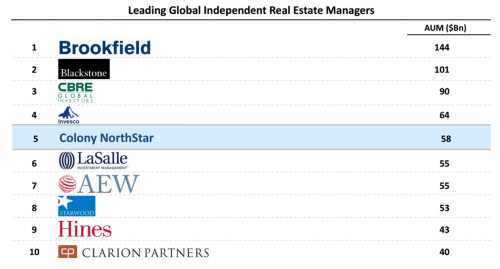

Colony Capital, NorthStar Asset Management, and NorthStar Realty Finance Combine to Form the 5th Largest Global Real Estate Investment Manager

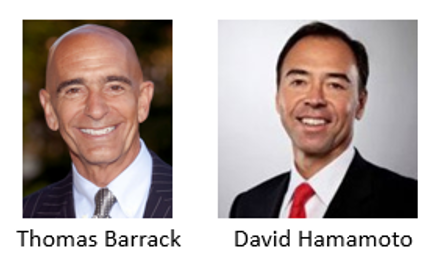

On June 3rd, three leading real estate firms announced that they would merge into a single real estate investment trust with approximately $58 billion in assets. According to the Wall Street Journal, the three-way stock merger will result in Colony Capital (NYSE: CLNY) shareholders owning 33.25%, Northstar Realty Finance (NYSE: NRF) shareholders owning 33.9%, and NorthStar Asset Management Group (NYSE: NSAM) shareholders owning 32.85% of the combined firm. Richard Saltzman, CEO of Colony, will be CEO of the combined company. Thomas Barrack Jr, founder of Colony Capital, will be Chairman, while David Hamamoto, founder and Chairman of NorthStar Realty, will be vice chairman. The combined entity will be named Colony NorthStar, and will be the 5th largest real estate investment manager based on assets under management. The three companies combined had a market value of over $6.85 billion the day before the merger was announced, and cost synergies are anticipated to produce nearly $115 million in annual cost savings.

The deal sheds light on publicly-traded real estate investment firms’ continuing quest to unlock shareholder value by separating their real estate and management businesses into separate entities. Firms in many other sectors of real estate have engaged in similar transactions over the past few years, including multifamily (Altisource Residential), retail (Sears), restaurants (Darden) and hospitality (Hilton). The Colony NorthStar merger development comes just shy of two years after NorthStar Realty Finance formally spun out NorthStar Asset Management into a separate publicly-traded entity in June 2014. This merger essentially reverses the process.

The Colony NorthStar merger can be considered partly the result of the current dislocation between the stock price and NAV of many REITs. In early 2016, NorthStar Asset Management hired Goldman Sachs to explore strategic alternatives after 2015 saw its stock price drop from around $24 to below $14 by the end of the year. Post-spinoff, NorthStar Asset Management was not a REIT that owned property, and yet its public market valuation followed the trend that developed throughout the REIT industry 2015, with large portions of the sector trading below NAV. Activist investors have gotten involved in many of these situations, one of the most prominent being Land and Building’s Jonathan Litt. In the case of NSAM, Litt’s firm calculated that the NAV was above $20. Litt initiated a proxy contest, citing conflicts of interest in the management agreement between NSAM and NRF, among other things. Whether the merger will solve the value discrepancy and the other management issues remains to be seen. However, investors should expect to continue seeing activist investors agitate for actions to unlock shareholder value at REITs that are trading below NAV. Several other current examples of this include Sessa Capital’s proxy battle with Ashford Hospitality Prime, and Land and Building’s push for changes at New York REIT.

The merger also raises the profile of Colony Capital and Thomas Barrack, who has invested more than $60 billion in hotels, offices, vineyards and other properties since starting his firm in 1990. Colony Capital was created in 2014 when Barrack combined his private equity and publicly-traded REIT businesses. This deal is another highlight in a recent series of transactions for the firm, including the September 2015 merger with Starwood Waypoint Residential Trust that formed the $7.7 billion Colony Starwood Homes.