On November 6, 2012, Colorado Amendment 64 was passed by initiative, thereby legalizing the recreational use of cannabis. Once Colorado Governor John Hickenlooper signed the law into place, a brand-new industry was born: the cannabis industry. Since then, seven states and the District of Columbia have adopted expansive laws legalizing marijuana for recreational use. Naturally, industrial real estate was penciled in as a beneficiary of the new laws. “Alternative Uses for Industrial Space: The Marijuana Market” was one of the headlining discussions during the NAIOP I’CON ’17: “Trends and Forecasts” event in Long Beach, and was heavily attended. Even without factoring in the marijuana boom, industrial real estate has seen fantastic growth, with an increase in the types of tenants looking to rent into the asset class. But for landlords of industrial properties, there can be many unique problems that come with the leasing of space to marijuana retailers and growers. As a result, while rents for industrial properties have seen a boost from the new tenant type, there are still many risks associated with renting to the cannabis market.

If Denver’s industrial real estate is any indication, the absorption that will take place from the increase of marijuana dispensaries will be specialized. Denver has seen over 4.2 million square feet of industrial space occupied up by marijuana growers as of the end of 2016, taking up nearly 3 percent of the industrial market. This gross space is up 14 percent since the second quarter of 2015. Overall, the Denver market is home to 145 million square feet of warehouse space. The overwhelming majority of grow space in the metro area falls within Denver city limits. But growers specifically tend to seek out space that is relatively small (25,000 to 50,000 sqft) and has ample power, electricity, and ventilation. Also, since approximately 85% of industrial properties in Denver are encumbered by a loan, the majority of industrial spaces may find it difficult to rent to marijuana growers and dispensaries due to lender restrictions. As a result, rents for marijuana growers and dispensaries can be up to three to five times higher than market levels, and investors have noticed.

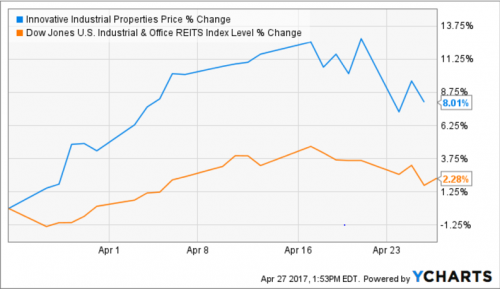

Many major players have begun to take notice, and institutional capital is beginning to flow into the cannabis industry. One example can be found with Innovative Industrial Properties, a REIT founded in 2016. Innovative Industrial Properties gives investors exposure to cannabis real estate through its “acquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated medical-use cannabis facilities.” Since its formation, the REIT has raised $67 million in public offerings. Another recent example can be found when FutureLand Corp., a Denver-based cannabis cultivation leasing company, made waves when the Kodiak Group, a mainstream private equity firm, bought $1 million of its stock. While the industry is gaining exposure, it is also important to note that there can be many risks associated with renting to these tenants.

Many problems arise for landlords simply because marijuana is not yet recognized as legal federally. For example, federal law does not allow credit cards to be used for marijuana sales. As a result, the business model for marijuana typically has employees at warehouses and dispensaries converting cash into money orders, which can then be deposited or cashed out. This leads to poorer financial documentation, and as a result traditional due diligence may not work. The methodology also leads to rental payments being made mostly in cash or money order, with one Denver area landlord reporting that he accepts 90 to 95 percent of his rental income in checks or money orders, and only 5 to 10 percent in cash.

As industrial real estate is not federally legal, landlords also must keep an eye out for the political climate. Approximately 1,700 properties in Colorado are currently leased to marijuana businesses. So far, they have experienced about 15 raids for violation of state law. In these raids, no property owner has been held liable. The reason States can legalize marijuana without fear of federal repercussion is the Rohrabacher–Farr amendment. Since 2014, the Rohrabacher–Farr amendment, which prohibits the Department of Justice and the Drug Enforcement Agency from spending funds to interfere with the implementation of state medical marijuana laws, has protected states and the cannabis industry from federal legal intervention. But since Rohrabacher–Farr is a budget amendment, it must be approved by Congress annually along with the federal budget.

Under current U.S. Attorney General Jeff Sessions, Rohrabacher–Farr may be at risk. The current political powers are not pro-marijuana, and new legislation may make it difficult for landlords to lease to cannabis growers and dispensaries. To address this, landlords and tenants have been adding clauses to leases. For example, in Colorado it has become typical for cannabis based leases to have clause stating that if the landlord or tenant receives a letter from the federal government demanding that the tenant cease operations, the landlord will hold the lease null and void, allowing the tenant to vacate within 30 days.

The cannabis industry is an exciting new tenant type that can strongly add to the appeal and demand for industrial properties. The overall industrial market should see a boost in demand as marijuana becomes widespread, especially for the types of warehouses growers seek to occupy. But landlords should be aware of the many risks, both political and financial, that comes with the attractive rents the cannabis industry will provide.