In 2017, Congress established a new community development program known as Opportunity Zones in order to encourage long-term investments in low-income urban and rural communities nationwide. The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory.[i] In order to determine which areas are eligible for the Opportunity Zone designation, the program uses low-income community consensus tracts as the basis, and the chief executives of every U.S. state and territory had a set number of days from December of last year to designate up to 25% of the total number of these tracts in their respective states or territories as Opportunity Zones.

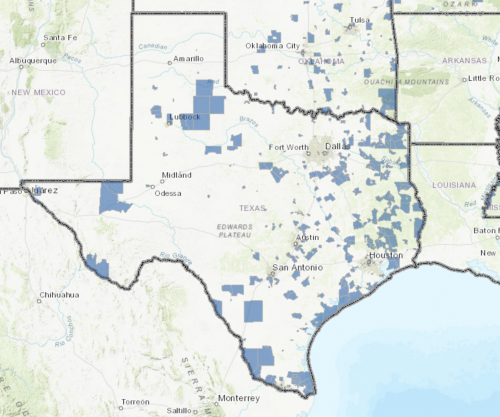

On April 9, 2018, 18 states were added to the list of states and territories that contain Opportunity Zones, as designated by the Department of Treasury and the IRS. As of May 9, 2018, the current list of states and territories that contain these designated Opportunity Zones includes: Alabama, American Samoa, Arizona, California, Colorado, Delaware, Georgia, Idaho, Kentucky, Michigan, Mississippi, Missouri, Nebraska, New Jersey, Northern Mariana Islands, Ohio, Oklahoma, Puerto Rico, South Carolina, South Dakota, Texas, Vermont, Virgin Islands, and Wisconsin.[ii] An additional 22 states and Washington D.C. have made announced their nominations for Opportunity Zones, and approval is expected to occur in mid-May. The current map and list of specific Opportunity Zones can be found here.

These Opportunity Zones rely on Opportunity Funds, private sector investment vehicles that invest at least 90 percent of their capital in Opportunity Zones. These funds not only allow investors to improve upon needing and deserving communities around the country, but also provide them with a variety of tax incentives from the reinvestment of their capital gains.

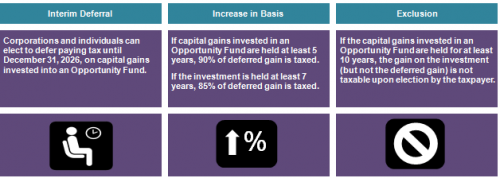

First, any capital gains reinvested in any of these Opportunity Funds will receive a temporary tax deferral. This deferral will take place until the date on which the investment in the Opportunity Zone is sold or December 31, 2026, whichever is earliest.

Second, the longer one invests in these Opportunity Funds, the greater the tax benefits are. If the investment is held for at least 5 years, the basis of the original investment is increased by 10%. If it is held for at least 7 years, an additional 5% is added, resulting in up to 15% of the original gain being excluded from taxation.

Third, a long-term investment in these Opportunity Zone Funds can result in a permanent exclusion from taxable income of capital gains occurring from the sale or exchange of investments in these Opportunity Zone Funds. If the investment in these funds is held for at least 10 years, then the investor will be excluded from taxable income of capital gains from these investments. (not the original capital gains that were re-invested in these funds)

In order to invest in an Opportunity Zone, investors need not live in any of these designated areas. As eligible taxpayers, investors simply are required to choose from the list of approved Opportunity Zones and invest in a Qualified Opportunity Fund by self-certifying, which entails completing a form (to be released in summer 2018 by the IRS) and attaching this form to his or her federal income tax return for the taxable year.

[i] Economic Innovation Group (Ed.). (2018). Opportunity Zones. Retrieved May 1, 2018, from http://eig.org/opportunityzones

[ii] United States Department of Treasury (Ed.). (2018, May). Opportunity Zones Resources. Retrieved May 9, 2018, from https://www.cdfifund.gov/Pages/Opportunity-Zones.aspx