Photo Credit: Commons

Retail properties in the US are sliding again. After two years of more favorable investor sentiment, retail has become the lowest ranked property type in 2017 amongst investors, developers, and retail operators. There are however, some areas in retail that standout against these falling figures. One retail type seems to be doing particularly well: dollar budget stores.

As a brief backdrop, 2017 had 5,321 retail closings announced from the beginning of the year till June 23. This was a 218 percent increase from the previous year. Amazon and online retail are common buzzwords in the discussion of brick and mortar decline, however, other key issues include current lease structures with rent increases that are far outpacing sales growth and shopping centers burdened with troubled anchors on long-term leases. Radioshack and Payless Inc, added to the growing list of retail closures in 2017 with 1,000 and 512 stores respectively. The spiraling number of closures is causing more fear and caution amongst investors and of those surveyed by NREI, 37 percent believe it is better to sell, 41 percent believe it is better to hold, while only 22 percent believe it is better to buy. While millennials and online shopping are frequently cited as causes for declines in brick and mortar retail especially in apparel and housewares, baby boomers are still the largest single US consumer group. As more baby boomers are entering retirement, retail spending is declining as a higher percentage of income is spent on food and beverage, entertainment, and travel.

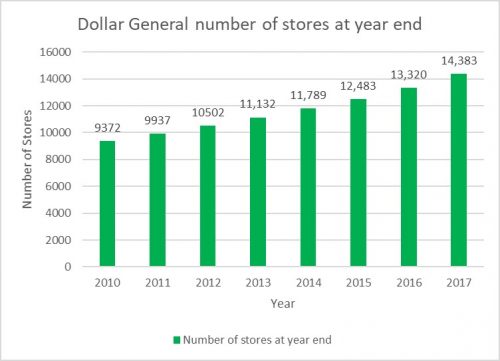

Amidst this seemingly bleak background, however, not all retail is doom and gloom. Class A retail properties for example, continue to have a promising outlook. Recent news of talks between Brookfield’s takeover of the remaining shares of General Growth Properties (GGP), one of the largest publicly traded mall owners, appears to point to a general confidence in growing long-term value and cash flow in top tier retail properties. In addition, non-mall shopping centers appear to have no significant changes throughout the past year in vacancies. On the other side of high-end retail, budget shoppers have benefited from the rapid increase of dollar store chains throughout the country. We focus here on Dollar General which plans to open 1,000-2,000 stores in 2017 and continue its expansion in following years. In an era where retailers are planning on down-sizing, Dollar General has more than 14,000 stores and its rapid expansion is defying most brick and mortar retail trends. Dollar General’s key competitor, Dollar Tree is also thriving. Dollar Tree acquired Family Dollar in 2015 in a deal valued at $10 billion bringing its total store count to over 13,000 after the merger.

Photo Credit: Dollar General

Dollar budget stores including Dollar General focus on local neighborhood markets in smaller spaces. Dollar General stores for example, average about 7,300 square feet in size and offer a no-frills interior. Located in strip malls rather than large shopping centers, the Dollar General provides a far different shopping experience compared to department stores like Macy’s that are about 130,000 square feet. During the recession, budget stores like Dollar General saw an increase in sales as consumers became more budget conscious in their shopping choices, and opted to stay closer to home to save on gas. These frugal spending behaviors have carried into the post-recession era and dollar budget retailers have continued to benefit. A key strategy has been to stay as local as possible, where even customers that shop at big box retailers like Walmart choose to stop by their nearby Dollar General instead. The bare-bones interiors of its stores also provide impressive turnaround times in recouping new store development costs. A typical 7,300 square feet Dollar General store costs about $250,000 to build, and pays for itself within 1.7 years of opening. In addition, stores carry about 10,000 SKUs and the company is well-informed on the profitability of each product.

Chart Created from Dollar General Public Filing

The current schedule for the 1,000 plus stores in 2017 follows closely in line with Dollar General’s localized strategy. So far, it appears that the plan is working. While Dollar General stock has experienced significant volatility in past years, it is back to reaching its all time high levels at around $95 per share which it first hit in 2016. According to its public filings, the Tennessee-based company’s rapid expansion does not seem to have a cannibalization effect on its nearby stores. Dollar General has increased same store sales revenues for the 26th consecutive year. While Dollar General lost a long battle with Dollar Tree in acquiring Family Dollar, it is instead using the momentum from its profits to rapidly expand while the more cash-strapped Dollar Tree is currently slowing down expansion. As of 2016, Dollar General has an impressive track record with sales at $15.98 billion, a 5.9% increase over nine months as of October 28, 2016. Net income was up from $789 million to $837 million. Questions remain however, what will happen once the initial integration setbacks of competitor Dollar Tree and Family Dollar are over. Could this be the start of another glut of overbuilt retail spaces?

It will be interesting to see how consumers respond to this expansion war between dollar budget stores and if revenue growth will continue to keep up with supply. One trend that appears to side in favor of dollar retailers is that the frugal consumption patterns of American shoppers does not appear to be dwindling any time soon. While news of large scale store closures and failing retail centers remain rampant in the real estate market, the success of less flashy retailers like Dollar General remind us of businesses that find success by strategically tapping into current consumer demands and behavior even amidst a predominantly challenging retail real estate climate.