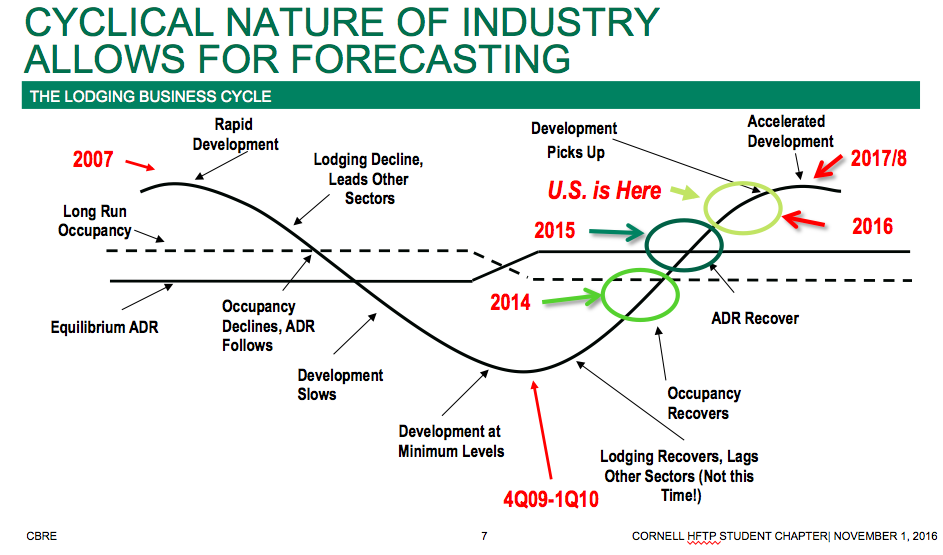

With the hotel and hospitality industry being a leading indicator for U.S. real estate, it is essential that forecasts for 2017 take a macro-level view from the perspective of the hotel sector. The following discussion comes from a presentation by Robert Mandelbaum, Director of Research Information Services, CBRE Hotels, to the Cornell Chapter of HFTP (Hospitality Financial and Technology Professionals). Although the outlook presents positive tones in occupancy levels, ADR is expected to level off.

With the hotel and hospitality industry being a leading indicator for U.S. real estate, it is essential that forecasts for 2017 take a macro-level view from the perspective of the hotel sector. The following discussion comes from a presentation by Robert Mandelbaum, Director of Research Information Services, CBRE Hotels, to the Cornell Chapter of HFTP (Hospitality Financial and Technology Professionals). Although the outlook presents positive tones in occupancy levels, ADR is expected to level off.

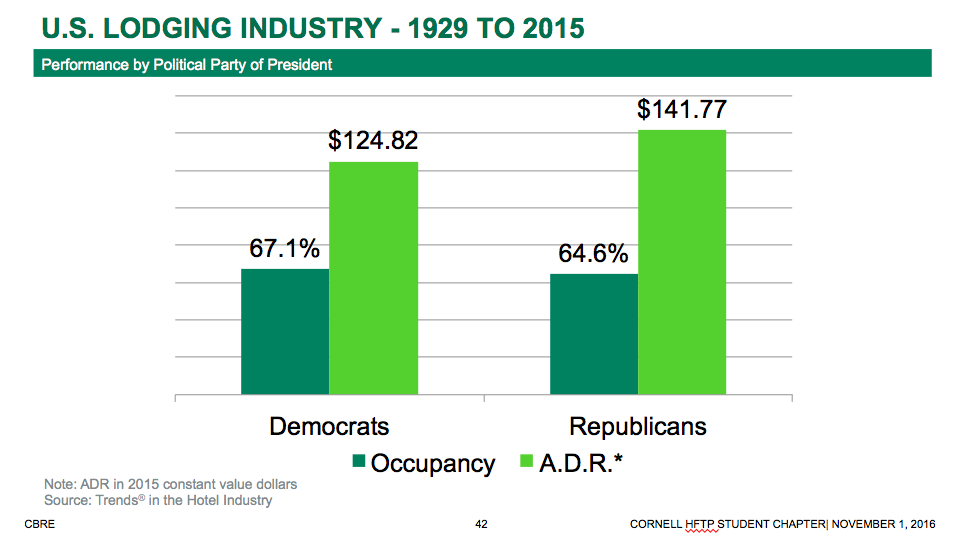

During Robert Mandelbaum’s presentation, the Presidential Election came into focus, and detailing the trends in ADR and Occupancy came into full view based on the two major political parties. While democratic presidents tend have elevated occupancy, the ADR during their terms tends to be deflated in comparison.

During Robert Mandelbaum’s presentation, the Presidential Election came into focus, and detailing the trends in ADR and Occupancy came into full view based on the two major political parties. While democratic presidents tend have elevated occupancy, the ADR during their terms tends to be deflated in comparison.

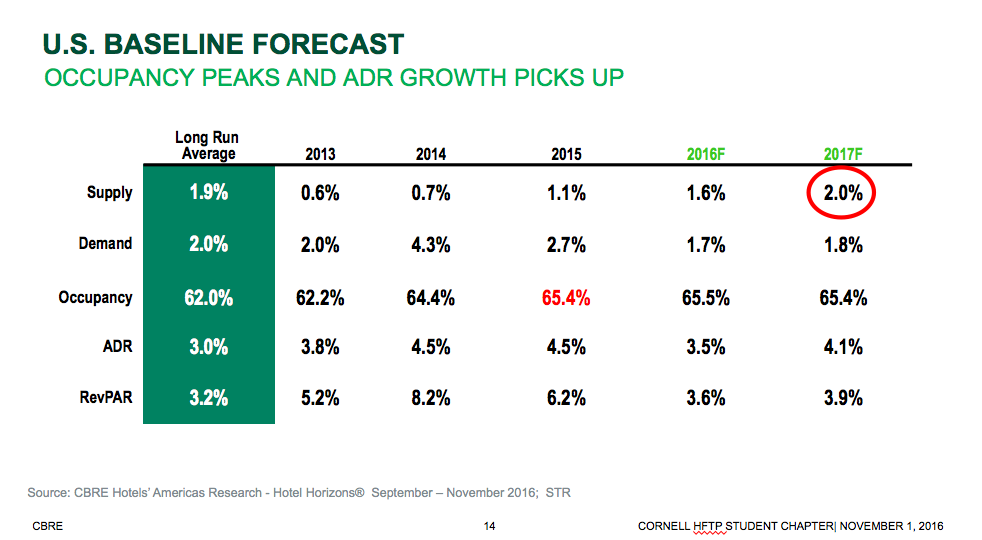

Fittingly, Donald Trump made his first move in Manhattan in 1980 by renovating the Commodore Hotel at Grand Central Station into the present-day Grand Hyatt. Obviously, with a President-Elect who has roots in hotel development, management, and licensing, the expectations for ADR look to follow suit behind the trends for republican presidents. With the Long Run Average for ADR maintaining year-over-year three percent growth, CBRE Hotels-Americas Research expects ADR to top out at somewhere near 4.1%. However, the growth of ADR has been falling since 2014.

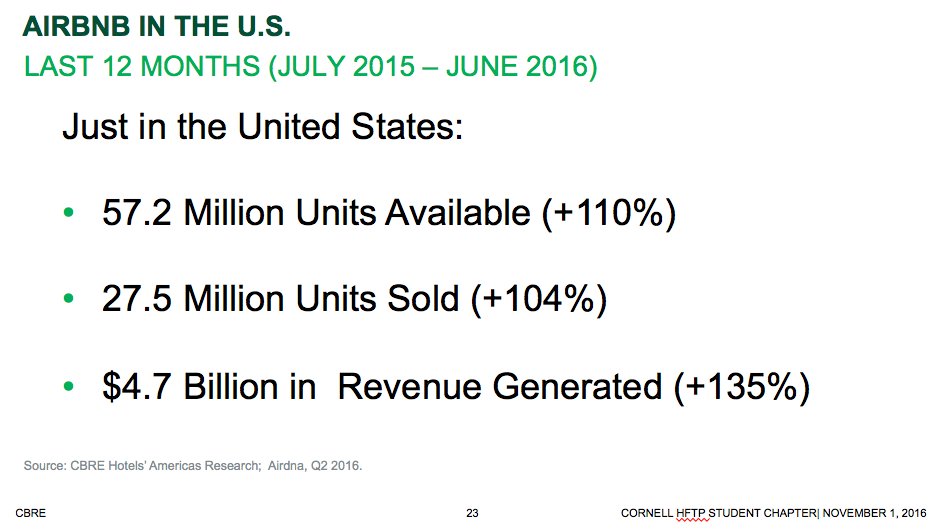

Moreover, CBRE Hotels-Americas sees AirBnB having an increased impact on U.S. hotel ADR and RevPar. With the increased supply provided by AirBnB units, U.S. hotel managers have created defensive mechanisms to assist in maintaining occupancy levels that have sacrificed ADR and RevPar. By recommending that travelers book rooms directly via the hotel website rather than through OTAs, and by implementing improved dynamic pricing, U.S. hotel operators have been combating the disruption of AirBnB’s business model by going straight to the customer through improved service mechanisms.

Moreover, CBRE Hotels-Americas sees AirBnB having an increased impact on U.S. hotel ADR and RevPar. With the increased supply provided by AirBnB units, U.S. hotel managers have created defensive mechanisms to assist in maintaining occupancy levels that have sacrificed ADR and RevPar. By recommending that travelers book rooms directly via the hotel website rather than through OTAs, and by implementing improved dynamic pricing, U.S. hotel operators have been combating the disruption of AirBnB’s business model by going straight to the customer through improved service mechanisms.

Further, the foremost respected research hotel firm sees occupancy continuing its record trend. As the Long Run Average has maintained a healthy 62.0% level, Robert Mandelbaum presented a case for occupancy to fall off slightly from the 65.5% achieved in 2016 to 65.4% in 2017.

Along with these trends, hotel managers will continue to have difficulty maximizing top-line revenue and EBITDA goals due to their shared eradicator: labor costs. Across the country, hotel operators will have to negotiate the impacts of rising salaries, wages (potential elevated minimum wage legislation), benefits (Affordable Health Care Act), and additional staff required by elevated occupancy. With respect to staff needs, hotel managers will have to determine whether they take on additional staff as they reach the crest of the hotel cycle, despite near-record levels in occupancy that are not expected to tail off anytime soon.

Along with these trends, hotel managers will continue to have difficulty maximizing top-line revenue and EBITDA goals due to their shared eradicator: labor costs. Across the country, hotel operators will have to negotiate the impacts of rising salaries, wages (potential elevated minimum wage legislation), benefits (Affordable Health Care Act), and additional staff required by elevated occupancy. With respect to staff needs, hotel managers will have to determine whether they take on additional staff as they reach the crest of the hotel cycle, despite near-record levels in occupancy that are not expected to tail off anytime soon.

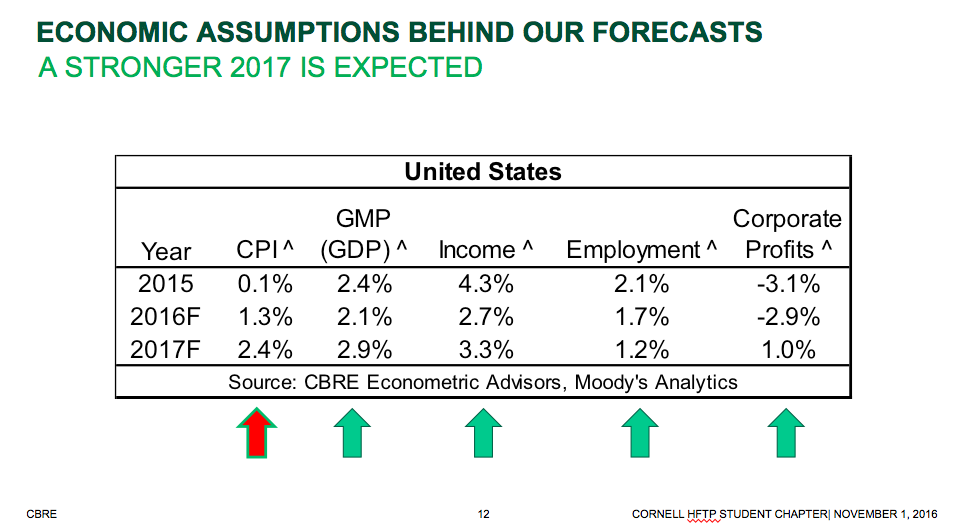

Additionally, Mandelbaum made special notice of the expectation of elevated inflation in the years to come. If CPI does reach the 2.4% level discussed, then it will have important factors across the industry. From the higher inflation, owners can potentially look to increased valuations, which might enable them to harvest gained equity, despite recent financing difficulties they have experienced. However, the price increase in other goods can potentially lead to decreased occupancy levels, as Americans have to devote more of their paychecks to necessities.

Additionally, Mandelbaum made special notice of the expectation of elevated inflation in the years to come. If CPI does reach the 2.4% level discussed, then it will have important factors across the industry. From the higher inflation, owners can potentially look to increased valuations, which might enable them to harvest gained equity, despite recent financing difficulties they have experienced. However, the price increase in other goods can potentially lead to decreased occupancy levels, as Americans have to devote more of their paychecks to necessities.