On Thursday, February 13th, 2020, the Cornell Baker Program in Real Estate had the unique pleasure of hosting two speakers during the week’s Distinguished Speaker Series – Joe Levine and Ben Pfinsgraff. Levine is co-founder of Mercer Street Partners, a New York City-based value-add real estate investment firm, where he leads the acquisitions and asset management efforts, in addition to serving on the firm’s investment committee. Levine holds a BA from Cornell’s School of Hotel Administration and is a frequent lecturer in the Distinguished Speaker Series. Levine was joined by business partner and friend, Ben Pfinsgraff, Chief Executive Officer of Common House, an inclusive urban social club concept that he co-developed in Charlottesville, VA in 2017, which targets secondary growth markets. Following a stint in Major League Baseball, Pfinsgraff graduated from the University of Virginia’s Darden School of Business, began a career in investment banking, and ultimately returned to Charlottesville to take on the hospitality industry. Levine and Pfinsgraff individually delivered a message on their respective companies before diving into the story of the Mercer Street/Common House relationship.

Levine addressed the audience first, and provided a timeline of his prior work experiences within multiple companies. His commercial real estate background includes time spent as a Managing Director of United Realty Trust, Vice President of Asset Management of Chartres Lodging and Kokua Hospitality, and operations experience at Loews Hotels. But, Levine is a big proponent of becoming the author of your own life story, creating the life you want to create, and choosing to be more than two-dimensional. Levine took his own guidelines to heart when he left the industry altogether in 2009 and moved to Jackson Hole to work in a ski town for five months, before becoming involved in the film industry, while performing stand-up comedy, amidst partaking in life-changing travels to India. It was then that Levine transitioned his message towards his eight “Rules for Success”, which stretch beyond the quantitative skills necessary for success in this industry. His list includes: 1. Invest in Relationships, 2. Author Your Own Life Story, 3. In Every Crisis, There is an Opportunity, 4. Never Give Up, 5. Listen, Ask Questions, Always Be Learning, 6. Be Efficient, 7. No One is Above You, No One is Below You, and 8. Nothing Matters More Than Your Reputation.

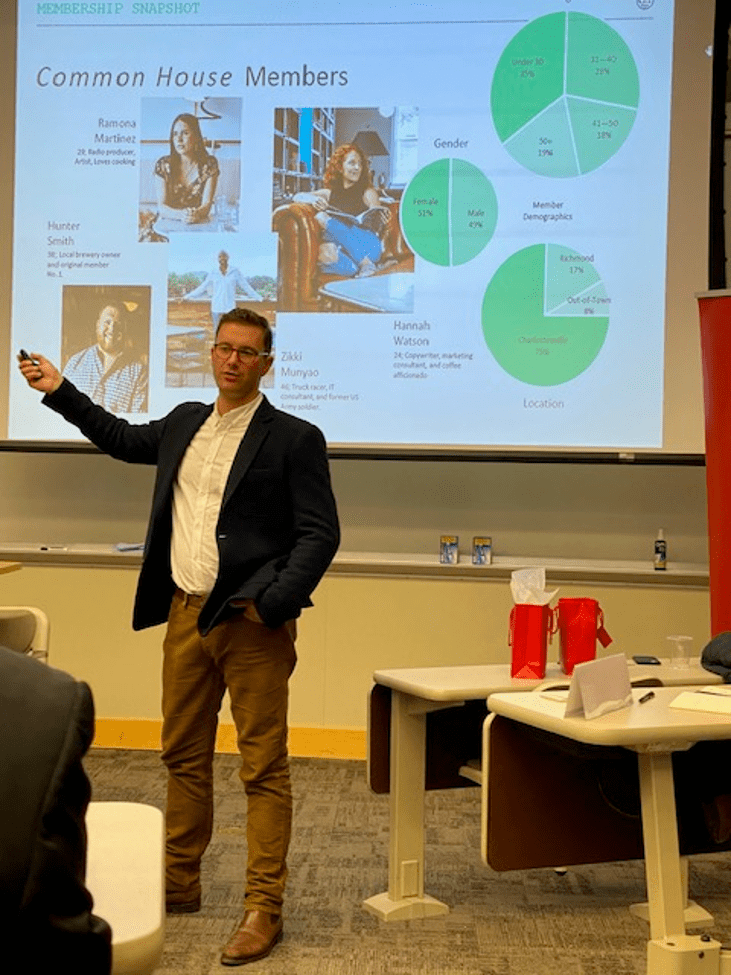

Levine met Pfinsgraff through a mutual friend in Richmond, VA, a city where Levine is heavily invested in various multifamily developments and where Pfinsgraff will open his second Common House location in September. The original Common House opened in 2017 in Charlottesville, VA, and is home to 1,300 members who enjoy meeting & workspace, food & beverage services, running & wine clubs, various fine arts events and unique programming, and, above all, a sense of community. In his business structure at the time of inception, Pfinsgraff was running Common House as an operating company that also owned its real estate, but realized that the best way to facilitate growth into future markets would be to function primarily as an operating company, and partner with a property company. Enter Joe Levine and Mercer Street. The two business partners appear to be a perfect fit since their investment theses are strikingly similar. Both are increasingly keen on secondary and tertiary markets, markets they prefer to refer to as “growth markets”, primarily in the South and the West. Pfinsgraff cites research which has identified what he believes to be a long-term demographic shift away from gateway cities to these growth markets. The cities Common House has targeted have all seen 10% year-over-year population growth, with most of the movers identifying as millennials, who are re-locating within their new city’s urban core, as opposed to the suburbs. Cities like Richmond, VA, Chattanooga, TN, Greenville, SC, and Knoxville, TN all demonstrate these characteristics, and will likely soon become home to a Common House. Mercer Street’s research has identified these trends too, using obscure metrics such as tracking urban cores with a large populous of tattoo parlors – believing that this will show where the up-and-coming “5pm-9pm Hipster Cities” are. Levine and Pfinsgraff also believe these markets demonstrate recession resistant characteristics, driven by government, higher education, and healthcare industries.

The Common House is not your grandfather’s country club, and Pfinsgraff and Levine certainly are not your stereotypical, stiff, old-school businessmen, either. Instead, they are bringing a forward-thinking, new-school approach to capitalize on the re-emergence of urban life in cities that many other investors consider too small. As they look forward to new locations there will certainly be a challenge in attempting to efficiently systemize procedures within The Common House’s business plan without losing the unique character which has made it a success thus far. But, with each new city and community welcoming the concept with open arms, Levine and Pfinsgraff could not be more excited about their creative market niche.