Guidelines for real property ownership in new frontiers often develop as afterthoughts – reactive measures to adverse events rather than prescriptive ones – and this seems to be true even for the so-called “final frontier” of outer space. Since the space race of the 1960’s and 70’s, little work has been done to advance the groundwork laid by two international treaties of that era: The Outer Space Treaty of 1967, and the Moon Treaty of 1979. In the decades following the Apollo missions, the cost of space travel remained prohibitively expensive, and a couple of high-profile tragedies led many to question whether space exploration was worth the cost. For these reasons, the discussion of how extraterrestrial property rights are to be governed has largely been shelved.

Since roughly the beginning of the 2000’s, advances in rocketry and computer-aided flight technology have driven down the cost of space travel and this has reinvigorated the imaginations of many. This time around, not only has the strategy changed, but so too have the players involved. Several billions of dollars in infrastructure is now dedicated to objects floating in loosely-regulated orbit, and many more billions are tied up in speculative research. In the early days, space exploration programs were entirely state sponsored, and their purpose was a mixture of legitimate scientific endeavor and Cold War-fueled chauvinism. Today, the narrative has switched to a purely capitalistic pursuit, spearheaded by some of the world’s wealthiest entrepreneurs. The United States has witnessed the emergence of numerous space travel companies and ancillary services in the past two decades. The most noteworthy of these new companies – SpaceX and Blue Origin – have founders who also run some of the most radical game changing corporations in the world (Tesla and Amazon, respectively). A vast concentration of wealth in these few individuals, in conjunction with prestigious prizes like Ansari and Google Lunar X, has made it possible to invest in an area of high-tech development that previously required a government-funded operation.

Much of this speculation has been fueled by a potential market for space tourism, though companies like SpaceX and Boeing are making a bet on services which cater to economical, repeated commercial access to space. Rapidly reusable rockets capable of travel beyond Earth’s orbit had long been the goal of NASA since before funding to the program was scaled back. This reusable rocket system would allow for much cheaper payload costs and would significantly expand the feasibility of space exploration ventures. Among these promising new uses are the proliferation of telecommunication satellite launches and, led by Washington-based Planetary Resources, resource mining operations on celestial bodies such as asteroids. In 2017, SpaceX successfully demonstrated its reusable rocket development program in multiple stages (Henry, 2017), which is a strong indication that the revolution in commercial space exploration is imminent.

With the heralding of a promising new era in space, much like with the discovery of oil in the Arctic Archipelago or gold in southern California, comes challenging questions from a legal perspective. The two treaties referenced earlier represent the sole regulatory framework for extraterrestrial property rights, and the Outer Space Treaty of 1967 (signed by the United States and 107 other nations at present) expressly prohibits the “national appropriation by claims of sovereignty” of the moon and other celestial bodies (United Nations General Assy., 1967). It is unclear, then, which governing body will preside over the nuances of property ownership if celestial bodies are to be exploited for commercial benefit. Private property laws vary widely from nation to nation and are the foundation of Western capitalism. The right to the exclusive use of a particular parcel, for example, may constitute an appropriation by restricting others from using such sites, as these rights are only protected by the law of that sovereign which enables them (Keehn, 2018).

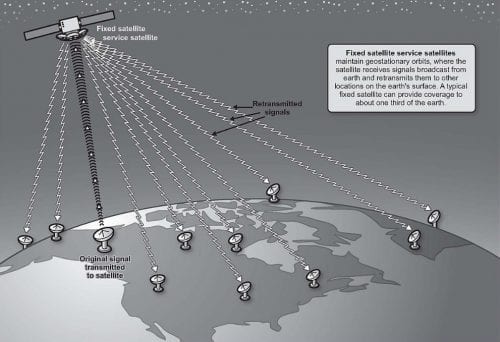

Further still, the Outer Space Treaty refers generally to “the moon and other celestial bodies” in the solar system, which is to say nothing about positions in the aether of space, such as a satellite in geostationary orbit. Geostationary orbit refers to a “slot” in the orbit of the earth in which a satellite may remain in a fixed orbit over a particular point on the earth’s surface. This type of orbit is important for the proper functioning of telecommunications satellites and other uses, and when one considers the diameter of this orbit at 35,786 kilometers, it seems like there would be plenty of “space” to go around. However, due to specificity of radio frequencies and orbital altitudes which make these satellites functional, there are only around 2,000 feasible locations for such satellites (Finch, 1986).

There has been an effort by equatorial countries to claim sovereign ownership of geostationary orbit via the Bogota Declaration of 1976, as all geostationary orbits are fixed directly above those countries, but this was blocked by the United Nations, which claimed that the Outer Space Treaty would also apply to geostationary orbits so long as they are deemed to exist in what is defined as “outer space”. Though unsuccessful, the declaration brought up issues within the treaty which require further exploration, namely the fact that once developing countries achieve the ability to place objects in such an orbit for their own purposes, there may be no slots remaining.

Block allotment planning is one remedy which may gain traction in the international community for the demarcation of outer space property. Such a program would take the total available property and allocate it according to a proscribed weighting method. This would effectively create a market for developing countries to lease their allotment to sovereign buyers when not in use, and profit from market forces while they build up their space programs. It would also be a revenue source for states to lease their allotment to private companies for mining or satellite use (Finch, 1986). For this sort of arrangement to work would require a significant amendment or reworking of the Outer Space Treaty, which would be an extensive and lengthy process – particularly when the economic benefits of such a renegotiation are based on speculative technology (Simberg, 2012).

Much of the world, however, does not share the first-come-first-served spirit typified by American capitalism. This may pose a costly challenge for U.S.-based entrepreneurs hoping to secure mining rights, or even for the nascent Chinese space program’s current lunar efforts. Enabling legislation in the U.S. has recently been passed (the Commercial Space Launch Competitiveness Act of 2015), though it may stand on unstable legal ground when tested in the international arena (Keehn, 2018). In time, market forces and the tenacity of ultra-entrepreneurs may test the reserve of the United Nations. But if real property markets beyond earth prove profitable, what was once dubbed the space race may soon resemble something more like a gold rush.

Works Cited

Finch, M. J. (1986). Limited Space: Allocating the Geostationary Orbit. Northwestern Journal of International Law & Business, 788-802.

Henry, C. (2017, March 30). SpaceX demonstrates rocket reusability with SES-10 launch and booster landing.

Keehn, J. (2018, July 26). Welcome to the New Space Age. Bloomberg Businessweek.

Simberg, R. (2012). Homesteading the Final Frontier: A practical proposal for securing property rights in space. Competitive Enterprise Institute.

United Nations General Assy. (1967). Treaty on Principles Governing the Activities of States in the Exploration and Use of Outer Space, including the Moon and Other Celestial Bodies. New York: United Nations Office for Outer Space Affairs.