Ben Butcher, Chief Executive Officer, President, and Chairman of the Board of STAG Industrial, visited the Baker Program in Real Estate last week as the next key leader offering students and faculty insights by way of the Distinguished Speaker Series. During his time at STAG, Butcher has overseen the expansion of the company from its small beginnings in 2010 to its post IPO capital deployment of $1.8 billion, representing the acquisition of 228 buildings totaling approximately 46 million rentable square feet, to its presence today, owning 290 properties in 38 states.

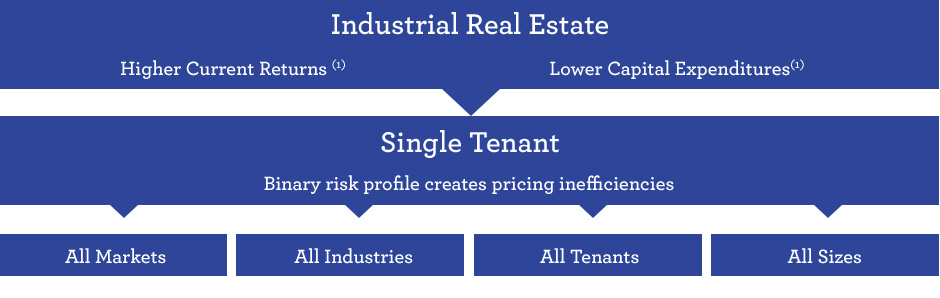

STAG has deployed a unique strategy with its focus on single-tenant industrial properties that exist throughout secondary markets and a variety of property classes. “For real estate, the only thing that really matters is cash flow,” said Butcher. “Our focus is producing the most cash flow per dollar of equity that we can, with a focus on industrial properties. We’re really agnostic as to location, lease term, tenant credit- a lot of things that other people evolve decision rules around.” STAG is able to maximize cash flow by being a good relative buyer and by having an investment thesis that is differentiated from the rest of the large industrial buyers, which in turn presents lots of opportunities to acquire.

In reference to the unprecedented growth of STAG, Butcher attributes it to STAG identifying and taking advantage of a market inefficiency that has continued to persist in the industrial market, as well as the sheer size of the US industrial market. “Growth was due to this market inefficiency that we identified- being able to buy assets for less than they’re worth based on their ability to produce cash flow, and, surprisingly, that inefficiency has persisted and maybe even gotten better for us.” Butcher also highlighted the fact that STAG mostly competes against small buyers, which STAG has a significant cost of capital advantage over. Furthermore, the US industrial market is exceptionally large, with over $1 trillion circa value. Approximately half of that value is single-tenant, the key asset type for STAG’s acquisitions. From there, STAG focuses on about 1% of that market, providing a very large opportunity for STAG to continue to pursue its strategy.

Going forward, Butcher sees STAG continuing to grow as a result of what he describes as “a persistent inefficient market, single-tenant industrial.” STAG’s total enterprise value now is a little under $3 billion in assets, a figure that Butcher predicts to double in the next five years. He attributes these opportunities to grow through acquisitions to the increasing industrial demand, which is highly correlated to GDP Growth. “There are three key factors of GDP Growth that have contributed to industrial demand: the resurgence of the manufacturing industry, the shortening and fattening of supply chains, and, most importantly, e-commerce. There are estimates that as much as three times warehouse space per dollar is required to support e-commerce sales [compared to] brick and mortar sales. That is creating demand in buildings broadly across the entire infrastructure of the United States.”

Butcher provided many takeaways and insights about the industrial market, and the students and faculty of the Baker Program look forward to learning more key lessons from the next industry leader in the Distinguished Speaker Series.