Senior living – including senior apartments, retirement homes, and nursing homes – has been a growing area of interest among real estate students here in the Baker Program. With an aging generation of baby boomers and a healthy investment environment for pension funds, broad population demographics in the US seem poised to support growth in senior living for years to come. These fundamental underpinnings in the senior living subsector are somewhat obvious, but the numbers paint a more complex picture.

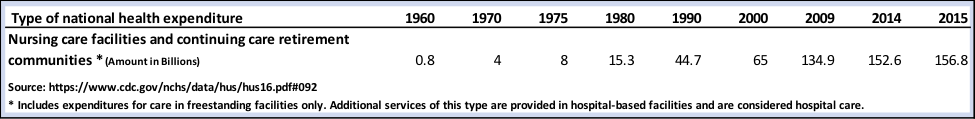

If US dollar health expenditure (money paid out for services and fees) in nursing care and retirement communities is any indication, the space has seen substantial inflows in recent decades.

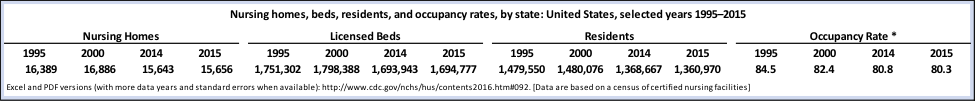

Yet, according to data from the CDC, there’s been a net 3.2% decline in the number of licensed beds and an 8% decline in the number of residents in these care facilities over the last 20 years. This, despite a nearly 186% increase in spending in the space.

To dive deeper into this apparent paradox, let’s look through the lens of the consumer or tenant in this case. What sources of funding do tenants have and how secure are the funding sources? End of life care is expensive. According to a 2016 Cost of Care Survey by Genworth Financial, the national median monthly rate for an assisted living facility (one bedroom) was $3,628 and appears to be rising faster than inflation/CPI. The same study showed the national median monthly rate for a private room in a nursing home to be $7,968. Most people entering senior living facilities pay for care largely out of pocket or with some combination of cash and insurance. Government programs like Medicare will only cover costs for a stay of less than 100 days but Medicaid is a viable option for those that qualify. The financial position of baby boomers is unique in that many of them worry about outliving their financial resources and fear being unable to recover financially from any holdover effects of the recession. This, coupled with an explosion in healthcare costs over the last few decades, has led to some pressure and is perhaps a headwind to those seeking senior living going forward. To bridge the gap between spending and a declining number of residents, I suspect a smaller number of wealthier tenants are helping to prop up the industry.

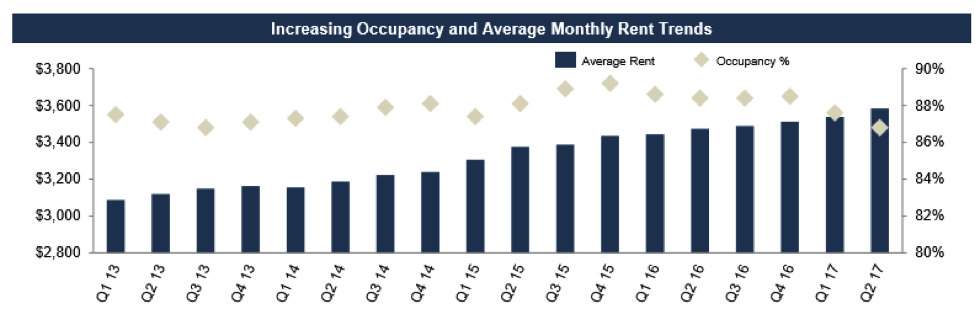

For another prospective, I wanted to consider the investor side to senior living, so I found the MD&A of one of the largest* senior living REITs in the country to see what recent advisory these professionals have offered. Capital Senior Living (NYSE ticker: CSU) is based in Dallas and has a current Buy rating from 5 sell-side analysts. Capital Senior Living owns around 129 senior housing communities (83 are company owned, 46 are leased from various other REITs) with over 16,500 residents in 23 states as of Q2 2017. Management states that senior housing rents are starting to see growth. This growth in rent is reflected in their accounting, but I find it worth noting that Capital Senior Living’s occupancy rates are down over the cited period. This would support the reasoning mentioned earlier between rising spending and declining number of tenants/occupancy.

The company’s guidance reflects an active acquisitions streak, touting 16% cash-on-cash returns though accretive purchase, largely financed with debt. If Capital Senior Living is a proxy for other investors in the space, growth seems to be largely coming from purchasing acquisitions with long-term debt and not necessarily just from an increase in core business operations like increasing occupancy rates on existing properties. Perhaps this level of activity by professional investors simply points to where we are in the cycle as an increased level of M&A has long been viewed as a late cycle activity.

The senior living subsector seems to be experiencing a change in long-term fundamentals. Some seniors are feeling pressure as factors like income inequality, underperforming or underfunded retirement plans, and rising healthcare costs bifurcate the group. Affordability is an increasingly serious issue that could continue to drive occupancy rates down but perhaps the future of senior living will be supported by fewer but wealthier tenants? I think if there is any certainty, it’s that the future direction of senior housing will continue to rest within a complex political and macroeconomic framework.

*It’s important to note that like other areas of commercial real estate, the senior living subsector is an extremely fragmented marketplace with no truly dominant player, however Capital Senior Living is larger than most in the space.

Sources:

https://www.medicare.gov/what-medicare-covers/part-a/paying-for-nursing-home-care.html

https://www.cdc.gov/nchs/data/hus/hus16.pdf#092

https://www.agingcare.com/Articles/senior-living-communities-rate-increases-152286.htm