The benefits of involving the private sector in traditionally public roles of delivery and operations of mega-projects include the sharing of risks, more effective vetting of the financial viability of projects, integrating resources, applying best practices and innovations, and establishing a life cycle-long perspective of costs and accountability (Rocca, 2017). Amidst the context of strained public finances and limited borrowing capacity, public-private partnerships (P3s) can provide private capital to alleviate short-term financing constraints without adding to the public debt burden[1]. Despite the potential advantages, skepticism of private involvement in infrastructure projects continues to challenge the adoption of P3s, especially in the United States. In addition to public perception conflating P3s to be the privatization of public assets, this sentiment is hardened due to a handful of transactions that did not close or underwent restructuring (Deye, 2015). While there may have been several reasons for the failure of these transactions, an important one to consider is that they might not have been suited to be transacted as a P3 in the first place. This article explores an evaluation tool known as a Value for Money (VfM) analysis, to assess the best public value between a conventional and P3 procurement across the life cycle of the asset.

Due to the high transaction costs associated with P3 deals, in order to reach their full potential in the U.S., institutional reforms are necessary to standardize processes. Key among these is the incorporation of a VfM analysis to help determine the optimal procurement strategy, whether involving the private sector in some or all of the roles related to designing, building, financing, operating, and maintaining an asset versus these roles being carried out completely by the public sector. It is imperative to note that a VfM analysis does not establish whether the project is a good use of resources or whether the project is even affordable by the public. A separate benefit-cost analysis and financial feasibility assessment respectively would need to be undertaken to make that determination (Federal Highway Administration, 2012). Instead, a VfM analysis compares the risk-adjusted net present value of the life cycle costs of various delivery mechanisms to determine which mechanism has the lowest life cycle costs. The case for P3s must rest on the efficiency gains associated with the bundling of construction, maintenance, and operations, and not on their financing advantages (Engel, Fischer, & Galetovic, 2014).

The U.S. Department of Transportation P3 Toolkit (2012) lays out the following methodology for a VfM analysis. The first step is to create a Public Sector Comparator (PSC) to estimate the costs associated with a hypothetical conventional delivery of the project i.e. the project being financed, owned, and operated entirely by the public sector. The PSC must include risk-adjusted capital and operating costs, procurement costs, oversight costs, overhead costs, and financing costs, all not always considered in public procurement estimation. In parallel, a pre-procurement Shadow Bid is created to estimate costs, financial structure, and other assumptions of a P3 bid to make an apples-to-apples comparison. After consideration of qualitative factors, and stress testing for risks and discount rates, if a P3 approach is determined to have a lower life cycle cost, bids are invited. The analysis must be then repeated with the actual bids during procurement to ensure the validity of the results.

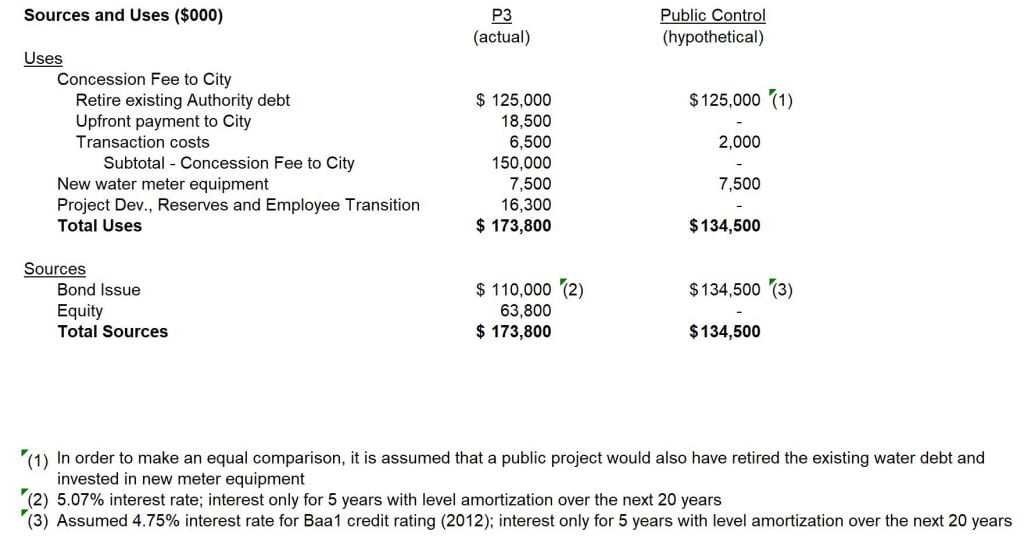

Under the terms of the agreement, Bayonne Water paid an upfront fee of $150 million that was used to retire existing City water debt ($125 million), contribute to the City’s general fund ($18.5 million), and pay for the transaction fees related to the concession agreement ($6.3 million). They also agreed to spend $7.5 million for meter and billing upgrades to reduce the high proportion of non-revenue water in the system. Lastly, over the life of the project, Bayonne Water would pay up to $3.5 million each year for system upgrades and repairs ($2.5 million), regular maintenance ($0.5 million), and a City oversight fee ($0.5 million). This is laid out in the Sources and Uses Table below. As expected, the P3 option has a higher upfront cost due to the initial concession payments, the increased transaction costs, and more importantly the higher cost of capital. This is only half the picture, however, and the decision for or against a P3 cannot be based on this.

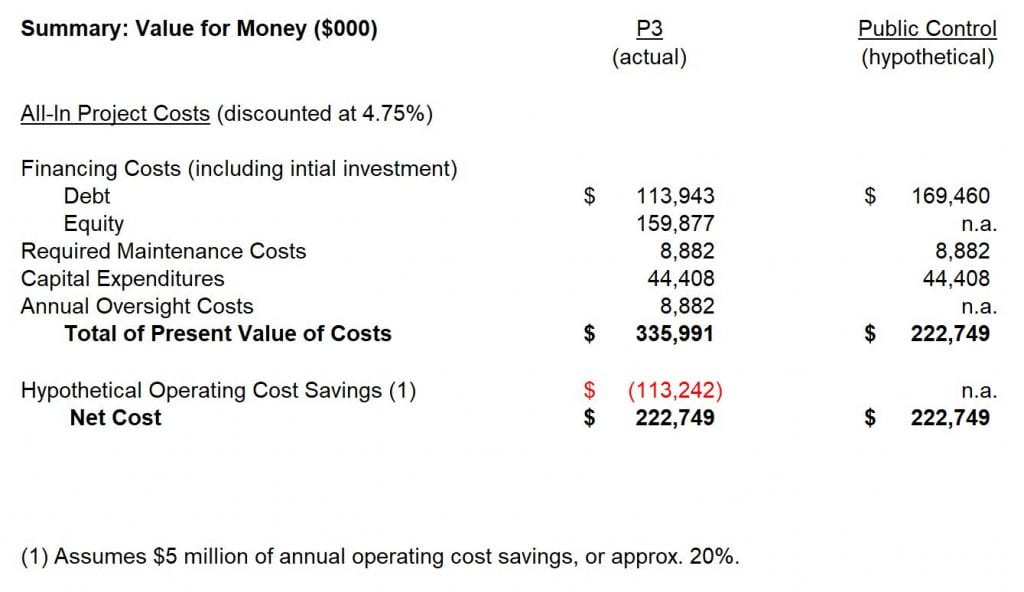

A more accurate understanding is gained by examining the value derived from the differential of the life cycle project costs for each delivery mechanism. Since this is an analysis without the benefit of all the actual numbers that went into making the decision, it has been back-calculated to what would have made both choices a wash. This is calculated to be an annual operating cost saving of $5 million, or approximately 20%, from comparable water utilities this size. While this operating cost saving is probable due to significant investments that went into repairs and upgrades, the decision to go ahead with a P3 would have been based on additional value derived from the transaction. These could include the retiring of outstanding debt that led to a credit upgrade from Baa1 to A3, the contribution to the general fund, the contractual performance standards to make up for the deferred maintenance of the system, and the reduction of non-revenue water, all of which the City’s Municipal Utilities Authority (MUA) was unable to do itself.

With the advantage of hindsight studying this project six years after it began, there is clear evidence of improvement in the physical aspects of the system with the $19 million investments in aqueducts, pumps, pipes, and hydrants, the real-time monitoring through SCADA[3] and GIS, and Advanced Metering Infrastructure (AMI) comprising 11,000 meters. Together, this has contributed to a 38% decrease in consumption and close to 3000 leaks repaired, saving 150,000 gallons per day.

On the flip side, there have been two increases in rates higher than the projected 4% – 13% in 2016 and 9% in 2019. Bayonne Water has stated that these were due to a combination of two aspects: first, multiple mains repairs during extreme weather that led to an increase in capital expenditure beyond the $2.5 million per year for which they were contracted; and second, reduced consumption due to the repair of the much higher than foreseen leakage in the system and more importantly, due to the departure of a large industrial client, both of which necessitated the spreading of costs across the users to ensure the guaranteed minimum return. While this continues to fuel public skepticism about private involvement in infrastructure, a better approach would have been a deal structure without the ratepayers bearing demand risk and a rate stabilization fund maintained by the City to avoid direct and immediate pass-through of unanticipated costs to the ratepayers.

While it is beyond the scope of this article to judiciously evaluate and stress test these risks and other subjective factors important at the time, this after the fact examination makes it clear that a Value for Money analysis would have been imperative to prudently make the decision for or against a P3. In addition, to test for and eliminate biases in the calculations, especially the qualitative elements, it is necessary to conduct such VfM analyses under the scrutiny of the general public and, wherever ambiguous, test the sensitivities to ensure that the decision is not solely based on a variable that is not predictable far into the future. Furthermore, similar to the best practices in the United Kingdom, Canada, and Australia, P3 advisory bodies must be set up at state and federal level to serve as expert agencies to aid municipalities in conducting these complex transactions, with decision-making tools like Value for Money to ensure the best outcomes for consumers.

—

NOTE: The analysis models were built under the guidance and supervision of John Foote, Senior Lecturer at the Cornell Institute of Public Affairs (CIPA). He teaches Value for Money analysis in his course PADM 5755: Infrastructure Finance at Cornell University.

—

[1] It must be emphasized that privately financed infrastructure services are not provided “for free” and the users and/or taxpayers still pay for it in some manner no matter the financing or mode of deployment (Spiegel & Verougstraete, 2018).

[2] Availability payment concessions are those where the concessionaire receives a periodic payment from the public partner based on the “availability” of a facility at the specified performance level (Center for Innovative Finance Support, 2017)

[3] Supervisory Control and Data Acquisition

—

References

Anderson, S. A., Nunn, R., & Shambaugh, J. (2019, July 2). Wise infrastructure investments can stabilize the economy and reduce climate risk. Retrieved October 15, 2019, from The Brookings Institution Web Site: https://www.brookings.edu/opinions/wise-infrastructure-investments-can-stabilize-the-economy-and-reduce-climate-risk/

Center for Innovative Finance Support. (2017). Payment Mechanisms in Public-Private Partnerships (P3s). Washington D.C.: U.S. DOT Federal Highway Administration.

Deye, A. (2015, September 25). U.S. Infrastructure PPPs: Ready for Takeoff? Retrieved October 14, 2019, from The World Bank Web Site: https://www.worldbank.org/en/news/opinion/2015/09/25/us-infrastructure-ppps-ready-for-takeoff

Engel, E., Fischer, R. D., & Galetovic, A. (2014). The Economics of Public-Private Partnerships: A Basic Guide. New York: Cambridge University Press.

Federal Highway Administration. (2012). Value for Money Assessment for Public-Private Partnerships: A Primer. Washington D.C.: U.S. Department of Transportation.

Rocca, M. D. (2017, July). The rising advantage of public-private partnerships. Retrieved from McKinsey Capital Projects & Infrastructure: Insights: https://www.mckinsey.com/industries/capital-projects-and-infrastructure/our-insights/the-rising-advantage-of-public-private-partnerships

Schmitt, J. (2016, April 15). Can investing in social infrastructure jump-start economies? Retrieved October 12, 2019, from World Economic Forum Web Site: https://www.weforum.org/agenda/2016/04/can-investing-in-social-infrastructure-jump-start-economies

Spiegel, S., & Verougstraete, M. (2018, May 31). When (and when not) to use PPPs. Retrieved October 21, 2019, from World Bank Blogs: https://blogs.worldbank.org/ppps/when-and-when-not-use-ppps

World Bank Group. (2016, October 31). Government Objectives: Benefits and Risks of PPPs. Retrieved October 14, 2019, from World Bank Public-Private Partnership Legal Resource Center: https://ppp.worldbank.org/public-private-partnership/overview/ppp-objectives