Airbnb, the online marketplace for short-term rentals, has announced that its forthcoming debut in public markets is likely to take place in 2020. The company has created a platform for homeowners and renters who wish to sub-lease their real estate to transient strangers, placing them squarely in competition with the over 18 million hotel guestrooms currently in place across the globe. This concept is one of many technology-based services emerging in recent years that are disrupting longstanding real estate business models. Some of these models, including WeWork and its widely publicized non-IPO this past September, were scarcely the gamechangers many expected them to be. Increased caution is appropriate when evaluating Airbnb’s future in the wake of such flops, but this article will argue that investors ought to be optimistic about the company’s debut. Airbnb, with its over 650,000 hosts, has been at the forefront of the democratization of commercial real estate in the U.S. and abroad, and is buoyed by its able corporate leadership. Despite ambivalence among city planners, locals, and the lodging industry, the platform is championed by the many thousands who continue to use the service every day. These virtues will combine to equal a staying power that rivals the company’s top competitors, even as they roll out their own rental platforms.

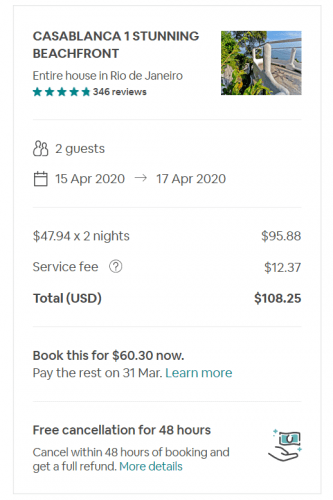

The business models of major hotel franchisors such as Marriott and Hilton have similarities to Airbnb. In both models the primary profit center is through the collection of fees based on a percentage of each transaction. Like Airbnb, hotel brands also do not own any real estate, but rather provide value to hoteliers through their brand’s goodwill, service, support, and proprietary platform for enabling reservations. The primary difference between the two models is that major hotel brands attempt to offer a highly curated product through having precise control over the guest experience. They assemble large swaths of guests with similar tastes and needs to a particular street corner near a particular attraction and charge a particular price point for that experience. Brand standards allow lodging companies to offer different experiences to different guests, and in this way are able to expose themselves to a wider breadth of the market. Airbnb, by contrast, has much less control over their hosts’ offerings. The company has focused instead on providing complete transparency so that guests can choose the exact experience that is right for them. It accomplishes this by requiring professional photographs of the space, a comprehensive list of amenities, informing the exact price breakdown, showing the approximate location of the property, and encouraging an open line of communication directly between the host and guest in case questions arise. This approach opens the platform up to an even wider market share of both guests and hosts. The most price sensitive guests can choose more spartan accommodations whereas those looking for a resort-type experience can rent luxurious properties and even entire homes. Since 2016, guests can also pick and choose their own “experiences,” which are informal excursions hosted by local guides who might, for example, have a specialized knowledge of local scuba diving or cliff-jumping.

The nature of this business model, where offerings are literally as decentralized and diverse as the hosts that list them, poses many strengths for Airbnb over traditional lodging. For starters, it allows for much greater flexibility in accommodation type – from length of stay to number of guests. Traditional lodging experiences are not designed for stays longer than a week, and extended stay offerings almost exclusively cater to business travelers. This diversity of offerings had been one of Airbnb’s major competitive advantages before Marriott rolled out its own home rental service this past year – Marriott Homes and Villas. But this platform is different from Airbnb in many ways. For starters, it only lists homes on the luxury end of the price continuum, only in Europe and the Americas, and these homes are exclusively managed by professional management companies. This aligns with lodging companies’ aforementioned commitment to brand standards – a stubborn refusal to relinquish any semblance of control over the guest experience to property owners. It has also allowed them to provide added value to its Bonvoy Loyalty members, who can earn points through Homes and Villas stays as they would at Marriott’s other properties, something Airbnb currently does not offer.

Airbnb, in contrast to Marriott’s centralized brand management, puts enormous faith in their so-called “community” of guests. Leadership, from its earliest days in 2008, have emphasized a reactive approach to the guest experience rather than a prescriptive approach, which is guided by user feedback and a careful rolling out of new products like Experiences. In an answer to Marriott’s Bonvoy loyalty program, for instance, Airbnb has long had plans to roll out the “Superguest” membership based on feedback from its user base. This step, when it finally materializes, could establish more of a foothold for Airbnb in the ever-crowded lodging space. The platform could plausibly become the choice for occasional travelers whose needs are hyper-specific, or for locations that are too remote to have attracted traditional lodging properties. It allows guests to vote with their dollar on exactly the right amenities for their situation, and also entrusts hosts to appropriately add supply wherever there may be a need, such as in places and times where the existing hotel stock is not sufficient to accommodate demand.

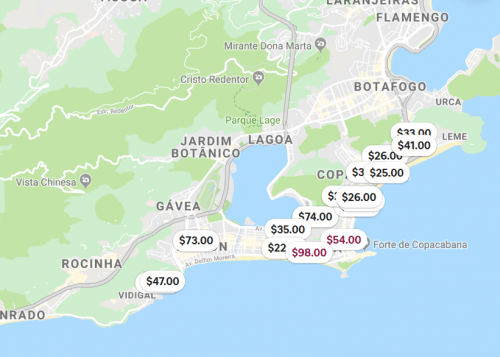

This aspect of Airbnb’s value became clear when the combination of the 2014 World Cup in Rio de Janeiro and the subsequent 2016 Summer Olympics resulted in a social and infrastructure nightmare for Brazil, and the commercial real estate market in Rio still has not recovered. One study estimates that the relocation of Rio residents during this period exceeded 22,000 families (Muller & Gaffney, 2018), and from 2014-2016 the supply of hotel rooms increased 32.4% (STR, 2016). In the aftermath of these events, hotel operators in Brazil faced crippling vacancy rates and the former residences of Rio’s working class have disappeared in their wake. While this is certainly not a new phenomenon among host nations to such Mega-events as these, the combination of corruption and private interests that allowed such overdevelopment will likely take decades to repair (Muller & Gaffney, 2018). On the other hand, if allowed to proliferate as it has in recent years, Airbnb’s business model could be exactly the antidote to such “ambulatory occasions of a fixed duration” (Muller & Gaffney, 2018). Its flexibility could allow locals to capitalize on their qualifying existing spaces without being badly displaced, provide a much-needed source of income directly into the hands of locals who would be impacted most by these events, and ensure urban areas continue to employ an organic pattern of land use, which accommodates its own needs rather than the whims of transient events.

In order to facilitate a global network of properties and transactions from both the guest and host experience, Airbnb’s engineers had to build a robust payment processing platform. Its payment handling capability has evolved substantially since its inception in 2008, and now includes provisions for handling all manner of transactions in countless jurisdictions. In the “base case” transaction, a guest reserves a room, pays online via credit card, and the funds are paid out to the host, less any taxes or fees. But cross border trans

actions proved to be much more complicated, which all came to a head during the aforementioned 2014 World Cup and Olympic Games in Brazil. Most Brazilians use domestic credit cards which can only be processed in Reais, but at the time Airbnb only accepted major international credit cards. This oversight resulted in only 6% of Airbnb’s rentals being booked by Brazilians during the World Cup (Kessler, 2016). Airbnb quickly addressed this issue ahead of the 2016 Summer Olympics.

By offering a system of invoices called Boletos, guests could pay for reservations in their own currency by bringing a printed invoice into their local bank. Rather than alienating an entire market area from their platform, Airbnb worked quickly to come up with a relatively painless solution, and this solution has proven scalable to many other emerging markets with similar hurdles (Zhu & Kim, 2016). Not only does this creative feat of engineering create value for users in the form of payment security and simplicity, but the payment platform is a valuable product in and of itself, with the ability to be licensed by other online marketplaces in much the same way that PayPal and eBay complimented each other. Having mostly solved for the issue of integrating its business model internationally, the company has further established itself as an urbane player in the lodging sector.

Airbnb has shown a lot of promise in over a decade of continuous improvement, but it has a number of challenges still to address. City and state governments around the world have enacted legislation, or have at least begun to consider how to crack down on the growing share of short-term rentals on the market. Opponents of companies like Airbnb range from powerful hotel lobbies such as the American Hotel and Lodging Association, to small, local citizens groups. These opponents complain that short-term rentals negatively impact the urban and social fabric in a number of ways, including increasing home prices, distorting the character of residential neighborhoods, and decreasing the number of long-term rentals, which is said to further contribute to the housing affordability crisis. Research has indeed indicated that short-term rentals could be responsible for as much as one fifth of the year-over-year increase in U.S. rents (Barron, Kung, & Proserpio, 2018), prompting cities like New York, Los Angeles and Paris to enact strict regulations. In 2014, New York’s attorney general’s office released a report claiming that as many as 72% of Airbnb’s rentals violated state zoning laws in some way (Airbnb in the City, 2014). Even in spite of this, Airbnb has been favored by New York judges, who recently placed an injunction on a law which would require Airbnb to share its hosts’ addresses and identities. The company still faces challenges from hosts who violate New York’s Multiple Dwellings Law, i.e. those hosts leasing units in certain types of buildings for less than 30 days at a time, yet liability for these violations remains ambiguous.

The liability issue is one that has persistently nagged Uber, the peer-to-peer-type transaction platform for ride hailing. Addressing guest safety and security concerns has become a major challenge for the two companies’ public relations, as stories emerge of violent encounters with hosts, unsafe or unsanitary riding/lodging conditions, and others. This has been another point of concern, contributing to Uber’s share price falling over 30% since its highly anticipated public offering in May 2019. It is worth mentioning that Uber debuted at a much more conservative value-to-sales multiple of 7X, compared with its rival Lyft, which debuted two months earlier at a multiple of 11X. To date, Lyft’s value has plummeted over 45%, and the two companies have settled around a valuation of 7X sales. Others in the peer-to-peer marketplace space, such as Etsy, are trading at multiples closer to 12X.

Regulatory pressures like these have maligned the inflated values of peer-to-peer marketplace technology, and they remain a big question mark for Airbnb moving forward. Local governments could put a hard ceiling on Airbnb’s growth potential, and could even chip away at in-place revenues in the near future. Still, given Airbnb’s robust reservation platform, the strength of its leadership, and the democratization of the lodging sector on which it has built its name, it is likely that Airbnb will debut at a valuation tied closely to an established hospitality franchisor like Hyatt or IHG, which currently trade at multiples around 15 or 16 times EBITDA. Earlier this year, Airbnb sold shares at a valuation of roughly $35B. It has not yet released its 2018 earnings, but based off 2017’s earnings of $2.7B (call it $3B), this puts their EBITDA multiple at roughly 12 times. Regulatory and liability concerns aside, it seems like Airbnb still has a lot of room to run in 2020, and, in time, will create lasting value for investors and users alike.

Works Cited

Barron, K., Kung, E., & Proserpio, D. (2018, March 29). The Effect of Home-Sharing on House Prices and Rents: Evidence from Airbnb. Retrieved from SSRN: http://dx.doi.org/10.2139/ssrn.3006832

Kessler, S. (2016, May 27). How Airbnb Made its Payments More Accesible to Brazilians for the Rio Olympics. Retrieved from fastcompany.com: https://www.fastcompany.com/3060291/how-airbnb-made-its-payments-system-more-accessible-to-brazilians-

Muller, M., & Gaffney, C. (2018). Comparing the Urban Impacts of the FIFA World Cup and Olympic Games From 2010 to 2016. Journal of Sport and Social Issues, 247-269.

New York State Office of the Attorney General. (2014). Airbnb in the City. New York: State of New York’s Research Department and Internet Bureau.

STR. (2016). Rio De Janeiro Adds 9,500 Hotel Rooms for Olympic Games. Hendersonville, TN: Smith Travel Research.

Zhu, A., & Kim, K. (2016, September 12). Scaling Airbnb’s Payment Platform. Retrieved from medium.com: https://medium.com/airbnb-engineering/scaling-airbnbs-payment-platform-43ebfc99b324