Jason Henderson, Jason Spencer

Introduction

Hardly a day goes by without the release of a handful of news stories about autonomous vehicles (or AVs for short). The proverbial “tipping point” of awareness has been reached in the public consciousness as AV technology is quickly becoming the new focus of firms from Silicon Valley to Detroit and beyond. Automation has, and will continue to have far-reaching implications for many human activities, but for driving, the technology is here. Google has been in talks with automaker Ford (1), Elon Musk has declared that Tesla will have the appropriate technology in two years (2), GM is paired-up with Lyft (3), Uber is in development-mode (4), Microsoft and Volvo have announced a partnership (5), Apple has been piloting its top-secret project “Titan” (6), Toyota is working on its own technology (7), as is BMW (8). Audi (9) made a splash by sending a driverless A7 concept car 550 miles from San Francisco to Las Vegas just in time to roll-into the 2016 Consumer Electronics Show. Clearly, the race is on. (Download PDF)

The incredible appeal of AVs is hard to deny. The productivity benefits of doing other activities instead of driving have been estimated to be worth $5.6 trillion a year globally (10), saving drivers an average of 50 minutes a day in the United States (11). The reduction in traffic fatalities from over 30,000 people a year in the United States and over 1.2 million worldwide represents an enormous opportunity to save lives (10). AVs also hold the possibility of significantly lowering the cost of transportation due to labor being shifted from human drivers to computers. MIT-based startup nuTonomy plans to launch thousands of driverless taxis in Singapore in the next few years after announcing that its prototype vehicle successfully completed the first of a set of driving tests in March of this year (12). AVs are likely to yield much greater travel efficiency due to the fact that they can drive more efficiently, and the total vehicle-count on the road may decrease since AVs could alleviate the need for single-ownership and usage (13).

With great potential benefits, however, come more than a few uncertainties and possible negative effects. Research suggests that vehicle-miles traveled (VMT) will increase because of the induced demand of more convenient travel, better access, and lowered cost per mile, especially if the vehicles are shared. With that increase in demand comes greater congestion. For the real estate industry, there are a number of implications as the use of a wide range of asset types are affected, influencing property values. Although the information being assembled is incomplete, for the purpose of this report, the assumption is made that existing physical roadway infrastructure is sufficient and will gradually be improved, as consumer demand will eventually bring legislative support to provide transportation funding.

Implications

The major travel implications primarily fall into three categories: individual travel decisions, transportation system impacts, and industrial and logistical impacts.

Individual Travel Decisions

People will choose to travel more

With the attraction of AVs, studies have shown that households with more auto-dependent locations are likely to travel more, due to the reduction in travel time costs related to doing other productive activities besides driving (14).

Travel is made more convenient to non-drivers, further inducing demand

Young people, the elderly, the physically-impaired or disabled, or those visitors lacking a driver’s license will contribute to new travel demand, estimated at up to an 11% increase in vehicle travel (14). The increased travel demand would directly result in additional total trips as well as total vehicle miles traveled (VMT), and pricing regimes may direct people to use shared, on-demand AVs.

People will be able to share vehicles more easily, and travel will be cheaper

Due to the ability for AVs to “self-taxi,” it will become more convenient for households to share less vehicles, and for many households to forego car ownership in favor of AV-based taxi services. Household vehicle ownership is estimated to decrease by up to 43%, from 2.1 vehicles per household to 1.2 vehicles per household by the time AVs become the dominant mode of vehicular transportation (15). The rise of services like Avis Budget Group’s ZipCar, Daimler AG’s Car2Go, and General Motors’ Maven demonstrate the growing comfort many people have with simply renting a vehicle when they need one, and the shift automakers have been making towards becoming transportation service companies, instead of just automobile producers. Both GM and Volkswagen have indicated that they are moving from an “ownership model” to a “mobility-on-demand model,” which may presage private ownership as a subscription-based service.

In addition to the improved ease of sharing vehicles, the economics of sharing are hard to ignore: contrast the owned-vehicle utilization rate of around 5% (18) with the utilization of a shared AV, which besides the time it takes to refuel, repair, and clean, is available for usage at all times. MIT’s SENSEable City Lab estimates that in an all-AV scenario, around 80% fewer cars would be necessary in order to take passengers to every destination they need to be at the time they need to be there (16). As the use of AV technology increases, the cost of vehicle ownership will not be able to compete with shared and subscription-based transportation services, which the auto-industry is indicating that it is moving towards. What were once auto companies selling cars are likely to evolve into transportation service companies that happen to design and manufacture vehicles.

People will not have to park as many vehicles

A study of 41 major Central Business Districts in the United States found that on average, 31% of space is devoted to parking (17). McKinsey estimates that AVs have the potential to reduce parking space by around 61 billion square feet (5.7 billion sq. meters (11). Put another way—with an estimated 800 million parking spaces in the United States (18), amounting to 144 billion square feet of parking total—the maximum potential reduction is nearly 42%, close to the projected 43% reduction in vehicle ownership.

Transportation System Impacts

The impacts on all transportation systems are not yet fully-understood, and will likely have rather complicated effects. Variables such as transit access, local regulation and involvement with operators, and transit agencies will make a difference in determining what system evolves in any given area or city. Furthermore, the nuanced segments of transportation demand spread across varied geographies mean that the range of types of AVs (size, number of seats, vehicle type) and frequency with which they will travel will largely depend on how the demand interrelates with the existing transportation infrastructure.

Lower-Density areas and suburbs may see the greatest impact

A 2013 study (19) funded by the US Department of Transportation and carried-out by researchers at the University of Michigan came up with a simpler type of model constructed to demonstrate the likely transportation mode shifts brought about by fixed-route shuttle AVs. The researchers modelled a set of transportation outcomes for four types of neighborhoods in metropolitan Chicago with similar regional rail access, but different characteristics of income and density. Based on the model, AV-type shuttle usage to commute to the regional rail stop became:

- Higher-income/Higher-density (Evanston) 14%

- Higher-income/Lower-density (Skokie) 36%

- Lower-income/Higher-density (Pilsen) 22%

- Lower-income/Lower-density (Cicero) 41%

In each scenario, AV shuttle ridership grew while driving, walking, and biking decreased, with the greatest reduction in driving from the lower-density neighborhoods. One of the key findings in the report is the fact that AV-based shuttles help to alleviate what is commonly referred to as the “first/last mile problem,” which is the transportation difficulty of dealing with the first and/or last leg of a trip or commute. AV services may be able to provide a considerable solution to that problem. In a similar fashion, companies such as Bridj in Boston, and Chariot in Silicon Valley are offering private bus service solutions to this exact problem, and are becoming ever-more successful at predicting and managing the transportation demand for this type of service (20). The traditional role of transit agencies has been to collect data for the sake of collection, but nimbler operators are learning that by making constant use of the data they collect from their users, routes can be made increasingly cost-effective, or changed to meet varying rider demand.

Central Business Districts may see little impact

As with lower-density areas and suburbs, Central Business Districts (CBDs) will certainly see their fair share of AVs, and they could eventually become the dominant mode of transportation for taxi-like services. However, the impact on mobility will be due less to the fact that CBDs and other high-density locations generally already have good access to transit. Taxis may no longer have human drivers and will be easier to call to your location, but the benefits and relatively low cost of robust and extensive public transportation systems such as subways, trolleys, and light/regional rail will continue to be attractive.

As noted in the Michigan study (20), higher-density areas would exhibit significantly less shift in transportation usage to the AV shuttles predicted in the model due to the ability to simply walk or bike to a conveniently-located transit stop or commute destination. The greatest benefit will be for neighborhoods in which vehicle travel is commonly necessary, especially given constraints such as limited or expensive parking, for trips taking unfamiliar routes, or ones ill-served by convenient transit options.

Industrial & Logistics Impacts

A whole range of industries are already affected, and will continue to be impacted by AV technology. Shipping and logistics companies foresee the ability to drastically reduce labor costs with automated trucks and warehousing processes, and automated industrial and fleet vehicles seem poised to continue this trend towards automation.

Goods shipment and logistics will undergo radical shifts to automated pickup and delivery

The announcement of Daimler’s autonomous Freightliner Inspiration 18-wheeler truck in May, 2015 brought with it some further industry realization that the age of semi-autonomous trucking is not that far away. In fact, it could be only ten years by Daimler’s estimation (21). Not only would there be significant labor cost savings in linking a series of AV trucks to a lead driver for long-haul trips, but Daimler and other automakers suspect that the safety record would greatly improve. Of the roughly 330,000 annual truck-involved accidents in the United States, about 90% are caused by human error, which causes around 4,000 fatalities. Researchers believe that computers will be better truck drivers.

Global logistics firm DHL published an expansive report in 2014 outlining the current and planned applications of AVs in warehousing, handling, shipping, and delivery of goods (22). The authors predict AV and vehicle-to-vehicle communication technology will continue to develop at a rapid pace in indoor facilities. AVs such as order-picking shelf handlers, forklifts, and modular conveyors are already used in warehousing and distribution centers, and in addition, major shipping facilities such as seaports and multi-modal inland stations already employ various automated technologies due to the magnitude and complexity of modern shipping needs. The report contends that in closed facilities further automation is entirely possible and implementable.

The next area of innovation will likely be for last-mile delivery. It’s unlikely that AVs will be able to handle the physical delivery of parcels from a vehicle to a doorstep anytime soon, however, it is conceivable that the delivery support vehicle may become automated. Taking this a step further, DHL also speculates that AVs and automated handling technologies may be able to deliver parcels to a fixed loading station. Currently, these are loaded manually for services such as DHL Packstations and Amazon Lockers, but due to the specified sizes and design, automation may be possible. In addition to the fixed locations, delivery AVs may even act as mobile repositories, available for parcel delivery and pickup in certain locations at certain times of the day.

Industrial, fleet and agricultural vehicles will become more automated

In addition to trucking, many industrial activities are well-suited to AV technology. Mining giant Rio Tinto is already using fully autonomous truck fleets at two sites in Western Australia for the mining of iron ore (23), and BHP Billiton and Fortescue are working on doing the same. In the agricultural market, John Deere has been selling auto-steering and self-guidance technology in their tractors in over 100 countries worldwide for many years (24). Due to their use on mostly private, rural land, the rollout of semi-autonomous tractors has been steady, and looks only to increase from growing evidence of better yields due to operational cost efficiency with the technology. Several other types of vehicle fleets warrant speculation: transit buses, snow plow vehicles, and garbage and recycling trucks. The labor costs associated for each of these activities is significant, and many municipalities have been, and will continue to be under pressure to contain operating costs that have grown municipal debt levels to near historic highs (25).

Timing

The timing debate is one of the most contentious. While the technology continues to improve at a rapid pace, regulations allowing for AV usage are still developing. The additional cost premium of AVs should be getting lower and lower each year, but the public adoption and planning efforts are far from certain.

First release in late 2010s, adoption by 2025-2030

A 2012 KPMG/Center for Automotive Research report roughly predicted the regulatory timeline thus far, and next up, predicts that the first vehicle-to-vehicle and vehicle-to-infrastructure technologies will be released to the market by 2018 or 2019. Furthermore, by around 2025, there will be sufficient built-in and aftermarket products to support driver automation (26). This chimes with several other predictive assessments, including a McKinsey report that by around 2030 consumers will begin to adopt AVs (11), and more specifically, an RCLCO Advisory report that by 2030-2035, real estate assets will be impacted in a much greater magnitude than before (27). However, lessons may be learned from the adoption rate of transformative products such as smartphones. Under that model, the adoption rate of AVs would be much faster than anticipated.

Price premiums will decline from the 2020s to 2040s

Research at the Victoria Transport Policy Institute tracked the cost premiums, adoption timing, and market saturation of previous vehicle technologies such as air bags, automatic transmissions, and navigation systems to predict the timing and price premiums that AV technology may exhibit (14). The prediction offered is that AV technology would likely take about 20 years from 2020 to compose around half of vehicle sales in a given year:

- Throughout the 2020s – large price premium, 2-5% of vehicle sales

- 2030s – moderate pricing premium

- 20-40% of vehicle sales

- 2040s – minimal pricing premium

- 40-60% of vehicle sales

These timing estimates may be too far into the future, assuming faster adoption rates through the development of less-expensive AV technology, subscription-based transportation services, and increased market demand.

Regulatory hurdles exist: different state laws for AVs

Several states have begun introducing regulations for AVs, including Nevada, Florida, Michigan, and California (13). While states continue to pass regulatory measures aimed at AV usage and standards, there is pressure from the industry for better coordination. Google executives argued in March 16 that although at least 23 states have passed 53 pieces of legislation on the subject, a patchwork of differing state laws will make matters more difficult for operators.

At the federal level, the White House proposed a $4 billion spending bill that would aim to have federal regulators (chiefly, the U.S. Department of Transportation) work closely with automakers to develop policies and rules that would allow vehicles to travel safely without a human driver at the wheel (28), however, the bill does not have Congressional approval nor appropriation. By February 2016, the National Highway and Traffic Safety Administration ruled that Google’s computers could be classified as a driver (29), but since the states have the authority on this issue, developments at the state level will have the most impact.

Transportation plans are behind the curve

A 2015 study by the National League of Cities found that only 6% of member city transportation plans include the potential impact of driverless technology, and only 3% take into account private transport companies such as Uber and Lyft (30). In the meantime, the trend towards sharing vehicles and rides rather than owning a personal vehicle are made clear from numerous growth examples like taxi services Uber and Lyft, shuttle services Bridj and Chariot, and vehicle-subscription platforms such as ZipCar, Car2G0, and Maven.

Real Estate Impacts

AVs will significantly impact existing transportation infrastructure, buildings, and the way in which transportation activities interact with real property. Some of these potential impacts are discussed below; as AV technology evolves, further impacts will undoubtedly emerge. In the face of this uncertainty, real estate planners, developers, and investors should continue to follow established best practices as these practices, generally, are most conducive to accommodating unforeseen events.

AVs may not require road widening, but could create opportunities for conversion

AVs will use existing roads much more efficiently than conventional cars currently do. To what extent existing roads will be used more efficiently is open to debate: Several studies contend that AVs will increase the capacity of existing roads somewhere between two to four times (12). Assuming a multiple of two, an existing road that can currently accommodate 10,000 vehicles per hour would be able handle 20,000 AVs per hour. While this inherent capacity increase will alleviate the need to build new roads or widen existing ones, roads that become more congested have the potential to become significantly less pedestrian-friendly. In addition, certain roads that currently have minimal traffic could become more congested since the algorithms that control AVs will continuously look for the most efficient route.

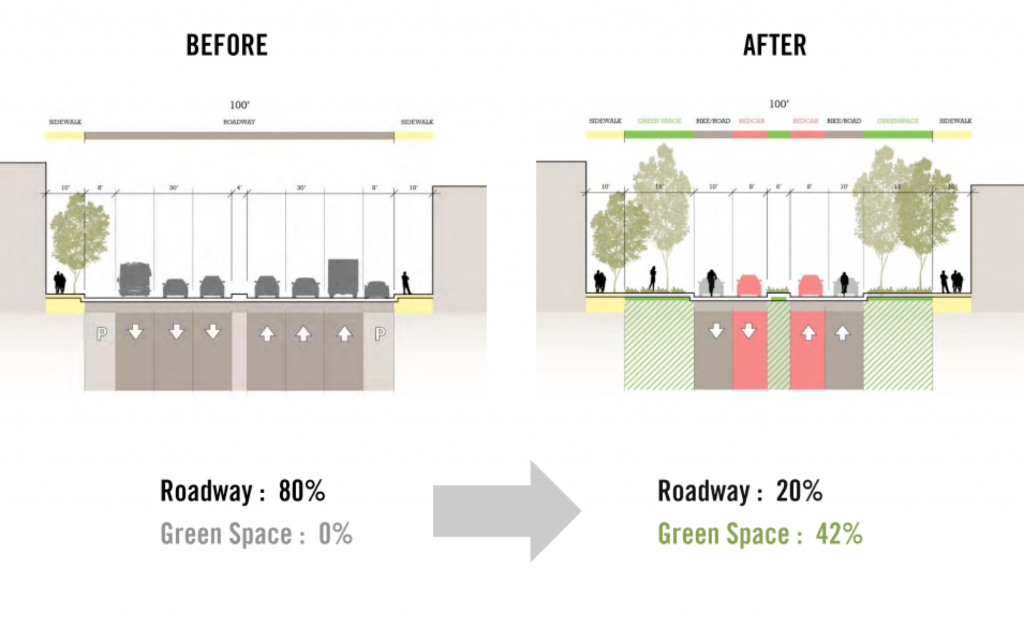

The link between increased AV use and the conversion of parking spaces to public and private use offers other implications for altering land values. Architecture firm Perkins + Will has been thinking about these unintended consequences and has proposed narrowing existing roads to the point where the capacity of the road remains unchanged. The additional space in front of buildings and in-between two-way boulevards could provide for a range of usage options such as widened sidewalks, tree-lining, parking, retail seating, and storm-water runoff filtration. The emergence of AV usage may indeed present interesting opportunities to reinvent the public spaces currently devoted to automobile transportation and parking while enhancing the quality of the urban or suburban public realm.

Impacts on New and Existing Buildings

AVs will allow parking to be uncoupled from the building; new developments will become denser; and more space within them will be available for productive use. While very little space will be required for parking, space will be needed for loading and unloading and as standing space for AVs waiting for passengers or arriving with passengers.

Office: opportunities with over-parked sites and good locations

The design impacts AVs will have on office buildings are likely to vary depending upon location. CBD office buildings with attached or integrated parking garages will be impacted the most by AVs. If there is no longer demand for on-site parking, this space will go unused. The configuration and proximity of AV loading and off-loading zones may also impact the design of CBD office buildings. No one is certain about what loading and offloading model will emerge. Buildings may have their own loading station or centralized stations similar to today’s subway stations. It may even be possible to convert some of the existing integrated parking space into loading and unloading space.

While AVs may decrease tenant demand for suburban office buildings more so than they will for CBD office buildings, the design impacts they will have on suburban office buildings are likely to be minor. The typical suburban office building that is part of an office park is already designed for access by car, and has ample areas for loading and offloading. Suburban office parks built to accommodate vehicular traffic will likely continue to become denser and more mixed-use in nature. Buildings built within new and existing office parks are likely to be placed closer to the road and one another, and land vacated by parking could be used to increase building density.

Multifamily: extra space conversion or sale

While many multifamily developments already have a surplus of parking, AV usage will make this surplus more ubiquitous and apparent. Garden-style apartment complexes may be able to absorb excess parking space by building more units, installing additional amenities, or selling off excess parking space as retail sites.

Converting the integrated parking areas within existing mid and high-rise buildings will be more difficult. Possible uses of this existing space include converting some of the space into passenger loading and offloading areas, renting the space for storage, or installing additional building amenities within the space.

Hotels: altered travel patterns will impact where travelers seek lodging

The design impacts AVs will have on hotels will be similar to those on multifamily buildings. Existing CBD hotels will likely not need additional space for passenger loading and unloading, since most guests already arrive via taxi or public transportation and do not park on-site. AVs will have larger design impacts on existing select and limited service hotels that have large surface parking lots. Like existing multifamily properties, select and limited service hotels may be able to monetize their surplus parking by adding more rooms or by selling off the space for ancillary development.

Changes in travel patterns due to AVs may also impact select and limited service hotels. A large percentage of these hotels are located in rural locations, adjacent to highway intersections that link major routes. As AVs become more widespread, travelers might decide to let their cars drive them to their final destinations, as they sleep, instead of staying at these hotels overnight.

Industrial: continued automation, reduced congestion

The design of industrial facilities will likely remain relatively unchanged since most of them already have some level of internal automation that is used to offload trucks, sort products, and load the sorted goods onto different trucks for distribution. Industrial building design changes will likely be dictated more by advances in this internal automation and less by AVs. However, as loading processes become more efficient and road transportation times become shorter and more predictable, truck courts may become smaller.

AVs might cause new facilities to be built in different locations since the cost and timing factors may change significantly. Larger multi-modal facilities will continue to be built due to the cost efficiency of shipping goods by rail and sea. Concurrently, if AVs reduce traffic congestion, large industrial tenants may also demand several smaller facilities that encircle the CBD rather than one large facility located outside of it.

Retail: tailwind for current shift to experiential, and opportunities for distribution

There are several competing market forces in the retail space right now, and the line between retail and entertainment space is becoming obscure, as retailers and brands shift into experiential retail. Large traditional retailers like Sears, Sports Authority, and Kohl’s are closing stores, while online, boutique retailers such as Warby Parker and Bonobos are opening brick-and-mortar stores in CBDs.

AVs are likely to impact the design of retail properties in the following ways: community and neighborhood retail centers anchored by grocery stores will most likely see the size of their parking lots shrink as more customers arrive in one AV, shop, and are driven away by another. As such, new community and neighborhood retail centers will likely be built closer to the road. Some tenants that sell groceries may choose to take advantage of AVs and use their stores as distribution centers for home deliveries, shifting space from floor retail to logistical operations.

Regional and super regional malls have become more mixed-use in nature over the last ten years, and this trend is likely to accelerate with AVs. New regional and super regional malls will occupy less land, and existing centers will be able to convert some of their existing parking garages to other uses. Going forward, all shopping centers are likely to have more entertainment options within them.

Sustainability: better land use is achievable

Whether or not vehicle-miles traveled increases or decreases and what their underlying power source is will be the most significant environmental impacts of AVs. Coal-powered electrical grids recharging electric AV batteries may pollute much more than the current paradigm. At the same time, AVs will have an impact on the environment and the sustainability of the built environment.

Since AVs will be able to navigate road networks more efficiently, existing roads will be able to accommodate denser traffic patterns without widening them, and in locations where traffic patterns do not become denser, road widths could be reduced, in turn decreasing the amount of impervious surfaces. Within CBDs, increasing the ratio of permeable surfaces to total surface area should increase the volume of storm water runoff that is absorbed and filtered by the underlying soil. As a result, cities will be able to forgo expanding existing or building new storm water treatment systems. Developments that have to retain storm water on site may be able to build smaller cisterns or bio-swales. Having a higher ratio of impervious surfaces will also reduce the urban heat island effect, reducing the demand for air conditioning – and electricity – in the summer.

AV’s will allow more space within a given building to be dedicated to productive use and not parking. This ability to house more productive space within the same building volume will allow developers to build denser buildings and should make urban infill sites more attractive for development, reducing the pressure to build on greenfield sites.

Some building owners may even be able to make their existing building’s more sustainable by converting some of the surplus parking space into areas that house sustainable design features, such as storm water cisterns, gray water collection areas, and bike storage areas.

Challenges and Opportunities for the Portfolio Manager

Specific Challenges

Existing parking garages

While there will be a lot of extra parking capacity, some existing parking garages may increase in value, while others will decrease significantly. The garages that will likely increase in value are those that are well located, have favorable access to major transportation arteries, and have a flexible parking layout.

AV operators such as Uber, Apple, Lyft will likely be attracted to garages with more flexible and geometrically symmetrical layouts. These attributes will allow them to park more cars in these garages and install charging and cleaning stations. A percentage of the existing parking garages that do not have these attributes might get converted to other uses, such as self-storage, but most of these poorly-positioned garages will likely decrease in value, prompting demolition or replacement until more appropriate development yields the best land value.

Certain tenancies will become more risky

As with any major industry disruption, businesses that cannot reinvent themselves or ones that are structurally-vulnerable may fall by the wayside. AV usage will create many new tenancy opportunities while simultaneously disrupting the $198 billion US auto insurance industry (31), and the entire “crash economy” business of medical care, lawyers, and auto-body shops (32). Below, a list of tenancies that are highlighted as specific risks going forward:

Tenancies likely to suffer from loss of business due to increased AV usage:

- Parts stores such as AutoZone, Advanced, and CARQUEST

- Auto dealerships

- Auto-body shops: decreased accidents

- Personal injury attorneys: decreased injuries from accidents

- Truck stops catering to human drivers

Tenancies likely to require retrofits to shift away from retail and towards fleet service:

- Auto repair shops

- Tire shops

- Car-wash

Tenancies and businesses facing likely disruption of business:

- Auto insurance companies: less personal insurance policies, and decreased accident rates

- Driving schools

- Car rental centers such as Enterprise, Budget, and Hertz

- Disrupted municipal systems

- Revenue from traffic tickets

- Revenue from vehicle licensing/registration

- Revenue from DMV fees, and some DMV locations may become less necessary

Specific Opportunities

Urban infill sites near existing subway and light rail stations

AVs will increase the values of urban infill sites that are more than a half a mile from existing subway and light rail stations. In urban settings, new, multifamily residential units tend to get developed adjacent to existing subway or light rail stations. Typically, the transit authority does not own enough land or faces regulatory restrictions that prevent it from building large parking structures at these urban stations like it does at stations that are located in more suburban locations. As such, the density of existing developments tends to decrease dramatically a short distance away from these existing stations because residents are unwilling to walk to the nearby by transit station and are not able to park their cars at the station. With AVs, current and future residents will be able to use AVs to get to and from the stations – or into the CBD – and there should be a greater demand for residential space in these neighborhoods, which will spur additional demand for additional retail space.

Properties with available space: Well-located suburban offices & retail

Sites with additional buildable space or FAR could be an opportunity for investment, especially those that are located close to CBDs. As AVs become more prevalent, fewer parking spots will be required. As a result, there may be opportunities to buy retail centers that are close to the CBD that have large surface lots with the intent of building new structures in the existing parking lots or demolishing the existing structures and building new ones.

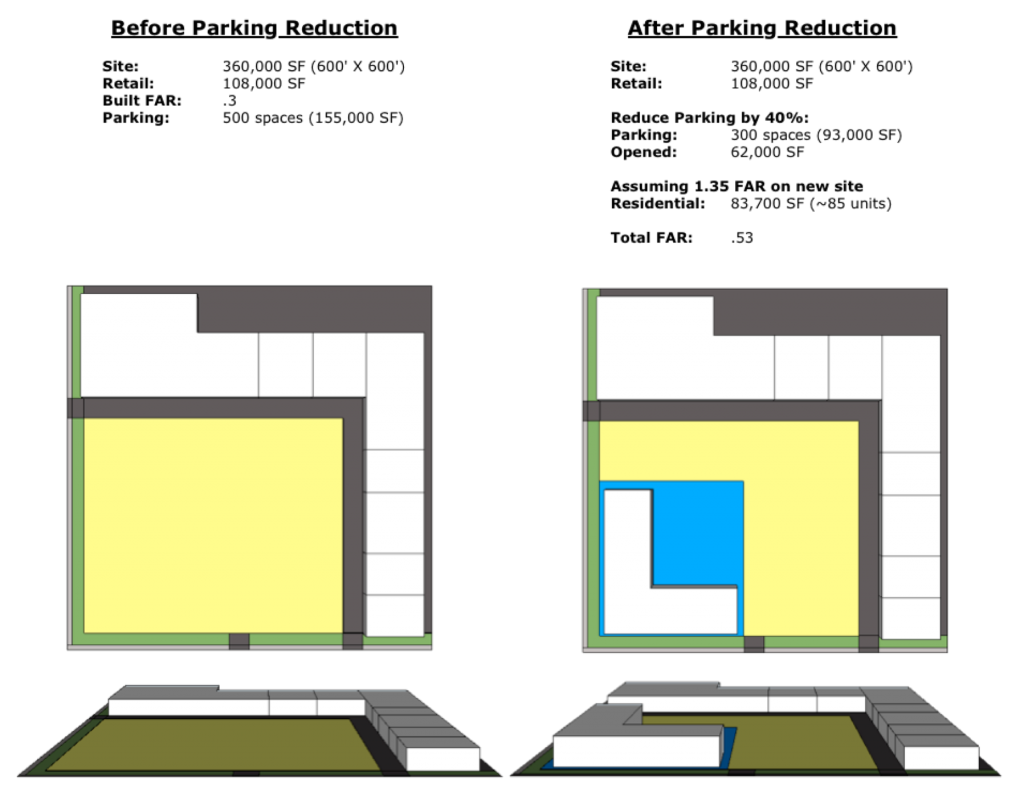

To demonstrate the value lift of reclaimed parking space for a typical suburban property, Figure 2 above shows a simplified redevelopment of a FAR .3 retail or office property consisting of 108,000 SF on a 600’ by 600’ block with a 4.6 space per 1,000 SF parking ratio. If we use the assumption that parking demand is reduced by 40%, and zoning allows for readjustment of parking density and site density, then allocating a 40% portion of the existing parking lot would yield an area of roughly 93,000 SF. Assuming a three story height limit and 1.35 FAR on that portion of the site, one could build 83,700 SF of new product– residential per this example.

Assuming that development cost is $280 per SF, and rents are $2.20 per SF per month with a 30% operating expense margin and 85% building efficiency, the development cost is $23.436 M, and the annual net cash flow is $1.878 M. If new residential of that type and in that market trades for a 6% cap rate, then the new building could trade for $31.3 M. Overall, if the project is allowable, the reuse through reduced demand for parking creates a potential value lift of around $7.86 M, or nearly $94 per SF of additional buildable space.

New construction requiring fewer parking decks

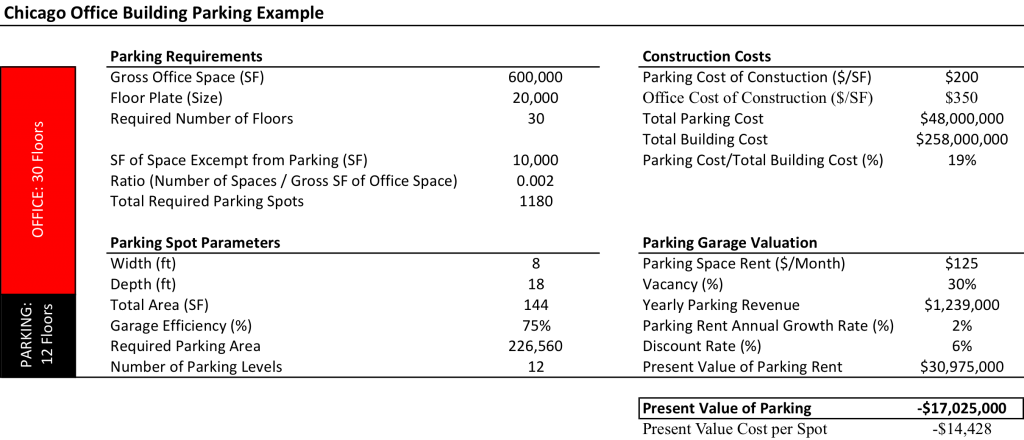

As AVs become more prevalent, office buildings will not need to have as much parking. Assuming that municipalities maintain the same FAR in a given area, this will allow developers to build office building with more space dedicated to productive use. The following examples (See Tables 1 and 2) display the current costs of parking in a new office building and the potential valuation increases by not having to build as much parking space.

If a developer in Chicago wants to build an office building with 600,000 SF of gross space, the current zoning requires the developer to build an additional 12 floors of parking (1,180 spots) within the building. Assuming that these spots are rented out for $125 per month and that the cost of building the parking areas is $200 per SF, the present value of the parking garage is negative $17 million (approximately -$14,400 per spot).

If a developer in Chicago wants to build an office building with 600,000 SF of gross space, the current zoning requires the developer to build an additional 12 floors of parking (1,180 spots) within the building. Assuming that these spots are rented out for $125 per month and that the cost of building the parking areas is $200 per SF, the present value of the parking garage is negative $17 million (approximately -$14,400 per spot).

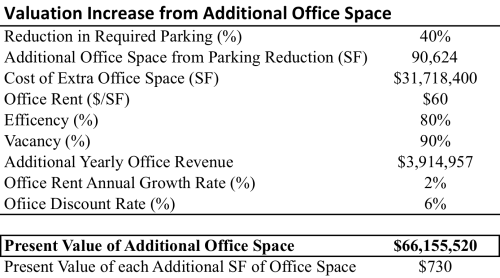

If the same forty-two-story office building is built with 40% less parking, the developer will be able to build an additional 90,624 SF of office space. Assuming that this space is rented out at $60 per SF annually, the presence of the additional office space will increase the value of the building by $66 million. As such, developers will be able to unlock substantially more value from the project site.

Clusters of car dealerships and auto repair shops

Car dealerships and auto repair, and tire/muffler shops are often clustered together. As direct and fleet car sales become more prevalent, enterprising dealerships and auto shops will restructure their businesses to cater to the new AV market, while others may go out of business. There may be opportunities to buy individual dealerships and auto shops at deep discounts and assemble large sites that could be redeveloped into a better combination of uses or another use, since the value of the assembled, underlying real estate may not be reflected in the value of the individual companies.

Conclusion

AVs present a unique set of challenges and opportunities to real estate owners, operators, and investors. The role of transit is enhanced for areas suffering the last mile problem, the advent of private transportation services will alter the landscape of shared transportation, the de-coupling of parking from certain sites will free space to allow for denser forms of development, and industries that rely on human drivers will shift to make room for companies that serve the AV market. As the cost of private transportation shrinks, and ineligible drivers obtain access to better transportation, more miles will be traveled, but as the necessity of vehicle ownership becomes less of a factor, and AVs travel more efficiently, the woes of congestion may decrease.

Much of the value in real estate is shaped by location, the built environment, and access. Real estate values will respond as the rules of access are re-written with the advent of AVs. Change will be coming much sooner than many realize, and since real estate is typically viewed as a long-term, relatively illiquid investment, investors should take these future realities into consideration.

The authors would like to thank:

Alex Zikakis, President of Capstone Advisors

Gerald Tierney, Senior Project Architect at Perkins + Will

Robert Brown, Managing Dir. & Principal at Perkins + Will

Spencer Levy, Head of Americas Research at CBRE

Professor Michael Tomlan, Cornell University

(Endnotes)

1 Justin Hyde and Sharon Carty (Dec 21, 2015), Google Pair with Ford to Build Self-Driving Cars, Yahoo! Autos. (https://www.yahoo.com/autos/google-pairs-with-ford-to-1326344237400118.html)

2 Kirsten Korosec (Dec 21, 2015), Elon Musl Says Tesla Vehicles Will Drive Themselves in Two Years, Fortune Magazine Online. (http://fortune.com/2015/12/21/elon-musk-interview/)

3 Aarti Shahani (Jan 5, 2016), Lyft, GM Teaming Up To Create Fleet Of Driverless Cars, NPR All Things Considered. (http://www.npr.org/sections/thetwo-way/2016/01/04/461922098/lyft-gm-teaming-up-to-create-fleet-of-driverless-cars) ; see also: Mike Ramsey, Gautham Nagesh, “GM, Lyft to Text Self-Driving Electric Taxis,” WSJ, May 5. 2016.

4 Tess Danielson (May 22, 2015), Why Uber’s driverless car has been spotted all over Pittsburgh, The Christian Science Monitor. (http://www.csmonitor.com/Technology/2015/0522/Why-Uber-s-driverless-car-has-been-spotted-all-over-Pittsburg)

5 Arjun Kharpal (Nov 20, 2015), Microsoft, Volvo strike deal to make driverless cars, CNBC News. (http://www.cnbc.com/2015/11/20/microsoft-volvo-strike-deal-to-make-driverless-cars.html)

6 Daisuke Wakabayashi (Sep 21, 2015), Apple Targets Electric-Car Shipping Date for 2019, The Wall Street Journal. (http://www.wsj.com/articles/apple-speeds-up-electric-car-work-1442857105)

7 Toyota promises driverless cars on roads by 2020, (Oct 7, 2015), BBC News: Technology. (http://www.bbc.com/news/technology-34464450)

8 Edward Taylor and Irene Preisinger (Sep 15, 2015), BMW eyes new business opportunities with autonomous cars, Reuters. (http://www.reuters.com/article/us-autoshow-frankfurt-bmwdesign-idUSKCN0RF2K220150915)

9 Aaron Mamiit (Jan 8, 2015), CES 2015: How Did Audi’s Self-driving Car Travel 550 Miles from San Francisco to Las Vegas?, Tech Times. (http://www.techtimes.com/articles/25327/20150108/ces-2015-how-did-audis-self-driving-car-travel-550-miles-from-san-francisco-to-las-vegas.htm)

10 Ravi Shanker et al. (2013), Autonomous Cars: Self-Driving the New Auto Industry Paradigm. Morgan Stanley Blue Paper.

11 Michele Bertoncello and Dominik Wee (2015), Ten ways autonomous driving could redefine the automotive world, McKinsey & Company.

12 Kari Paul (Mar 27, 2016), Self-Driving Taxi Passes Its First Obstacle Test in Singapore, Motherboard, Vice Media, (http://motherboard.vice.com/read/self-driving-taxi-passes-its-first-obstacle-test-in-singapore)

13 Todd Littman (2015), Autonomous Vehicle Implementation Predictions, Victoria Transport Policy Institute, (www.vtpi.org)

14 Michael Sivak and Brandon Schoettle (2015), Influence of Current Nondrivers on the Amount of Travel and Trip Patterns with Self-Driving Vehicles, Sustainable Worldwide Transportation Program (www.umich.edu/~umtriswt), University of Michigan.

15 Michael Sivak and Brandon Schoettle (2015), Potential Impact of Self-Driving Vehicles on Household Vehicle Demand and Usage, Sustainable Worldwide Transportation Program (www.umich.edu/~umtriswt), University of Michigan.

16 Matthew Claudel and Carlo Ratti (2015) Full speed ahead: How the driverless car could transform cities, McKinsey & Company Global Infrastructure Initiative.

17 Donald C. Shoup (2005), The High Cost of Free Parking, Chicago: Planner’s Press.

18 Mikhail Chester, Arpad Horvath, and Samer Madanet (2010), Parking Infrastructure: energy, emissions, and automobile life-cycle environmental accounting, Environmental Research Letters, Volume 5, Number 3.

19 Jonathan Levine, et al. (2013), Effects of Automated Transit, Pedestrian, and Bicycling Facilities on Urban Travel Patterns, University of Michigan.

20 Joseph Stromberg (Jul 7, 2015), These startups want to do for buses what Uber did for taxi rides, Vox Media, (http://www.vox.com/2015/7/7/8906027/microtransit-uber-buses)

21 Alex Davies (May 5, 2015), The World’s First Self-Driving Semi-Truck Hits the Road, WIRED, (http://www.wired.com/2015/05/worlds-first-self-driving-semi-truck-hits-road/)

22 Matthias Heutger and Dr. Markus Kückelhaus et al. (2014), Self-Driving Vehicles in Logistics, DHL Trend Research (http://www.dhl.com/content/dam/downloads/g0/about_us/logistics_insights/dhl_self_driving_vehicles.pdf)

23 Jamie Smyth (Oct 19, 2015), Rio Tinto shifts to driverless trucks in Australia, Financial Times (https://next.ft.com/content/43f7436a-7632-11e5-a95a-27d368e1ddf7)

24 Andrea Peterson (Jun 22, 2015), Google didn’t lead the self-driving vehicle revolution. John Deere did., The Washington Post (https://www.washingtonpost.com/news/the-switch/wp/2015/06/22/google-didnt-lead-the-self-driving-vehicle-revolution-john-deere-did/)

25 SIFMA (Q3, 2015) US Municipal Securities Holders, SIFMA Research & Statistics, (http://www.sifma.org/research/statistics.aspx) Accessed Feb 1, 2016.

26 Gary Silberg, Richard Wallace, et al. (2012), Self-driving cars: The next revolution. KPMG (kpmg.com), Center for Automotive Research (cargroup.com).

27 Taylor Mammen and Brandon Beck (2015), RCLCO future Series: A Driverless Vehicle Roadmap for the Real Estate Practitioner- Part 2, The Advisory, RCLCO (www.rclco.com/expertise)

28 Mike Spector and Mike Ramsey (Jan 14, 2015), U.S. Proposed Spending $4 Billion to Encourage Driverless Cars, The Wall Street Journal. (http://www.wsj.com/articles/obama-administration-proposes-spending-4-billion-on-driverless-car-guidelines-1452798787)

29 David Shepardson and Paul Lienert (Feb 10, 2016), Exclusive: In boost to self-driving cars, U.S. tells Google computers can qualify as drivers, Reuters. (http://www.reuters.com/article/us-alphabet-autos-selfdriving-exclusive-idUSKCN0VJ00H)

30 Nicole DuPuis, Cooper Martin, and Brooks Rainwater (2015), City of the Future: Technology & Mobility, Center for City Solutions and Applied Research, National League of Cities.

31 The Economist (2015), If Autonomous Vehicles Rule the World: From Horseless to Driverless, The World If, (www.worldif.economist.com)

32 James M. Anderson, et al. (2014), Autonomous Vehicle Technology: A Guide for Policymakers, RAND Corporation (www.rand.org)