The past decade proved to be an extremely volatile one for the solar industry in the United States. The outlook on the industry in 2010 anticipated high growth as it looked towards 2020, as advances in solar module efficiencies resulted in continuously declining costs. MIT research found that solar module costs fell by 97% from 1980-2012, due to both low-level factors (namely technology-level) and high-level factors (specifically public/private research & development and larger factories) which have led to significant economies of scale improvements. Additionally, government policies, including renewable portfolio standards, feed-in tariffs, and subsidies, which resulted in market stimulation were found to account for roughly 60% of the overall cost decline during that time period (MIT, 2018). However, in 2018, a 30% tariff was levied on all solar cell and solar module imports to the United States, resulting in an industry-wide pause due to the renegotiation of deals. Nonetheless, total solar generation in the United States grew from 0.1% of total electricity generation in 2010, to 2.5% in 2020 (seia.org). In the present-day environment, where the conversation surrounding alternative energy use has grown alongside the increasingly popular climate change topic, solar developers view that 2.5% number with wide-eyed optimism for future growth. As tensions between the United States and China grows by the day, the Solar Investment Tax Credit (ITC) stepdown is underway and the level of competition amongst solar developers vying for projects grows alongside the difficulty in finding qualified and experienced labor. With exciting yet risky times ahead in the industry, what will the next decade hold for solar developers?

The past decade proved to be an extremely volatile one for the solar industry in the United States. The outlook on the industry in 2010 anticipated high growth as it looked towards 2020, as advances in solar module efficiencies resulted in continuously declining costs. MIT research found that solar module costs fell by 97% from 1980-2012, due to both low-level factors (namely technology-level) and high-level factors (specifically public/private research & development and larger factories) which have led to significant economies of scale improvements. Additionally, government policies, including renewable portfolio standards, feed-in tariffs, and subsidies, which resulted in market stimulation were found to account for roughly 60% of the overall cost decline during that time period (MIT, 2018). However, in 2018, a 30% tariff was levied on all solar cell and solar module imports to the United States, resulting in an industry-wide pause due to the renegotiation of deals. Nonetheless, total solar generation in the United States grew from 0.1% of total electricity generation in 2010, to 2.5% in 2020 (seia.org). In the present-day environment, where the conversation surrounding alternative energy use has grown alongside the increasingly popular climate change topic, solar developers view that 2.5% number with wide-eyed optimism for future growth. As tensions between the United States and China grows by the day, the Solar Investment Tax Credit (ITC) stepdown is underway and the level of competition amongst solar developers vying for projects grows alongside the difficulty in finding qualified and experienced labor. With exciting yet risky times ahead in the industry, what will the next decade hold for solar developers?

Today’s commercial, as opposed to residential, solar developer can usually be placed in one of two categories: a pure play developer or an independent power producer. Pure play solar developers typically will go through the site selection process, work and negotiate with the local authorities having jurisdiction, put the land under contract (usually through ground leases, thus enabling tax expense benefits), go through the necessary entitlements, and then sell the land to an asset owner to develop. These asset owners are often a utility company, a hedge fund, or an independent power producer, whose business structure can be defined as a private utility company. Independent power producers typically negotiate or bid the construction of the solar field to an Engineer, Procure, Construct (EPC) contractor, and then hold on to the asset long-term upon completion, selling the energy back to the large public utility company who controls the power grid in that region. Depending on the specific scenario, independent power producers or pure play developers will execute a Power Purchase Agreement with the off-taker, or the entity committed to purchasing the power, based on a financial proforma one- to-five years before an EPC contractor would even get involved to begin construction of the field. Power Purchase Agreements are usually 20 years in length and specify a monetary amount structured around production (MW-hr), as opposed to installed capacity (kW), with the off-taker. Once Power Purchase Agreements are executed, environmental, cultural, wetland, and hydrology studies, among others, commence and upon approval, construction begins.

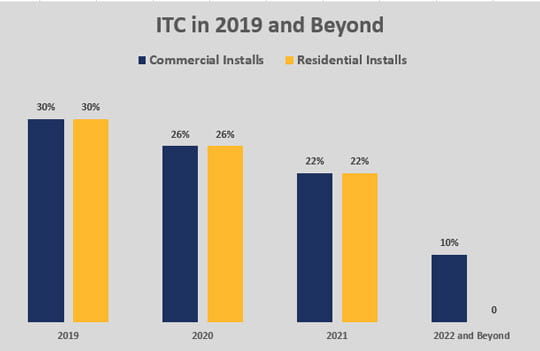

With the solar industry in its infancy, the United States federal government enacted the ITC in 2006, which has resulted in more than 10,000% growth of the industry according to the SEIA. The ITC, for which all residential and commercial solar development projects in the United States are eligible for, began as a 30% dollar-for-dollar tax credit based on the total amount of investment in the project, excluding purchase of land – another reason solar developers prefer ground leases. Recently extended by congress in 2015, the ITC began its step-down in funding projects at the end of 2019, and the step-down will last until the end of 2021. The step-down schedule reduces the ITC by 4% annually, until 2021, after which the residential credit drops to zero and the commercial credit stabilizes at a permanent 10% (seia.org). With 2021 on the horizon, and the inherently long and arduous project approval process, developers are fighting for ways to take advantage of the tax credit before it expires. Developers can safe harbor that year’s tax credit percentage through two avenues: 1. Beginning construction, and continuing construction or 2. Spending 5% of project costs, excluding land purchase (i.e. buying material, equipment, modules, racking, etc. and storing it in a warehouse or on-site). However, regardless of the year under which the project is safe harbored, that solar project will need to be complete and operating by 12/31/2023, or else the developer will no longer be able to claim the ITC.

The Trump Administration’s 2018 30% tariff laid out a 5% annual step-down over a four-year period, “stabilizing” at a 15% tariff in 2021. With most solar cells and modules on American solar projects coming from China, any proforma or Power Purchase Agreement which had incorporated pre-2018 costs received a 30%+ uptick as a result. Consequently, essentially all Power Purchase Agreements that were in place to be built in 2017 and 2018, but negotiated years earlier, ceased, or vanished entirely. Force majeure was claimed by private developers, and the industry laid off approximately 40,000 people while contracts and Power Purchase Agreements were renegotiated. With the renegotiated PPA’s now in place, many in the industry expect the backlogged buildup to finally begin construction in 2020 and 2021 (Stephen Rush, Berry Construction). With that buildup of projects scheduled to begin in addition to those negotiated post-2018-tariff-enactment, this decade looks to be off to a busy start for the solar industry.

With the approvals and negotiations processes timely, and a major economic driver of commercial solar development significantly reducing by 2022, alternative applications of solar are being explored. Community solar gardens have gained popularity in many municipalities, and are beneficial to home-owning and non-home-owning citizens who are now presented the option to purchase green power, as well as for the developers who these communities’ partner with. Existing commercial property owners and tenants alike, with many rooftops scattered across the country, have begun installing solar panels on top of their buildings in hopes of off-setting power costs. Tenants such as Target, IKEA, Adobe, Microsoft, and Apple have integrated this policy in the new construction on many of their stores and have added it to many of their existing stores. The weakest link in this strategy concerns the warranty and the lifetime of the existing roof. Say a 20-year warrantied roof is halfway through its warranty life; is it really worth installing solar for what studies have shown appear to be negligible benefits? Or, is the cost of installing a new roof just for the sake of installing solar worth it in terms of electrical cost benefits?

A popular recent trend on the east coast, where large acreage of open land is not as plentiful as it is in the deserts in the west, is the Distributed Generation (DG) market. Where 100+ megawatt projects are common out west, the Distributed Generation market programs target multiple small/mid-size projects scattered across pockets of land in Eastern states, as opposed to one massive hundreds-of-acres-big job. These jobs are typically $1m – $20m in size and are bundled by a developer into a package when bid out to EPC’s. This allows the developer to save costs by lowering jobsite supervision overhead, where multiple projects in a package, though separated by small distances across a state, can be managed by the same small group of project managers and superintendents. This type of development is seen as a long-term growth strategy for many small and mid-size solar development companies, which make up more than 90% of the entire U.S. solar industry (seia.org). Conversely, developers who solely seek the large jobs may become subject to a “solar-coaster” when dealing with overhead costs, as the scarcity of these type jobs can result in a period of time with a lot of work, followed by a period with no work at all once a big project is complete.

With an active start to the decade, combined with an innovative and adaptive outlook towards the future, the two large elephants in the room remain. How will solar developers adjust to a large tax incentive drop-off, and what do future trade relations with China look like? The solar industry as it currently exists appears to be propped up on dependence on the ITC, and accessibility to cost-effective Chinese solar cells and solar modules. With a Presidential election on the horizon, future policies may swing in favor towards the production of solar and other alternative green energy or may continue in volatility. As the 2010’s proved, regardless of policy hurdles created, solar energy growth looks to compound in the 2020’s as well.

http://news.mit.edu/2018/explaining-dropping-solar-cost-1120

https://news.energysage.com/2018-us-solar-tariff-impact-prices/

https://www.seia.org/blog/2010s-solar-milestones

https://www.seia.org/initiatives/solar-investment-tax-credit-itc

https://www.seia.org/blog/fueling-small-solar-business-growth-requires-itc