Author: Kara Harrison-Gates – Baker Program in Real Estate, Class of 2023

On September 2, 2021 the Cornell Baker Program in Real Estate had the privilege of hosting Andrew Dubill. Mr. Dubill is a Principal of Avanti Properties Group, a national leader in land investment and development.

Mr. Dubill had an unconventional entry into the real estate world – living proof that to be successful in real estate requires the right mind, not just the right studies. Armed with a Bachelor’s in Biology from Princeton and a JD from Virginia, he then spent time as the Staff Director for the National War Powers Commission. Craving a change, he leveraged his relationships to get his foot in the door at Avanti Properties Group, the company he has called home for the last 14 years.

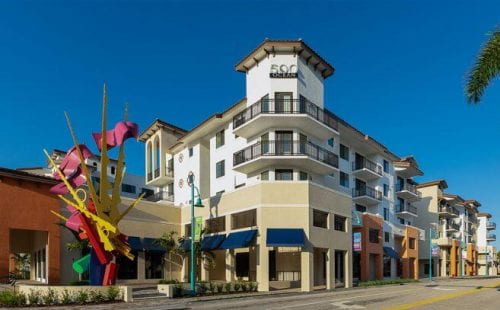

Avanti utilizes an unconventional approach in the real estate world, purchasing all their assets without the risk of debt. This model allows them to, “take the long approach,” as Mr. Dubill noted. By focusing on deep value land acquisitions in suburban corridors in high-growth cities, Avanti can then position investments for sale over time to the right builder. Mr. Dubill says the average deal cycle can take 5-6 years, a model that truly tests patience! But patience and persistence have paid off, as Avanti has been in business for over 30 years and most recently created its 10th equity fund, in which Cornell University is a participant.

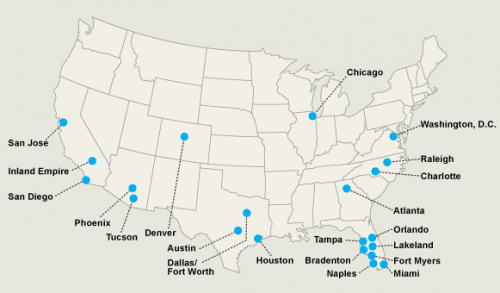

Mr. Dubill advised students to look for strong economic growth and to make sure local economies and population growth rates that outpace national averages. Another indication of a strong market is a diverse economy, offering more than three services or products within well-defined growth corridors. Avanti patiently searches for the ideal economic environment to find assets to acquire. Mr. Dubill says Avanti’s goal is to, “buy for a dollar and sell for four dollars.”

Filling a much-needed niche, Avanti can either hold or develop land until the right buyer comes along to buy and build vertically. Why is this necessary? Often builders do not want to carry vacant land on their balance sheets beyond their immediate needs, even as they plan for future communities. Without incurring the risk of leverage, Avanti can patiently buy and hold land assets as markets take shape for new development. “Land and leverage don’t mix!”, advised Mr. Dubill.

In recent years, Avanti has specialized in working with single family housing developers, and their projects deliver thousands of new residential units to flourishing markets that are in great need of new housing stock. A few fundamental principles of business from Avanti: engage local experts, invest with deep value, and conduct unforgiving predevelopment due diligence.

Mr. Dubill continued to offer strong advice to the eager students at the Baker Program. He has been working in real estate as technology has grown exponentially, but advises that nothing can replace driving down the street, both to see your product and understand your market. Additionally, study the surrounding geography and research environmental concerns. As importantly, know the experts and key players in the market where you work. Get to know the region, land, places and most crucially the people.

When asked for career advice, Mr. Dubill highlighted four key points:

- The best place to find deep lasting value is to focus on what others don’t.

- Don’t wait for the last dollar. If you have a good offer, take it!

- Know the big picture for each deal you are working on.

- Market knowledge will get you further than math or financial engineering. Know the market you are working in and most importantly, the experts who are in that market.