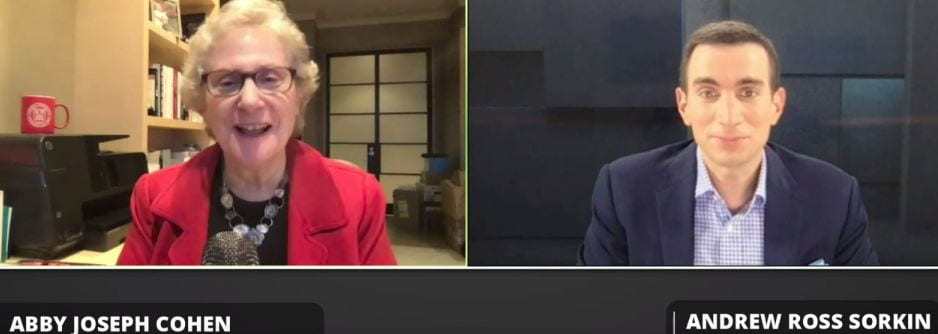

“Where are we? And what does the future look like?” These two questions guided the first virtual session of the 38th Annual Cornell Real Estate Conference, a discussion of Macro Trends and Market Insights between Andrew Ross Sorkin (’99) and Abby Joseph Cohen (’73). In front of over 1,000 guests who tuned in on October 22nd from their homes and offices, Mr. Sorkin (author, columnist for the New York Times, and co-anchor of CNBC’s Squawk Box) and Ms. Cohen (an economist and former Chief Investment Strategist at Goldman Sachs) considered the current state of the economy and the potential future effects of changes in taxes, demographics, and employment.

As to the current state of the U.S. economy, nobody knows for sure “where we are” but Ms. Cohen was willing to share educated guesses informed by her decades on Wall Street. What we do know is that “the worst of the economic recession induced by the pandemic is easing, and easing notably, but not evenly”, Ms. Cohen pointed out. Although there has been improvement in some categories, such as a rise in existing home sales and a relative decrease in new unemployment claims, the unemployment rate in general is still high. Though there have been general economic improvements from the depths of the second quarter, where U.S. GDP was down about 30% on an annualized basis, Ms. Cohen forecasted GDP to be down around 3 to 4% year-over-year with an unemployment rate of around 7% at the end of 2020. Ultimately, “It’s not where we want to be, but it’s better than it looked in April and May.”

Ms. Cohen took the opportunity to share her thoughts on the effects of private stimulus and the coming “forbearance cliff.” This forbearance includes lessees who have not paid rent, the 5-10% of households that have not been paying their mortgages, and even the 40% of households with student loans outstanding that have not made any payments during the current pandemic. Turning to commercial real estate, Ms. Cohen underscored the dichotomy between asset classes by sharing that industrial and class A office landlords have generally collected 90-95% of rents, but retail landlords have faced considerably lower rates of collection in the 50% range during this difficult period. All of this has led to anxiety about the unintended consequences of these forbearances ending, such as a potential rise in bankruptcies, not just among users of real estate, but real estate owners and operators as well. When pressed by Mr. Sorkin on the prospect of a liquidity crisis becoming a solvency crisis, particularly when considering a lack of further stimulus, Ms. Cohen shared the thoughts of many in the industry that the effects on real estate vary tremendously by region and by segment, with areas more dependent on tourism, such as New York City, facing a more protracted recovery in retail and hospitality.

In acknowledging the current tax debate, Mr. Sorkin raised the important question of whether higher tax rates would have a meaningful depressing effect on the economy. Reminding the audience that there is no guarantee that a tax plan outlined during a campaign will be implemented, Ms. Cohen began by sharing knowledge gained from the Trump Administration’s 2018 tax reform. Under these changes, the statutory tax rate and effective tax rates decreased for corporations. With more cash on hand, the average S&P 500 company increased dividends and repurchased shares instead of using it to grow, make long term investments, or hire more employees. This was a great immediate result for shareholders’ wealth, but not for economic growth. From this standpoint, modestly higher corporate taxes under the Biden Administration’s plan would likely not have much of an impact. From the standpoint of a higher tax on wealthy individuals, Ms. Cohen pointed to research showing that earnings over $400,000 do not typically go towards spending, but instead into savings and investment, reflecting the fact that middle income and upper middle income households fuel most of the consumption in the U.S. Lastly, when it comes to the Biden Administration’s potential elimination of the 1031 exchange, which enables real estate investors to roll capital gains taxes over into their next real estate investments, the consensus stands that it could hurt individual real estate investors more than corporations. In the view of economists, corporate tax changes do not have much of an effect on investment activities – “if there is a need for an investment, it happens,” Ms. Cohen quipped.

Acknowledging the current trend of mobility in the United States, Mr. Sorkin posited that taxes could be one of the driving forces. According to Ms. Cohen – “the jury is still out but not encouraging.” With past mobility intricately linked to job growth and quality of life, it will be interesting to see if the pandemic-driven relocation trends endure and whether the data suggests any tax-related motivation.

Wrapping up the session, Ms. Cohen used a powerful analogy to sum up her thoughts on the U.S. economy. “The U.S. economy is like a super tanker. It does not move all that fast, but it moves reliably, and it can weather big storms. Sometimes it gets bounced around a bit, but it takes an awful lot to get it off track. And when it does, it can take a while to get back on track.” Highlighting the fact that investors can get too focused on the short term, but the U.S. economy generally gets back on track in the long term. According to Ms. Cohen, if the country focuses on what has historically made the economy so robust – namely education and scientific research and development – the U.S. economy will remain as strong and resilient as it always has been.