Industrial real estate is vanishing in cities across America just as retailers are ramping up their demands for last mile fulfillment. Major players in online retail have gained a larger market share of consumer durable goods, and formerly brick-and-mortar retailers have expanded into this channel. Online sales are projected to grow by over $600 billion between 2017 and 2020, and this translates to an increased demand of about 184 million square feet of logistics space (CBRE, 2018). Consumers demand rapid fulfillment of online orders, often in as little as one or two days, which has caused the value of warehouse property in densely populated cities to rise. Couple this with the ever-present need to accommodate urban manufacturing firms, civic services, and construction staging, and we find a pressing shortage of physical space.

Part of the issue in accommodating this space stems from demographic trends, which have pushed the density of urban households to historically high levels (US Census Bureau, 2017). So-called “superstar cities” have become epicenters of the country’s best talent (Gyourko et al., 2013). These cities inherently benefit from winner-take-all economies, where a few highly desirable markets attract the vast majority of an industry’s capital and wages (i.e. professional sports, Hollywood’s film industry, etc.) (Frank & Cook, 1995). The problem with this trend is one common in urban economics. Real estate markets adjust their prices to respond to increasing demand for a particular type of asset. In this case, it is the creative class that commands the deepest pockets, and in turn, is the highest bidder for space. Urban housing prices in marquee cities have surged to unprecedented levels and this has put pressure on local zoning boards to free up space for more housing. In New York City alone, more than 11 million square feet of industrial space has vanished due to rezoning efforts between 2007-2016 (Hall, 2018).

This diverging supply and demand trend has accelerated prices for industrial real estate, creating an issue for merchants and their 3rd Party Logistics (3PL) partners who depend on this space to fulfill their orders. In order to stymie this trend, owners of industrial real estate have elected to go vertical. Multistory warehouses offer a tested strategy for fulfilling the demand for warehouse staging space. Though not a new phenomenon (these types of buildings are already commonplace in Europe and Asia), multistory buildings that can accommodate today’s freight vehicles at the capacity required are rare. The industrial development firm Prologis is currently constructing one such two-story warehouse in Seattle, and already has one in operation in Bronx, NY. The Bronx warehouse was a renovation project that now can accommodate 53-foot trailers from 10 loading docks, while the Seattle project is being built from the ground-up.

Today’s industrial real estate requirements are different from the leftover manufacturing spaces of the 19th and 20th centuries. While buildings of that era were built vertically due to the nature of steam and gas powered engines used in manufacturing, today’s space is desired primarily for logistics (3PL) and fulfillment warehousing (CBRE, 2018). This use has different implications for the built form. First, these buildings require an exceptionally large footprint in order to allow for the necessary clear heights, truck ramps on grade, and turning radiuses. Industrial warehouse facilities must be able to cater to incoming shipments from larger, long-haul vehicles as well as outgoing shipments via small delivery vehicles.

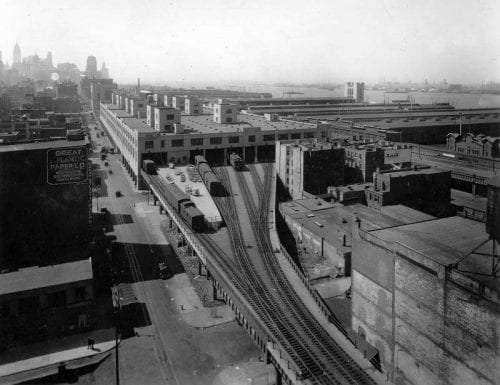

Major players in omnichannel retail are also in a race to provide the fastest fulfillment at the lowest cost to the end-user, and so logistics activities must occur as efficiently as possible. The advent of big box retailers in the mid-20th century placed central logistics centers at the intersection of major highways. But the added pressures of “one-click” convenience and two-day shipping have forced retailers into competition for central urban space, just as this space is being rezoned. As a result, online merchants have to build fulfillment centers on smaller lots, hence the reemergence of multistory facilities. Amazon and others may have missed significant opportunities in urban industrial real estate. Rezoning of these spaces has created expensive hurdles for their fulfillment business. Hudson Yards, in New York City, is one such redevelopment area that would have been an ideal location for logistics. Instead, the former Highline rail system, which traversed the neighborhood, has been replaced by a green way. Otherwise practical industrial buildings made of reinforced concrete are being replaced with new high-rises.

Investors should be wary that downtown logistics centers are a short-lived phenomenon. The imminence of autonomous trucking has major implications for fulfillment. For one, it would make logistics centers at the outer edges of cities desirable once again, since autonomous vehicles have a larger delivery radius than human-operated vehicles, making them more efficient. Labor closely follows transportation as one of the highest cost drivers in fulfillment, so productivity increases in the industrial labor force would also reduce the demand for downtown space (Berman, 2017). Due to the negative externalities of heavy trucking traffic in densely populated areas, it would not be surprising to see another exodus of this use from urban centers as soon as it becomes feasible. Developers and investors ought to consider building multistory warehouses with adaptive uses, lest these properties soon become obsolete like their forebears.

– – –

Works Cited:

CBRE. (2018). “2018 US Industrial and Logistics Outlook”. New York: CBRE Research.

Frank, R. H., & Cook, P. J. (1995). The winner-take-all society: Why the few at the top get so much more than the rest of Us. New York: Penguin Books.

Gyourko, Joseph & Mayer, Christopher & Sinai, Todd, (2013). “Superstar Cities”. American Economic Journal: Economic Policy. American Economic Association, vol. 5(4), pages 167-99.

Hall, Miriam. (2018). “Major Institutions Building First Multistory Warehouse to Solve NYC’s Last Mile Dilemma”. New York City: BisNow.

Berman, J. (2017). “CBRE data shows decent, but changing trends for logistics & industrial real estate in the Americas”. Supply Chain Management Review, 21(4), pages 66–68.

US Census Bureau. (2017) “American Community Survey: 2011-2015″. United States Census Bureau: Washington, DC.