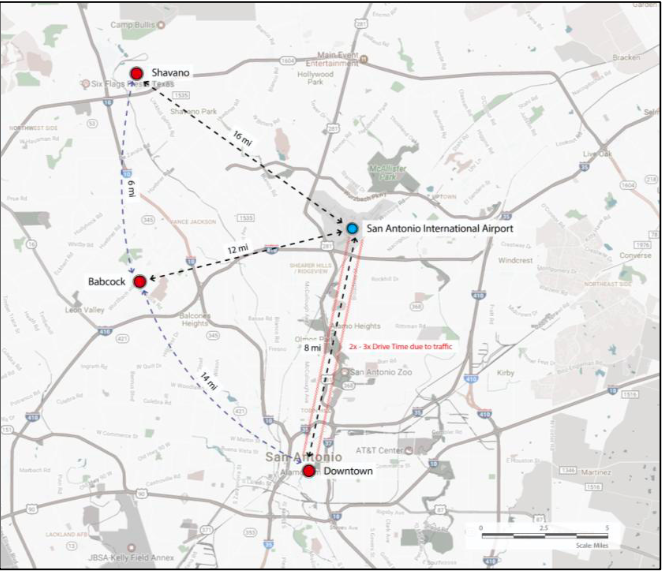

A deliberate decision maker, at the onset of the process Sullivan had conducted preliminary research on a wide range of alternatives. At one point, he had even considered more dramatic changes, such as relocating the entire company to Dallas, where the real estate market was more established on an institutional level. More recently, Sullivan focused on more pragmatic options that would keep TexREC in San Antonio and close to FinCo. These possibilities included (i) minor renovations to the current Babcock building, (ii) relocating to a TexREC property in the outer suburbs, or (iii) leasing or developing space in downtown San Antonio. With each option, however, the goal was the same—to position TexREC for continued future success.

Stay at The Babcock `

Perhaps the simplest route before Sullivan would be to stay put at TexREC’s current location in the Babcock area of suburban San Antonio. TexREC had developed the Class-B mid-rise building about thirty years earlier and occupied three of the floors while leasing out most of the remaining space to smaller professional tenants. Although the design and mechanical systems of the building had been considered modern and up-to-date when it was first completed, the Babcock building had now become an archetypal 1980’s suburban office building. The Babcock’s lobby was outdated with marble cladding, dating to the time of construction. A large atrium ran through its entire height, substantially reducing usable space while impacting energy efficiency by increasing heating and cooling costs. Many employees disliked the atrium, and Sullivan described the experience as walking through a tunnel, criticizing it for being disproportionately large as compared to the size of the building. The Babcock also lacked amenities of a modern workspace, with only a fitness center that had been tucked into a corner of the parking garage.

At the same time, remaining at the Babcock would provide several practical benefits to TexREC. Staying put would be the most cost-efficient route because TexREC already owned the premises, and having control over the leases allowed it space for future expansion. TexREC currently occupies 80,000 sq. ft. of the 140,000 sq. ft. net rentable area in the Babcock; the other smaller tenants occupy close to 40,000 sq. ft., while the

remaining space is currently vacant due to lease rollover. TexREC’s proximity to FinCo also allows for more frequent and meaningful interaction between management of the two companies. TexREC had also recently fitted out some of its spaces with modular furniture that both increased the density of workers and lent the interior a more contemporary look. However, its drab appearance was still apparent and Sullivan worried that such an approach might not be sufficient to alter TexREC’s appeal to younger workers, who typically preferred a much more open environment.

To address these issues, Sullivan believed that a complete overhaul of the Babcock was necessary, which would require a significant amount of capital. Sullivan had held initial discussions with structural and design consultants that TexREC had partnered with in the past, which revealed a budget of $11.2 million ($80 per sq. ft.). The consultants planned to cut down the height of the atrium by filling in the open space with expanded floorplates and revamping the lobby with contemporary finishes. They also recommended creating more transparency in the work areas, by replacing some of the interior walls with floor-to-ceiling glass and shifting the executive offices on the perimeter to a more central location, thus allowing more natural light into the workspace.

Sullivan believed these changes were essential and would probably reposition Babcock as a Class-A competitor in the market. The renovation of Babcock, however, would negatively affect employees and tenants during an estimated fourteen months of renovation. Sullivan’s team estimated these inconveniences would cost TexREC $500,000 in lost productivity and another $150,000 in the form of lease buyouts from in place-tenants who would have to relocate. Despite these costs, staying at Babcock remained the cheapest of the three options, with all-in-costs estimated to be $11.85 million (Exhibit 1).

Relocate to Shavano

TexREC’s second option involved relocation to a building it already owned in the Shavano area at the northern edge of San Antonio. Developed several years ago as an income-producing property, Shavano represented a moderately affordable option because its work spaces would not require any substantial modernization. The Shavano building for several years has been occupied by a regional bank, which has used it as its corporate headquarters but is expected to relocate once the lease expires in two years. The bank has not provided formal notice of its intentions however, and in the end may decide to stay put, complicating Sullivan’s position.

One of the major upsides of the Shavano building in Sullivan’s eyes was that it would provide employees easy access to the amenities offered at TexREC’s resort just around the corner. TexREC had developed the resort several years earlier, and it was now considered a premier destination in the central Texas area, with an Arnold Palmer golf course, recently completed spa, and fine dining. The location would also allow TexREC to more easily host investors and clients, showcasing the firm’s hospitality expertise, and shorten commutes for many senior employees, who mostly lived in the outer suburbs.

At the same time, Sullivan believed these locational amenities would also prove enticing for other potential tenants, and taking over the Shavano building for TexREC’s use would eliminate the possibility of earning potentially premium rents, which the parent company FinCo viewed as a major downside. Yet Sullivan was confident that he could convince FinCo, and had asked his team to analyze the necessary upgrades and provide a cost estimate for the relocation.

His team estimated an overall NPV of $15.42 million (Exhibit 1), which included minor upgrades to the 220,000 sq. ft. Class-A building, relocation costs, rent loss due to non-renewal of the lease, and additional rental income from leasing the previously occupied Babcock building. The team also recommended that TexREC occupy the 140,000 sq. ft. space required, and lease out the remaining space.

Ground-up Development in Downtown

The third and final option under Sullivan’s consideration was potentially the most complicated— participate in the development of a new Class-A building in downtown San Antonio. Sullivan’s contact at a local brokerage firm had already identified a promising 4-acre site not far from the Pearl District, which is San Antonio’s trendiest neighborhood with some of the best restaurants and bars. The area also boasted close proximity to the famed River Walk and cultural institutions such as the Culinary Institute of America and art museums. Sullivan recognized these amenities would exert a strong pull on younger workers. Perhaps even more significantly, Sullivan knew that development would allow for the use of sustainable features not available in older buildings, such as the Babcock and Shavano, and that the Pearl District also featured easy access to San Antonio’s admittedly limited public transit system.

Sullivan planned to bring in development partners to reduce TexREC’s capital commitment and risk, and initial discussions with potential partners suggested a deal could probably be reached on favorable terms. Sullivan judged that TexREC could obtain a 10- percent rental discount by pre-leasing 140,000 sq. ft. of the development before completion. Sullivan also hoped to secure a sale-leaseback clause that would grant TexREC the option of selling its equity stake to its partners three years after project completion. Sullivan was also considering the purchase of naming rights to the building, estimated to cost an additional $2.0 million, which he believed would provide an opportunity to reposition TexREC and announce it as a major player in the real estate industry. Sullivan’s analysts projected the NPV for this option at $32.9 million, substantially higher than the other two options, but more speculative.

One aspect of downtown development that worried Sullivan was that it would probably require a considerable commitment of his time to oversee the project and ensure that costs did not balloon out of control. Sullivan looked forward to such a challenge, similar to those he had previously confronted as a developer, but also realized his time might be better spent focusing on TexREC’s core business. Development of a new property downtown could also take several years to complete given the possibility of delays in obtaining approvals, and TexREC could outgrow its current location before then.

San Antonio Market Considerations:

As Sullivan continued to mull over the three potential locations, he also considered the dynamics of the broader economy and the local office market. On a national level, interest rates remained at near-historic lows despite steady economic expansion in the several years since the Great Recession. The low rates meant TexREC could obtain capital at a relatively low cost and invest it in the modernization of one of

the existing buildings or the acquisition of a new location. But market conditions also meant robust competition for real assets, especially in second-tier markets such as San Antonio with high upside, and steadily increasing construction costs.

Closer to home, the surrounding central Texas region for several years had benefited from healthy economic activity. Nearby Austin, in particular, has experienced tremendous growth in a range of industries, particularly in the technology and creative sectors. More recently, this momentum had started carrying over to San Antonio. The relative affordability of the area, both in terms of tax rates and the low cost of real estate, had caused many companies to relocate from major urban areas on both coasts. The result of this trend was increased job creation in the area. It also meant leasing a new location could be more expensive for TexREC, but that it could also generate substantial cash flow off the Babcock and Shavano, should it not occupy these buildings.

Northwest

Both the Babcock and Shavano buildings are located in the northwest San Antonio submarket, and Sullivan had recently tasked one of his analysts to pull market reports for the area. The region dominated San Antonio in terms of office demand and new construction and had done so for a number of years. Through the first half of 2016, over 556,000 sq. ft. of office space had been absorbed in the submarket, representing over six percent of existing inventory. With another 785,000 sq. ft. of development in the pipeline, Sullivan was concerned that new competition could complicate efforts to lease up the Babcock and Shavano buildings.

The northwest submarket is home to some of San Antonio’s largest employers and a diverse array of residential neighborhoods. Large retail centers and intermittent mid- and high-rise office buildings line the sides of major highways that crisscross the area, such as I-10 and Highway 410. Home to the main campus of the University of Texas at San Antonio, northwest San Antonio also hosts the region’s largest cluster of hospitals and medical services providers. Much of the housing in the area was comprised of older single-family homes in low- and middle-class neighborhoods. Recent development occurred primarily at the edge of the city as it steadily expanded towards Texas Hill Country in the form of new luxury single-family residences.

Downtown

In contrast to the northwest submarket, the reports on Sullivan’s desk clearly indicated a less vibrant—but improving—office market in the downtown area. Most of San Antonio’s major landmarks, such as the historic Alamo and the Tower of the Americas, were located downtown, which was easily accessible because of the numerous highways that intersected there. Vacancy rates hovered around 30 percent because of two million sq. ft. of new construction that had arrived on the market in the past two years. Absorption had not kept up with the new inventory, providing tenants with a range of choices and leverage in negotiations, which had pushed rental rates down and perhaps provided Sullivan’s team with an opportunity to secure an affordable long-term lease.

FinCo had originally been headquartered downtown, but as one of the city’s largest private employers its decision to decamp to the suburbs in the early 1970’s helped contribute to a broader exodus of jobs and residents that had caused the heart of San Antonio to languish for decades. In recent years, city officials had worked to reverse the trend, which had resulted in the development of a few multifamily buildings and plans by a regional bank to build and occupy San Antonio’s first new high-rise office building in several years. Once completed, the tower would bring 2,500 well-paid employees to downtown every day, which market watchers expected would energize the area and create momentum for further improvements.

Sullivan sympathized with the efforts to promote San Antonio’s urban core and wondered whether TexREC could contribute to them. Investment in a new downtown office would fit in with his goals of a socially responsible investment, by demonstrating the firm’s commitment to the local community. At the same time, Sullivan worried that a move downtown would entail unnecessary risk given that despite the city’s efforts, a vibrant urban core was by no means a foregone conclusion. On a more practical level, a downtown location would also place TexREC farther away from the local airport. The nature of the business required Sullivan and other managers to frequently travel to investigate potential investments, which was already complicated by the relatively limited number of direct flights available from San Antonio.

The Impending Decision:

Sullivan continued to ponder all of these issues as he pulled into the driveway of his suburban home. He recognized the importance of the impending decision on TexREC’s future and felt the pressure of it. He also understood that a choice would have to be made quickly in order to start the long process of obtaining the necessary approval from FinCo and preparing TexREC employees for the move; already rumors had started circulating about a potential move, causing some angst amongst employees. As Sullivan settled in for an evening at home, he committed to making a final decision in time to present it to his senior management team at next week’s meeting and get them started on the project.

Questions for Discussion:

1) Which option best positions TexREC for the future? What are the pros and cons of each option? 2) Is the NPV analysis the right approach or do the qualitative aspects outweigh financial concerns? 3) Does TexREC really need to invest such a large amount of capital in their own office?

4) How should Sullivan convince the parent company FinCo?

5) If Sullivan chooses to stay at the Babcock, is it worth upgrading to Class A? Are the design changes justifiable or is there scope for value engineering?

6) If Sullivan chooses to relocate downtown, should he opt for sale leaseback?

Exhibit 1:

Option 1: Renovate and stay in The Babcock building

a) Cost for renovation $80 per sq. ft. rentable area = 140,000 x 80 to upgrade to Class A:

b) Relocation strategy: Renovation will only partially impact employees, however a $0.5 million relocation costs are anticipated for the temporary adjustments

c) Lease termination of smaller tenants: $150,000 to terminate the remaining leases

Anticipated NPV – Option 1

$11,200,000

+ $500,000

+ $150,000

$11,850,000

Option 2: Move to Shavano

a) Renovation costs @ $30 per sq. ft. net rentable area = $30 x 220,000

b) Effective rent loss/ gain annually = $822,000 (NPV @10% discount rate):

i) Rent Loss annually at Shavano = $140,000 x $23 (average rent) [Remaining 80,000 sq. ft. will be leased out, the bank is willing to continue having a smaller

$6,000,000

+ $8,220,000

$52,200,000

– $24,000,000

+ $2,700,000 +2,000,000

$32,900,000

Option 3: Ground-up development in Downtown San Antonio

a) USAA Equity:

i) Land contribution: $3.2 MM

ii) Construction @ $350 per sq. ft. = $49 MM

b) Effective rent loss/ gain annually = -2,400,000 (NPV @10% discount rate):

Rent gain annually from leasing the Colonnade = $2,400,000

c) Relocation costs:

d) RealCo branding/ naming for the building:

Anticipated NPV – Option 3