On Thursday, October 8th, 2020, the Cornell Baker Program in Real Estate hosted Barry Bloom (SHA ‘86 and MBA ‘01), President & CEO of Xenia Hotels & Resorts (NYSE: XHR), a hospitality REIT focused on the United States’ top 25 markets and key leisure destinations. Xenia’s hotel assets are primarily in the luxury and upper-upscale chain scales and are operated by industry leaders including Marriott, Hyatt, and Hilton.

The hospitality REIT landscape has changed tremendously since COVID-19 hit the industry this year. Company valuations have fallen significantly, with XHR’s stock price down approximately 55% YTD. At the trough of the crisis, 31 of Xenia’s 38 hotels were closed. However, given that the hotel industry is recovering slowly but steadily, Xenia currently has no plans to re-suspend operations their 37 hotels open today.

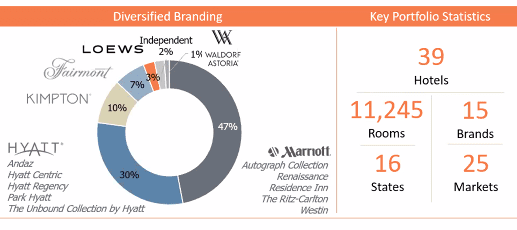

Xenia’s portfolio today consists of 38 luxury or upper-upscale hotels in top 25 or key leisure US markets. Most hotels in Xenia’s portfolio are branded, and all are now full-service following the recent and timely sale of their last select service asset in Massachusetts. Xenia is unique and well-positioned thanks to its broad geographical coverage, which allows diversification of income and demand generators. While it also focuses on the various drive-to and gateway destinations in the United States, the company has been particularly fond of in investing in the sunbelt region.

XHR’s portfolio as of 9/2/2020*

XHR’s portfolio as of 9/2/2020*

In addition to its geographical advantage, Xenia’s hotels are managed or affiliated with best-in-class brands who provide a significant brand promise to customers. Owning in key drive-to leisure markets such as Key West, Scottsdale, Napa, Orlando, Savannah has allowed quicker ramp-ups in the current environment. Finally, Xenia’s efforts to maintain and renovate their properties will position their assets well for a near-term ramp up and limited capital spending over the next several years. Flexible meeting spaces throughout their portfolio afford the ability to host groups, while meeting social distancing requirements.

Mr. Bloom is very proud of the extensive work put into analyzing and reworking Xenia’s balance sheet during this pandemic. Strong cash positions are important in the current environment and, as such, key provisions were put in place to increase liquidity, including floating a $300 million bond offering, which allowed the company to pay back certain credit facilities while increasing the company’s cash balance which they plan to hold as the business recovers.

In the last couple of years, Xenia has undertaken some large real estate return-on-investment projects, including the construction of a second ballroom at the Hyatt Regency Grand Cypress in Orlando, FL and a transformational renovation of the Park Hyatt Aviara Resort, Golf Club, and Spa in Carlsbad, CA. In the California Park Hyatt, Xenia completely renovated the guestrooms, corridors, and meeting space. They also renovated the public areas, F&B outlets and upgraded the building exterior and added waterslides to the completely renovated pool areas in order to better appeal to families. In the Florida Hyatt property, the additional 25,000 square foot ballroom is expected to have a phenomenal influence on future group demand. This new construction cost Xenia $32 million and was overseen by Xenia’s in-house design, construction, and project management team. These projects are evidence of Mr. Bloom’s belief that hotels, through adaptations for the future, are still an attractive asset class to be invested in.

As an overview of Xenia’s organizational structure, Mr. Bloom shared that there are currently 35 employees in the corporate office. Major business departments include investments, finance and accounting, asset management, reporting and analytics, legal, project management, and others such as human resources, IT, and administrative support.

Mr. Bloom’s passion for the hospitality industry influences his personal interests, which include leisure travel, electric cars, wine, coffee, and cheeseburgers. His love for the hotel industry developed early on family trips during his childhood. His teenage visit to the Greenbrier and 2.5 years of operational experience at Baskin Robbins in San Mateo, California were two of the key events that led him into the hotel business. This passion ultimately led to Mr. Bloom’s acceptance into Cornell’s Hotel School—the only place his parents would allow him to study hotel management.

During his undergraduate studies at Cornell, Mr. Bloom had two hotel operations internships and one finance internship. Following graduation, he worked at some significant hotel companies, including PKF (now CBRE Hotels), VMS Realty, RockResorts, Tishman, Hyatt, CNL Hotels, and Inland American Real Estate Trust. His most recent venture, Xenia, was born out of a remarkable spin-off from the select-service focused company Inland American in 2015, when the company decided to spin-off its lodging component as a NYSE-listed company without raising any additional capital.

In addition to his stellar professional contributions to the hotel industry, Mr. Bloom has also served as a full-time faculty member at DePaul University and Boston University. He advised young real estate professionals to take the road less traveled, expressing the importance of consciously and regularly evaluating and updating one’s plans—an especially timely comment in today’s environment. Mr. Bloom urged students in the room to find good mentors. Finally, he stressed the importance of management skills for success in the real estate industry. Mr. Bloom ended his presentation with the adjacent image, which encourages students to focus on the intersection of the things that matter and the things one can control.

In addition to his stellar professional contributions to the hotel industry, Mr. Bloom has also served as a full-time faculty member at DePaul University and Boston University. He advised young real estate professionals to take the road less traveled, expressing the importance of consciously and regularly evaluating and updating one’s plans—an especially timely comment in today’s environment. Mr. Bloom urged students in the room to find good mentors. Finally, he stressed the importance of management skills for success in the real estate industry. Mr. Bloom ended his presentation with the adjacent image, which encourages students to focus on the intersection of the things that matter and the things one can control.

The Baker Program thanks Mr. Bloom for his colorful lecture and wishes him continued success in the future.

*All images are from Mr. Bloom’s presentation or XHR’s websites and owned by Xenia Hotels & Resorts.