A growing emphasis on renewable energy and energy efficiency has inspired the production of several unique financing methods to assist with the initial capital requirements of these sustainable initiatives. This article will review five financing methods that real estate developers can use to support renewable energy ventures, and it will outline the advantages and disadvantages of each method.

-

Direct purchases of sustainable energy equipment

This method of financing is the act of purchasing sustainable energy equipment outright.

| Advantages | Disadvantages |

|

|

Who should choose this method?

This method is ideal for developers with a positive tax liability who could benefit from tax credits and accelerated depreciation.

The Royal Lahaina Resort in Maui, Hawaii purchased solar panels and, as a result, leveraged a state of Hawaii tax credit, federal ITC, and depreciation. With those incentives, plus the cost savings that will accumulate to $3.9M over the next 25 years, the Resort expects that the solar investment will pay for itself in just over a year. The Royal Lahaina is a prime example of a property owner that had a positive tax liability from positive earnings and took advantage of the associated tax deductions with the purchase of sustainable energy equipment.

Figure 1: Solar panels atop the Royal Lahaina Resort in Maui, Hawaii

-

Renewable energy equipment leases

Oftentimes developers will choose to lease renewable energy equipment to fuel properties rather than buying them outright. With an equipment lease, the property only has access to the renewable energy equipment (i.e., solar panels on the roof, geothermal wells beneath the building’s surface) for the duration of the lease. It is not uncommon for asset managers to later purchase the equipment from the lessor over the duration of the lease or as it nears expiration.

| Advantages[ii] | Disadvantages |

|

|

Who should choose this method?

This method is suitable for developers who do not carry large tax burdens and have reduced immediate access to capital.

This is a method offered by the Brooklyn-based energy efficiency company, Blocpower, as it plays a pivotal role in making the city of Ithaca, New York the first to decarbonize every building. In its leasing structure, Blocpower boasts additional benefits that could be coupled with equipment leases such as including regular maintenance and a 15-year performance guarantee. [iii] While Blocpower primarily focuses on the conversion of existing buildings, it sets a prominent example for the type of creative financing that could be applied to new developments.

-

Property Assessed Clean Energy (PACE)

Property assessed clean energy (PACE) loans allow the costs of renewable energy equipment to be embedded in the property assessment and paid for as part of property taxes. If the building is sold, this liability gets passed on through the sale. This assessment is a debt associated with the property, rather than with the property owner.[iv]

| Advantages[v] | Disadvantages |

|

|

Who should use this method?

Developers looking to reduce their environmental impact and taxable income without the need for a substantial down payment are great candidates for PACE loans.

In May 2021, the Poplar Apartments, owned by Niche Poplars, utilized PACE loans valued at just under $900K for a 24-year solar, water, and LED project. As a result of this financing, the project is expected to save just shy of $1M over the next 24 years plus hundreds of thousands of gallons of water and hundreds of tons of CO2.[vii]

-

Power Purchase Agreements (PPAs)

Power purchase agreements are agreements between a third-party equipment owner and an energy buyer who pays for the renewable energy for a set amount of time. Real estate developers can act as the seller of the energy or the offtaker (energy buyer) in these arrangements.

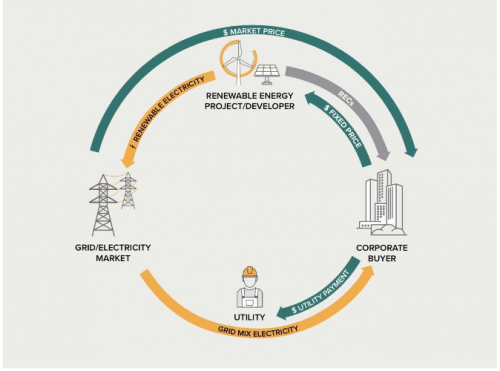

There are many forms of PPAs, but the two predominant forms are physical and virtual PPAs. A physical PPA is the purchase of energy at the point of production, where the customer receives the physical delivery of energy through the grid. A virtual PPA (also known as a financial PPA or synthetic PPA and illustrated in Figure 2) allows the offtaker to buy energy virtually. This agreement does not actually affect the source of energy consumed by the purchaser, rather it is aimed at companies who are focused on their environmental impact statistics.[viii]

| Advantages[ix] | Disadvantages |

For the energy buyer:

For the seller:

|

For the energy buyer:

For the seller:

|

Who should use this method?

The sale of a PPA is effective for developers who plan to install renewable energy equipment that has the capacity to provide more energy than their project requires. The purchase of a PPA should be considered by developers looking to offset their carbon emissions without the capacity to install equipment on their projects. For example, projects whose climate or location prohibits the effective use of solar panels or whose subsurface composition is not accommodating of geothermal wells are good candidates to purchase PPAs. [x]

A prime example of a property owner using its real estate to enter into a physical PPA is the Boulder Valley School District of Colorado signing an agreement where a third party owns and operates renewable energy equipment on school district property.[xi] An early adopter of this method, this case occurred in 2012 when the school district installed 1.4MW of solar PV within 14 schools, lowering the district’s energy bills by 10% over the life of the 20-year agreement. In this case, the school district benefited from this agreement by shifting the system performance risks to the third-party owner and operator while still being able to take advantage of renewable energy without the upfront cost.

Figure 2: Diagram of the process behind Virtual Power Purchase Agreements

-

Renewable Energy Credits (RECs)

Renewable energy credits (RECs) are tied to renewable energy produced by dedicated offsite energy facilities. Buying a REC does not buy the energy itself, rather a tradeable commodity representative of the clean energy attributes produced in external facilities. Corporations can deduct the clean energy attributes of these RECs from their total emissions, counting towards the reduction of their overall carbon footprint.[xii]

| Advantages | Disadvantages |

|

|

Who should use this method?

RECs are perfect for developers with a reduced capacity to install renewable energy equipment on their projects but who still aim to support the renewable energy industry.

An example of this is Hudson Pacific Properties who, recognizing the limited potential of its on-site renewable energy sources, entered into a three-year REC agreement that effectively negated all Scope 2 greenhouse gas emissions and brought the company 80% of the way to reaching its net zero carbon portfolio goal.[xiii]

* * *

While these five methods are highlighted, there is also a wide range of state and local incentives available to developers. In addition, it is not uncommon to see developers combine any of the five methods above to reach their sustainability goals.

The recommendations for who should use these methods are non-exclusive, meaning there are a wide range of real estate developers, asset managers, or property owners who could take advantage of all these methods and the recommendations above are simply a guide.

[i] Sunpower Commercial Dealer. Solar Shines on the Royal Lahaina Resort. SunPower Corporation. Retrieved December 1, 2021, from https://us.sunpower.com/sites/default/files/media-library/case-studies/cs-royal-lahaina-case-study_0.pdf

[ii] Laurence, B. K. (2013, January 10). Business equipment: Buying vs. leasing. www.nolo.com. Retrieved December 2, 2021, from https://www.nolo.com/legal-encyclopedia/business-equipment-buying-vs-leasing-29714.html.

[iii] Landing: Ithaca. Blocpower. (n.d.). Retrieved December 2, 2021, from https://www.blocpower.io/ithaca.

[iv] Rumsey, P. (2017, March 1). How real estate developers can profit from Solar. Greenbiz. Retrieved December 2, 2021, from https://www.greenbiz.com/article/how-real-estate-developers-can-profit-solar.

[v] The Office of Energy Efficiency and Renewable Energy. (n.d.). Property assessed clean energy programs. Energy.gov. Retrieved December 2, 2021, from https://www.energy.gov/eere/slsc/property-assessed-clean-energy-programs.

[vi] Pritchard, J. (2020, October 1). Borrow for green improvements and repay on your tax bill with pace. The Balance. Retrieved December 2, 2021, from https://www.thebalance.com/pace-loans-financing-for-upgrades-4124071.

[vii] Pace case studies. PACENation. (2020, October 9). Retrieved December 2, 2021, from https://www.pacenation.org/case-studies/.

[viii] Virtual Power Purchase Agreements (vppas): How they work, pros and cons & PPA types. EnergyRates.ca. (2021, September 14). Retrieved December 2, 2021, from https://energyrates.ca/power-purchase-agreement-ppa-vppa/.

[ix] Niklaus, A. (2021, October 25). What is a PPA? your definitive guide to power purchase agreement. Pexapark. Retrieved December 2, 2021, from https://pexapark.com/solar-power-purchase-agreement-ppa/.

[x] Power purchase agreements (ppas) and Energy Purchase Agreements (epas). PUBLIC-PRIVATE-PARTNERSHIP LEGAL RESOURCE CENTER. (n.d.). Retrieved December 2, 2021, from https://ppp.worldbank.org/public-private-partnership/sector/energy/energy-power-agreements/power-purchase-agreements.

[xi] : Borgeson, Merrian, and Zimring, Mark. Financing Energy Upgrades for K-12 School Districts: A Guide to Tapping into Funding for Energy Efficiency and Renewable Energy Improvements, 2013. https://www.energy.gov/sites/default/files/2014/06/f16/lbnl-6133e-co.pdf

[xii] Renewable energy credits (recs). EnergySage. (2020, December 23). Retrieved December 2, 2021, from https://www.energysage.com/other-clean-options/renewable-energy-credits-recs/.

[xiii] ULI. (n.d.). The Uli Blueprint for Green Real Estate— setting net-zero … Urban Land Institute. Retrieved December 2, 2021, from https://casestudies.uli.org/the-uli-blueprint-for-green-real-estate-setting-net-zero-goals-hudson-pacific-properties/.