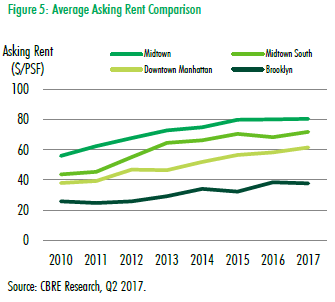

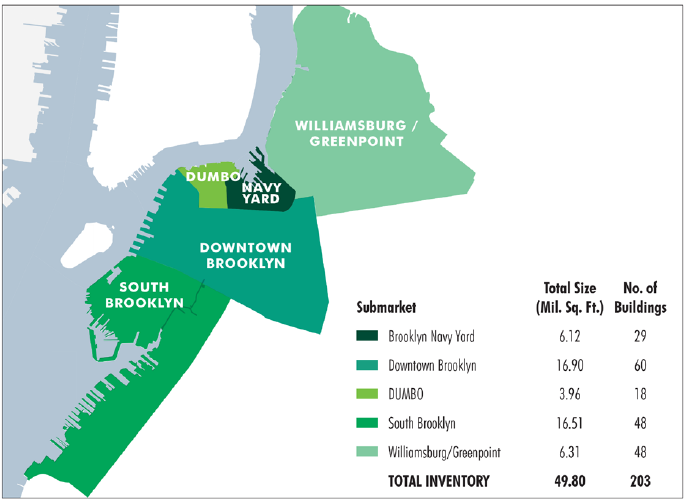

For decades, Manhattan has monopolized the office market in New York City (‘NYC’). However, Brooklyn is gaining momentum as the 4th largest office submarket in NYC after Midtown, Midtown South and Downtown. Brooklyn stands out due to its lower rents, specifically to TAMI (technology, advertising, media and information) tenants that are inclined towards providing a greater number of amenities to their employees in an urban setting. Brooklyn’s overall average asking rent is currently $37.73 per square foot, virtually unchanged from last quarter’s $37.80 per square foot, making the rents attractive to new tenants. There are currently nine office projects under construction in the Brooklyn market, which are expected to add approximately 3.9 million square feet of new inventory by 2020. Additionally, there are six other projects in various stages of pre-construction. The new supply has balanced out the additional demand in Brooklyn, keeping the rents stabilized overall.

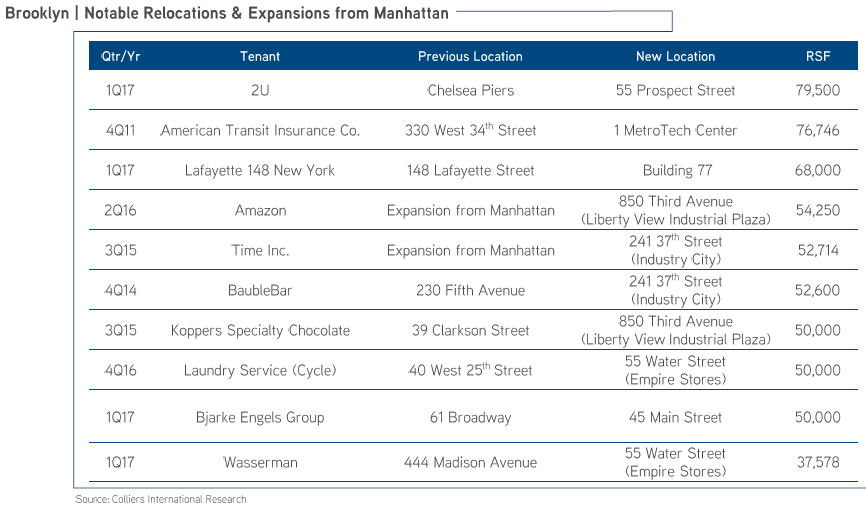

The migration of Manhattan tenants to Brooklyn in the last 16 months has exceeded 500,000 square feet in relocations and expansions. Brooklyn continues to push the envelope both in terms of geography and market size. Brooklyn is in the midst of a building boom, as developers seek to leverage the area’s popularity with young people who have migrated across the East River to escape Manhattan’s sky-high rents. Since 2010, the population of Brooklyn was estimated by the United States Census Bureau to have increased 5.3% to 2,636,735. As of 2015, Brooklyn’s estimated population represented 30.8% of New York City’s estimated population of 8,550,405.

One of the biggest draws for businesses relocating from Manhattan and other areas is that Brooklyn is where the young talent wants to live. In south Brooklyn, Red Hoek Point, a 795,000 square feet development at 280 Richards Street is a two-building, 7.7-acre campus. The project is developed by Thor Equities and designed by Foster + Partners and SCAPE landscape architects. It will offer floorplates of nearly 125,000 square feet and incorporate numerous amenities, such as immense open spaces that include a total of 3.6 acres of usable green rooftops, as well as a kayak launch, car and valet bike parking, and a waterfront restaurant. The project is expected to deliver by 2020.

Brooklyn is even being touted by NREI as the best bet for NYC to win the new Amazon headquarters mandate. The borough’s image as a hip hub for millennials could give it a leg up as the e-commerce giant hunts for the perfect locale for its second U.S. headquarters, according to Ofer Cohen, president of TerraCRG, a Brooklyn-based commercial-property brokerage. Amazon, aiming to build a corporate compound that will rival its original campus in Seattle, has solicited proposals for the project, which will cost more than $5 billion and create 50,000 jobs over the next 15 to 17 years. New York City entered the fray last week, promoting its big-city living, diverse workforce and extensive university system as attributes that officials hope will help overcome the drawback of being one of the country’s costliest housing markets.

Brooklyn’s prominence as an office destination rose with the redevelopment of Industry City. At Industry City, Atlanta-based Jamestown and its partners have become landlords to 450 businesses, up from 100 since acquiring the neglected industrial plot in 2013, according to Andrew Kimball, chief executive officer of Industry City. The 35-acre (14-hectare) site is well-positioned to meet Amazon’s need for space, especially if neighboring sites along the waterfront were to be integrated in a unified project.

Some projects, such as Building 77 at the Brooklyn Navy Yard, have begun to deliver. The performance of these assets in the second half of the year will serve as a bellwether of future deliveries. Creative tenants, which make up the majority of office demand in the outer boroughs, have been significantly less likely to prelease space than their traditional FIRE (Financial Services, Insurance & Real Estate) sector counterparts.

While, at first glance, submarkets such as DUMBO and Williamsburg have staggering vacancy rates, a deeper dive into the numbers reveals a dichotomy between older and newer buildings. Projects under construction or that have delivered since 2015 currently have a 49.1 percent vacancy rate, while the vacancy rate of assets constructed pre-2015 is just 11.8 percent. From 2015 to present, those newer assets accounted for roughly 44 percent of total leasing activity in the market—an impressive number considering such product represents just 16 percent of the total market of Brooklyn. For this reason, increased leasing activity is expected in these new developments over the next 18 months. Larger commitments will be necessary in the coming quarters to support a development pipeline that is only 15 percent preleased.

The Columbia Heights Associates, a joint venture between CIM Group, LIVWRK Holdings and Kushner Companies, unveiled plans for the repositioning of the Jehovah’s Witnesses Watchtower in DUMBO. The group purchased the five-building campus last year for $340 million. Upon completion of the redevelopment, the former Jehovah’s Witnesses headquarters will be rebranded as “Panorama” and will include 635,000 square feet of interconnected office space, as well as 35,000 square feet of retail and public outdoor space.

Also, recently announced was a 15,000-square-foot commitment by the NYU Tandon School of Engineering at the Brooklyn Navy Yard. The school will use the space for a virtual-and augmented-reality incubator. NYU Tandon received a $6 million investment from the Economic Development Corporation with the goal of creating 500 jobs over the next 10 years.

In May, the New York City Economic Development Corporation announced a plan for catalyzing office development in emerging business districts. The plan calls for City agencies to serve as anchor tenants for new developments in neighborhoods that have demand for more office space but that face challenges attracting a suitable anchor. This effort will benefit Brooklyn given the new developments and slow leasing activity in the recent past.

With these developments, the Brooklyn office market should stand out in the foreseeable future.