Often times Cornell alumni within the real industry return to campus to speak to current students about the work they are doing. A couple of weeks ago, Preston Mendenhall, Class of ‘93, Head of Corporate Affairs at Rendeavour was on campus to talk to students about the work the company is doing throughout sub-Saharan Africa and how Africa is poised to be the next emerging real estate market.

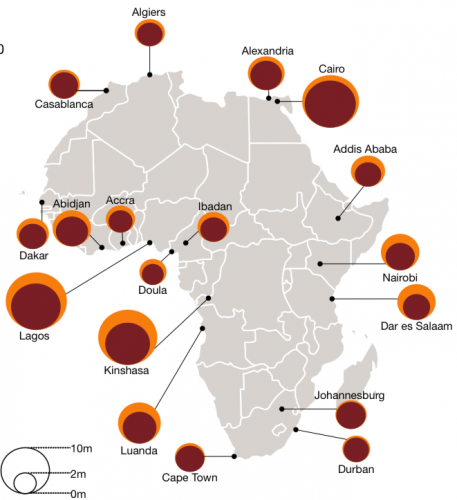

Rendeavour is the largest urban developer in Africa. The company is backed by an array of international investors. With a land portfolio of over 12,000 hectares (30,000 acres), the company is building seven satellite cities in five countries. Currently, the company has ongoing projects in Kenya, Nigeria, Ghana, Zambia and the Democratic Republic of Congo. The commitment that Rendeavour has made to investing in projects throughout Africa, underscores Africa’s status as one of the fastest growing markets in the world.

There are several drivers that contribute to Africa’s growth as an emerging region.

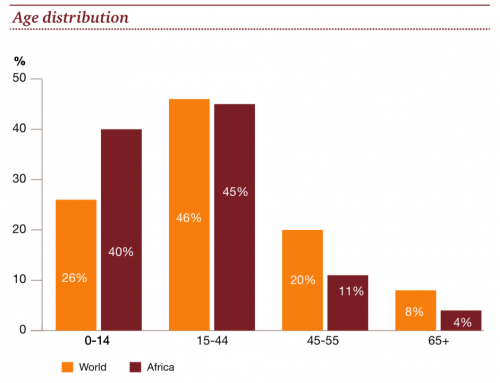

Growth in Population

Africa currently has the youngest population of any continent. In 2012 the median age was 19.7 years which is expected to increase to 25.4 by 2050[1]. This equates to a population of nearly 226 million people between the ages of 15 and 24 years old. This is in sharp contrast to western countries whose populations are now aging. In 2015 the median age of the US population was 37.8 years.

Urbanization & Rapid Economic Growth

Thirteen of the 20 fastest-growing economies in the world are in Africa. It is considered the most rapidly urbanizing region in the world. Its population is expected to increase to 56% by 2050, by which time one in four people on Earth will be African. The real estate industry in these rapidly growing urban areas will be effected tremendously by these dramatic population shifts. The UN expects that most growth will be in mid-sized cities and cities with less than one million inhabitants[2].

Expanding Middle Class

Africa’s share of the global workforce is expected to increase to 25 percent by 2050, up from 13 percent in 2010. The World Bank now classifies 27 of the 54 countries in Africa as either mid- or high-income countries, up from 15 in 2000[3]. All this growth shows the emergence of a growing middle class.

Market Transparency & Financial Reforms

According to the 2016 edition of Jones Lang LaSalle (JLL) Inc.’s bi-annual Global Real Estate Transparency Index, sub-Saharan countries are in the very early stages of building and reforming their commercial real estate industry infrastructure. The Index notes Botswana, Zambia, Ethiopia, Nigeria, Angola and Ghana as having recorded reasonable progress in transparency[4]. Many African countries are also implementing reforms in pension fund, stock exchange and banking regimes that can play an important role in financing real estate investments.

Rendeavour is a case of a company taking a long-term and strategic approach in investment in the region. In addition to the large land portfolio that they have amassed, they have committed to working with other local professionals and organizations in order to develop infrastructure and large-scale mixed-used and mixed-income developments that support Africa’s rapidly changing population. Several of Rendeavour’s projects showcase this commitment.

Tatu City – Nairobi, Kenya

Tatu City sits in a special economic zone located 24 km outside central Nairobi. It is a 2,000-hectare (5,000 acres) mixed use development, making it the second largest infrastructure development in the country. The development contains homes, schools, offices, a shopping district, medical clinics, nature areas, a sport & entertainment complex and various industrial facilities. It has the potential to house more than 150,000 residents.

Roma Park – Lusaka, Zambia

Zambia is one of the most urbanized countries in Sub-Saharan Africa. Roma Park is a 120 ha mixed-use development located in the heart of Lusaka. It is considered the city’s premier development, attracting significant interest from commercial buyers. The development is accessed via high-quality asphalt roads, and bulk infrastructure.

Appolonia – Accra, Ghana

Accra is the capital of Ghana. It has a population of 4 million which is growing at an annual rate of 2.6%. Appolonia is a 941-hectare mixed-use land development located on the outskirts of Accra, in partnership with the local community. The development is around 20 km from Accra’s Central Business District. It is a live-work-play environment offering various land uses such as residential, retail, light industrial, leisure and commercial plots, with good infrastructure and development control.

Due to the large scale of Rendeavour’s developments, the company is not able to build everything alone. Typically, it develops initial residential and commercial areas and then partners with or sells land to other developers which specialize in retail, commercial, residential and industrial properties. Other buyers include education, healthcare and entertainment groups which build the social amenities at Rendeavour projects. Rendeavour sees a high level of interest in its developments, primarily from local investors in its markets and increasingly from the international community. The amount of success that Rendeavour is having in Africa is proof positive that that continent is ripe for investment.

[1] https://www.pwc.co.za/en/assets/pdf/real-building-the-future-of-africa-brochure-2-mar-2015.pdf

[2] https://www.pwc.co.za/en/assets/pdf/real-building-the-future-of-africa-brochure-2-mar-2015.pdf

[3] http://www.africastrictlybusiness.com/news-analysis/africas-enticing-real-estate-market

[4] http://www.jll.com/greti/transparency/sub-saharan-africa