As many retailers continue to face reduced sales and store closures due to Amazon and other e-commerce alternatives, several of the big box names are pushing back with a combined tactic of partnering with Google, closing down and converting underperforming stores into distribution fulfillment centers, and focusing on growing stores near universities and in urban areas with smaller scale models. Facing intense competition from Amazon, earlier this year Wal-Mart and Google announced their partnership with the use of Google Express, which now allows customers the option to purchase hundreds of thousands of Wal-Mart’s products from the comfort of their own homes simply through a voice command. Google offers customers the option of voice ordering through its voice-controlled speaker, Google Home, Google’s own version of the popular Amazon Echo that features the Alexa artificially intelligent software assistant. Customers can also use Google Express through any of their other electronic devices using either its app or its website. While Google Express initially required customers to pay a $95 a year membership to receive free, fast delivery (similar to some of the benefits garnered from Amazon Prime membership at $99 a year), it announced with its Wal-Mart partnership that it will now offer customers free delivery, so long as they meet the store purchase minimums.

Wal-Mart sales had already been increasing for its online sales prior to the Google partnership, especially given its recent acquisition spree of several online shopping companies. Earlier this year, Wal-Mart purchased Jet.com, along with Bonobos, ModCloth, Shoebuy.com, and MooseJaw, amongst others. These acquisitions have allowed Wal-Mart’s online platform to offer customers a variety of products not available in stores- a strategy that is undoubtedly crafted in response to the massive online presence of Amazon. Wal-Mart has also focused on offering customers free two-day shipping on orders over $35 as well as faster shipping items for certain items. Wal-Mart currently has over 150 distribution centers. Of these, 11 of them (totaling 10.7 million square feet) are dedicated e-commerce centers, the first of which opened in 2013 in Fort Worth.[i] Wal-Mart is predicting online sales to rise by 40% in the next fiscal year, with online sales already experiencing tremendous growth in 2017. In Q2 2017, net sales growth was 60% year-over-year and gross merchandise volume growth was 67% year-over year, making this the second quarter in a row that Wal-Mart has experienced growth of 60% or greater in its e-commerce sales.[ii]

In response to the shift towards e-commerce, Wal-Mart has already begun closing down stores that are underperforming in favor of smaller stores in more densely populated urban areas and increasing the number of fulfillment centers for the company. Many of these newly abandoned big-box stores (both for Wal-Mart and other retailers) are being repurposed either as self-storage centers or as fulfillment centers for the increased e-commerce demand. The well-situated locations of these centers near many potential online shoppers makes them ideal for fulfillment centers, and the large, open frameworks and in-place HVAC systems makes quick conversions possible.

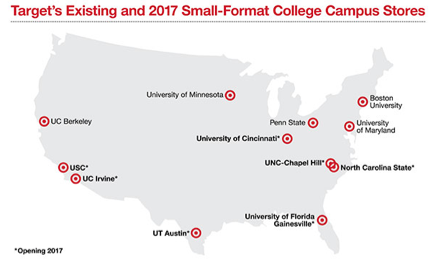

In mid-October, Target also announced its expansion of its partnership with Google Express to allow customers nationwide to order its products through the service. In 2018, Target shoppers will have the option of picking up purchases at their local Target store in just two hours, as well being able to receive a 5% discount off of their Target Google Express orders with the use of their Target card. Like Wal-Mart, Target is also focusing increasingly more on its online sales, and has begun planning to repurpose some of its less profitable stores into “hyper local” ecommerce fulfillment centers. In its plan, Target has identified 600 locations that it will retrofit to support its rapidly expanding online platform. These locations will serve both as local distribution centers and pickup stations for online orders. Also like Wal-Mart, Target is focusing its brick-and-mortar efforts on smaller, urban stores and college campus centered markets. To this end, Target is expected to open 30 new small format stores by year-end of 2017, with college-aged shoppers and young urbanites to be its primary target markets.[i]

For some big-box stores such as Costco, however, online sales have never been its intended focus, but rather an additional means added to compete with Amazon and other online retail giants. Like Wal-Mart and Target, Costco has also partnered with Google Express, but its online sales growth has remained a smaller percentage of its overall sales. As of end of Q2 2017, e-commerce sales for Costco only consist of 3.6% of its total revenue, up 0.2% from 2016. It has been experiencing strong e-commerce sales growth of 15%, but this is actually less of an increase than in past years, with e-commerce sales growth being 15%, 20.1%, 18.5%, and 17.7% in 2016, 2015, 2014, and 2013, respectively.[i] One key difference for big-box stores such as Costco is its business model, which offers even larger and often multipack items to customers who are willing to make the trek and will invest in purchasing its annual membership. Customers of Costco skew older than those of some of the other big-box giants like Target, and they report enjoying the in-store shopping experience due to perks like free food samples. It is also important to note that half of Costco’s shoppers are reportedly Amazon Prime members, indicating that they likely purchase different types of items in-store versus their e-commerce sales.[ii] Despite this, Costco has invested in 12 new fulfillment centers for its e-commerce sales in 2017 alone, bringing it to a total of 19 centers. While many like Wal-Mart and Target seem to have already benefitted from similar moves, time will tell if investing more in dedicated e-commerce fulfillment centers may be the best move for Costco and other big-box stores like it.

[i] Retail-index.emarketer.com. (2017). Costco Wholesale | Revenues & Sales. Retrieved November 04, 2017, from https://retail-index.emarketer.com/company/data/5374f24e4d4afd2bb4446617/5374f26a4d4afd824cc1579a/lfy/false/costco-wholesale-revenues-sales

[ii] Retail-index.emarketer.com. (2017). Costco Wholesale | Revenues & Sales. Retrieved November 04, 2017, from https://retail-index.emarketer.com/company/data/5374f24e4d4afd2bb4446617/5374f26a4d4afd824cc1579a/lfy/false/costco-wholesale-revenues-sales

[i] Thau, B. (2017, February 28). Target To Recast Stores As ‘Hyper Local’ Online Fulfillment Centers To Revive Ailing Business. Retrieved November 04, 2017, from https://www.forbes.com/sites/barbarathau/2017/02/28/target-to-recast-stores-as-hyper-local-online-fulfillment-centers-to-revive-ailing-business/#4a3ffac043fb

[i] MWPVL International Inc. (2017). The Walmart Distribution Center Network in the United States. Retrieved November 04, 2017, from http://www.mwpvl.com/html/walmart.html

[ii] Keyes, D. (2017, August 18). Walmart’s online sales continue upward trend. Retrieved November 04, 2017, from http://www.businessinsider.com/walmarts-online-sales-continue-upward-trend-2017-8