In commercial real estate the single-family housing market is often treated as a different industry entirely. Indeed, transactions in single family housing are often conducted between non-sophisticated owners and, more often than not, the financial aspect of the transaction is just one of many factors influencing a prospective buyer’s decision. Brokers often say a home sale is “an emotional purchase,” an asset in which a family may spend considerable amounts of their time. Recently, many entrepreneurs have entered the single-family housing markets, siphoning away opportunity from the millions of Americans who consider owning their own home. This is changing the dynamic of single-family property ownership and the trend could have wide ranging implications in the United States.

Several startups have entered the scene in the past decade, and each threatens to disrupt the virtue of homeownership that has come to define the American way of life. For starters, there are the so-called “iBuyers” OpenDoor and Offerpad. These companies tout the ability to make an offer on a home and close in as little as one week, then perform the heavy lifting to fix up the house and resell it, with the value proposition being that the process takes the stress and uncertainty out of the transaction. These companies rely on a type of proprietary algorithm which determines home values based on a complex multiple regression model—automatically factoring in everything from the local neighborhood to the age of the house—and then charging a 7 percent transaction fee for the service. Zillow, one the web’s largest real estate database companies and another user of pricing models in automatically determining home values, has also begun participating in the homebuying/selling space through Zillow Offers. These iBuyers claim to be distinct from home flipping companies, claiming that their value creation is in transaction services rather than in the actual price appreciation of their properties during the holding period.

The concept of iBuying, in and of itself, should not be cause for particular concern. The percent of market share these companies have is limited by the fact that many homeowners rely on keeping the maximum amount of equity they hold in their homes. This is especially true for those buyers who are moving out of starter homes, which are occupied for roughly only five years, and purchased with minimal down payments. In order to maximize the amount of home they are able to upgrade into, a 7% transaction fee can seem steep compared to typical brokerage fees in the range of 3-5%. This is especially true for those who think that, by leaving the pricing up to an algorithm, they are leaving money on the table (Harney, 2018).

The more portentous issue is the degree of accuracy such algorithms are commanding. For example, Zillow claims its Zestimate has a median rate of error of only 5% between its estimated sales price and the ultimate reality. Even more telling, a recent study by the Federal Reserve found no significant difference between human approximations of their home value and automated valuation models (AVMs), and in fact the computer models predicted home values within 10% of the actual value over 50% of the time, compared with only 40% for humans (Social, Economic, and Housing Statistics Division, 2018). It remains to be seen whether the uptick in private companies participating in this space will make significant improvements in the accuracy of AVMs, but heightened enthusiasm is evident.

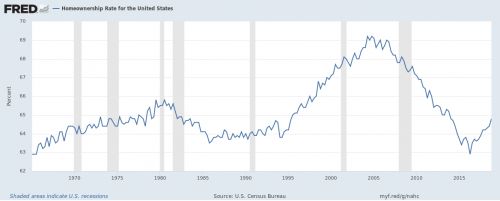

As in the case of the brokerage realm, single-family homes have also attracted the attention of a familiar class of buyer, with help from the federal government: Wall Street. In 2012, following in the wake of the housing crisis, Fannie Mae began to unload large portfolios of single-family homes held in receivership. Recognizing an opportunity to control large swaths of suburban property in major metro areas at large discounts, hedge funds, private equity groups, and institutional buyers soon became large-scale property managers. This, coupled with a cash-strapped population of Americans getting back on their feet, and the country’s working class quickly began to transform from owners to tenants, with the rate of homeownership dropping from over 69% in 2004-2005, to a low of less than 63% in 2016 (Goodman & Mayer, 2018).

A similar drop in homeownership rates, albeit to a lesser degree, followed the Savings and Loan Crisis of the 1980’s, where the United States saw that rate fall from 65.8% in Q3 1980 to 63.5% in Q4 1985 (Federal Reserve Bank of St. Louis, 2019). This does not accurately reflect the whole picture, however, because these numbers do not indicate the drop in home equity held by private citizens or families who still control their assets. The cost of housing has significantly outpaced wages in the latter half of the current decade, and this has promoted a new breed of entrepreneurs: those interested in fractional ownership of single-family real estate. Unison and HomeTap are two such companies which have begun either buying back existing equity from cash-strapped homeowners, or in the case of Unison, becoming a type of “limited partner” in home purchases.

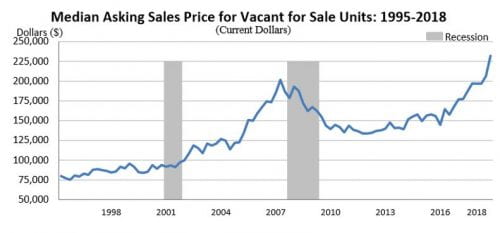

This trend towards less private citizen ownership is troubling because it creates a negative feedback loop. The growing sophistication of AVMs, coupled with stable price appreciation, will ensure that institutional and other deep-pocketed investors continue to look favorably on portfolios of single-family homes as a viable asset class, particularly at a time where demographic preferences are tending towards de-urbanization (Goodman & Mayer, 2018). Homes will increasingly transact from fund to fund, and cap rates will compress as firms get better at running single-family property management companies. This will have a positive effect on home prices, in an era where the economics of housing already place homeownership out of reach for younger families looking to settle down.

Traditionally, home equity has been a safeguard against economic uncertainty in a kind of emergency savings fund for unexpected events in life or in markets. As an increasing number of families are priced out of the neighborhoods where they are employed, and commuting from further away becomes no longer feasible, this safeguard will begin to diminish. Economic theory suggests that rents in desirable locations will increase to the point where any residual wage income has been claimed. This indicates that rather than putting money away for an emergency fund, or a retirement fund, to offset the absence of home equity, renters will instead be putting all residual earnings towards rent or transportation. The algorithm-driven profits in single-family home transactions along with a kindling interest in fractional home ownership may be a boon for some entrepreneurs, but it poses long-term dangers for economic stability as a whole.

Works Cited

Federal Reserve Bank of St. Louis. (2019). Homeownership Rate for the United States. St. Louis: FRED.

Goodman, L., & Mayer, C. (2018). Homeownership and the American Dream. Pittsburgh: Journal of Economic Perspectives.

Harney, K. R. (2018, October 26). Which is better at valuing your home – you or a computer program? The Real Deal.

Social, Economic, and Housing Statistics Division. (2018). Quarterly Residential Vacancies and Homeownership, Fourth Quarter. Washington, DC: US Census Bureau