The North American Free Trade Agreement (NAFTA) was signed into place in 1993, with a goal to reduce trading costs, increase business investment and help North America be more competitive in the global marketplace. The agreement is between Canada, the United States and Mexico, and put into place policies to facilitate cross border activity of goods and services between the three nations. For the past 20 years, NAFTA has thus spurred tremendous capital investment into the US industrial real estate market, to help spur this cross-border activity. President Trump recently commented on NAFTA calling it “the worst trade agreement in history”, and claiming he wants to renegotiate or dissolve it. Should he move forward in tightening up cross-border activities, the logistics market serving cross border activity stands to see dramatic changes.

The North American Free Trade Agreement (NAFTA) was signed into place in 1993, with a goal to reduce trading costs, increase business investment and help North America be more competitive in the global marketplace. The agreement is between Canada, the United States and Mexico, and put into place policies to facilitate cross border activity of goods and services between the three nations. For the past 20 years, NAFTA has thus spurred tremendous capital investment into the US industrial real estate market, to help spur this cross-border activity. President Trump recently commented on NAFTA calling it “the worst trade agreement in history”, and claiming he wants to renegotiate or dissolve it. Should he move forward in tightening up cross-border activities, the logistics market serving cross border activity stands to see dramatic changes.

Products assembled and made in Mexico often contain parts that came from the US, or elsewhere, and that have crossed the border many times before the item is completed. Every time the item crosses the border, some kind of value is added. As a result, many logistics centers have been developed and jobs have been created to handle the complex, back and forth supply chain. Recently, President Trump tweeted that “There will be a tax on our soon to be strong border of 35% for these companies wanting to sell their product, cars, A.C. units, etc., back across the border.”

Cushman and Wakefield, “The Impact of Trade Policy on the Industrial Market”

Should the 35% tax come to place, these items will be taxed every time they cross the border. That will greatly hurt the complex logistics system in place to handle these goods, as industrial real estate has historically been tied to global trade policies.

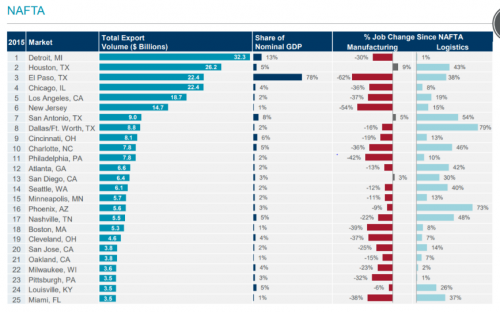

While a 35% tariff may seem unreasonable, even at 20% there will be a disruption in the current supply chain. What will likely be the impact, in terms of types of industrial asset classes that may devalue? There has been a growing concern[1] that buyers will likely start to balk at the prospect of paying higher prices for industrial real estate properties. The biggest concerns may come for the cities that had seen the most benefit from NAFTA. These cities can be identified to the right: Detroit, El Paso, Houston, and other cities close to the Canadian and Mexican border. In these cities, should the tariff lower the demand of logistics centers, the higher priced industrial properties may become more difficult to justify and to sell. Some features that have seen a premium attached to them, such as LEED certification and e-commerce friendly design, may see the premium shrink.

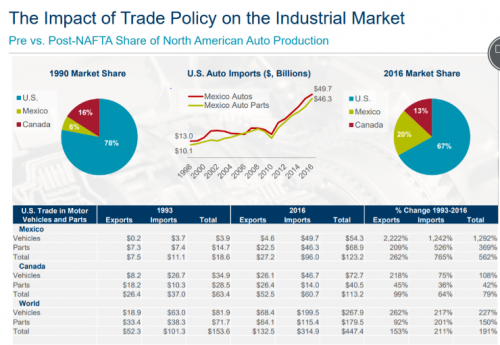

When it comes to specific goods that have benefitted from NAFTA, the automotive industry appears to be one of the most impacted from the agreement. The chart on the left details how the U.S. auto market had gone from importing about $23.1 billion in Mexican autos and Automotive p

Cushman and Wakefield, “The Impact of Trade Policy on the Industrial Market”

arts in 1998 to over $96 billion in 2016. Prior to NAFTA, the U.S. assessed various tariffs on autos and auto parts from Mexico. NAFTA phased out all U.S. tariffs on auto imports from Mexico and Mexican tariffs on U.S. and Canadian products as longs as they met rules of origin requirements. While the number may never drop as low as $23.1 billion, should tariffs be put back in place, it is reasonable to assume that cross-border trade flows in automotive parts may drop to lower levels. The industrial sites which had benefitted from warehousing all of these goods may see a drop in demand.

While all of this may strike a blow to the rapidly growing industrial market, there are of course many aspects of NAFTA that are outdated and may see growth in being renegotiated. In the 25 years since NAFTA was implemented, technologic advances in e-commerce have expanded dramatically. Updating the trade provision to reflect these changes in technological advancements is sorely needed. The automation process of cars, which has also become more commonplace, can also be topic that the US can renegotiate in an updated NAFTA. But while there are many smaller issues such as these that can be addressed and may benefit the industrial real estate market, a complete tear up of NAFTA does not appear to bode well for many logistic supply centers.

[1] https://www.bisnow.com/national/news/industrial/4-factors-that-could-threaten-industrial-real-estate-sales-80875